14th May 2018 –

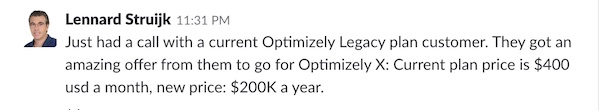

So 0k is the new annual minimum we hear—from customers who have reached out to us personally, and from customers lashing out on Twitter.

The pricing at Optimizely is changing, SMEs are being phased out. The sales team seems to be focusing only on the biggest players in the CRO space.

For months now, we’ve been getting messages from Optimizely customers like this:

When going public, companies have to prove profitability—and rethink how qualified the current management is to attract investors. Since Optimizely hadn’t been profitable, the road to IPO is clear: Spring Cleaning!

With offices in San Francisco, New York, Austin, Amsterdam, London, Cologne, Munich, and Sydney, you can find most jobs on their careers page linking to corporate standards and policies, all indicating that policies and processes are now ruling Optimizely under the new management. The startup atmosphere is out.

Changes in Senior Management

In December 2017, the Optimizely X Platform got the ISO/IEC 27001:2013 certificate. Now, in 2018, they are sunsetting the Optimizely Classic. These are clearly related. The entire platform is now called Optimizely X—so ISO 27001 applies to all features. And the non-certified version is cut from the product list (together with customers that paid up to ,000 a year). This seems like a calculated move to move up in profitability and have corporate processes in place pre-IPO.

Yeah! That’s the next step. Thinking of getting a landing page tool. What do you think of Unbounce? Optimizely seems too expensive for us now.

In July 2017, Former co-founder of Optimizely Dan Siroker stepped down as CEO—handing the role to Jay Larson. Larson was previously the CEO at Birst, as well as an executive at Mercury Interactive and success factors.

The Bottom Line

In July 2010, Optimizely raised 1.2M in their first seed round. And in May 2012 they made their intentions: clear they were going after Adobe Target. Since then, they’ve won their amazing race to surpass Adobe, and have settled on the throne of Enterprise A/B Testing.

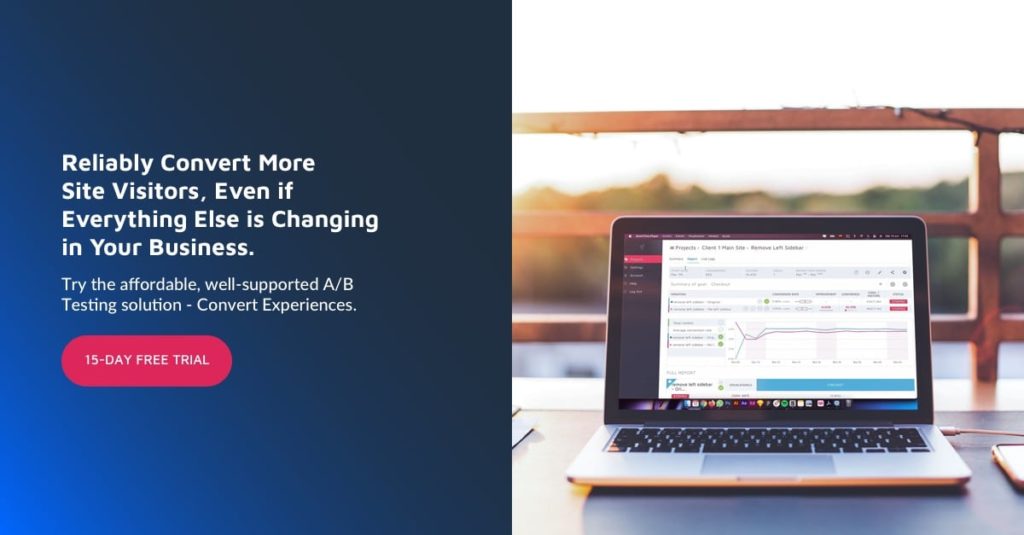

But for the folks left behind who don’t want to be forced to upgrade to exorbitant plans: hello. We’re Convert.com. We hope to get to know you.

Hey @Optimizely trying and failing to contact someone in sales. My team filled out the sales contact form on your marketing site a week ago and haven’t heard from you. You leaving a girl hanging? pic.twitter.com/uJuNftB4j6

While at Convert, we’ve been working to prepare for GDPR (now—we’re the only tool on the market, that doesn’t collect personal data)—Optimizely is rumored to have been preparing to go public. Here are some signals that indicate that might be where they’re headed.

Corporate Governance Upgrades: Policy & Process

On March 3rd, 2018, they added a second market offering to the list of funding history, which is the last and clear signal they are going IPO soon.

It was an amazing ride, and we’ve learned a lot from Optimizely—and are thrilled for their success.

Suddenly tons of salespeople “leave”? New customers are also being cut? Seems like a need to clean up on the heavy bonus structures, and win some much-needed profitability, pre-IPO. “Hello, anyone home to pick up the phone? No, sorry. We will be right back, we are clearing cash-heavy commission contracts with the sales team and adding only highly profitable enterprise customers”.

Optimizely’s IPO is coming soon…

Though, in the meantime, they’ve become unaffordable for SMB and SME.

@koomen I’m frustrated with @Optimizely’s sales process. Do I have to go find another tool? 6.M raised, but your sales team can’t be bothered pick up the phone? #OPTIMIZELY

When you’re a private company, you can afford to respect customer choice and not push forced upgrades on your customers. But as you go public, you might need to start thinking differently. You need to show profitability. Small customers drag averages down. And before any formal SEC-required filings and announcements—you want a clean ship, that looks good on the books.

Public companies that trade on the US stock exchanges are required to maintain certain standards in regards to corporate management. The external board of directors that Optimizely’s building is fit for these standards. But in addition, new formal controls, processes, and audits are being installed all over Optimizely.

![76 [Actually] Creative Valentine’s Day Instagram Captions](https://research-institute.org/wp-content/uploads/2022/02/76-actually-creative-valentines-day-instagram-captions.jpg)