Roundel, their internal Retail Media agency, has a dizzying array of options in the display realm alone, with managed services and self-service for those that want to pay for the privilege of the first-party data and take that in-house and use their own programmatic platform, like DV360 of The Trade Desk. They also have offerings that include Target social channels (Pinterest, Facebook) and Google Shopping to take advantage of. Add in a streamlined Circle Promotions offering in the mobile app that brands can use to offer discounts at their convenience to specific audiences or all of Target Circle members and an always-on sponsored products option through Criteo and you’ve got yourself a retail media mogul.

Amazon and Walmart are creating an empire of tech that their offerings sit on top of and expand far beyond sponsored products into programmatic/display, video, and AI-enabled units at scale. They also have hundreds of billions of dollars. Walmart’s playbook has been a combination of the building (Media Group, Plus, Fulfillment), buying (Joyrun), and all of the partnerships, notably Rover.com, ThreadUp, and Shopify.

What is Retail Media?

Recent partnerships with Bloq and Optoro look to bring recommerce (the refurbishment and reselling of ecommerce returns) front and center to the platform, enabling sellers to streamline retailer returns back out in the world directly through eBay. Watch for enhancements in advertising to follow beyond just promoted listings and larger display/email buys. Instart is everywhere—from partnerships with Sephora and Best Buy that break the “grocery” label to a beta test with Walmart (three cities)—is there anywhere they don’t deliver? Enter in a recent home-built solution for sponsored products that allow brands to boost that ever-important first-page visibility. Coupons, hero banners, and delivery promotions are also available through the Instacart team who have been booking media for three to four years now, gathering insights around new-to-brand, category share, and basket analysis that would make any brand want to double their budget.

10 Top Retailers and Media Offerings Compared*

So now that you have all the information, where do you go from here?

It’s all about the audiences. Retailers have amassed years of loyalty data, through programs with perks, points, and personal information. While previously leveraged before in a slow-to-scale and a rather impersonal way, retailers can harness “people as data sets” with considerable more relevancy and higher quality targeting to appeal to brands looking to generate new-to-brand buyers, foster loyalty buyers, and close the proverbial loop.

The world of retail media is dizzying at times—especially when you expand your thinking beyond retail media and into the greater mechanics and interplay of the retailers themselves including private marketplaces like Target Plus, Mirakl, and private label brands that sneak in onsite retailer search results. (And that is just the online piece). Google and Facebook post humongous numbers in advertising revenues on their properties—followed quickly by Amazon, indicating that not only is there demand but also profitability in digital advertising. You could say the biggest driver of why is money. It always is. And it helps pay the bills for the investment in tech.

*This list is in no particular order. Their program, Retail Media+ includes additional offerings in programmatic (using Home Depot’s first-party data), social (like Pinterest and Facebook), and Google Shopping options. Home Depot vendors can take advantage of these offerings any time of year or during home improvement-themed seasonal sales events such as Spring Black Friday or other holidays.

The answer tends to be an investment and structural change that can handle this audience-based approach over individual retailers or channels and their ROI/ROAS. And then, of course, there’s Instacart—everyone’s best friend for delivery and partner extraordinaire. With the exclusion of Target, which bought delivery competitor Shipt. Best Buy’s collection of first-party data over the last few decades, paired with over 1,000 brands and tech support services, indicates there’s more here than you might think in terms of potential retail media opportunities. By having an aging population focus and tech services with their products, they’ll build stickiness with consumers in a space with less competition and a long-term outlook. Kroger has inspired a flurry of headlines recently, including but not limited to a third-party marketplace powered by Mirakl, record ecommerce highs, expansion with Instacart, and of course, sponsored products and banners with PromoteIQ. Kroger’s loyalty card program is powerful. Targeting options via the self-serve platform with PromoteIQ is solid out of the box and includes coupon options. We recommend working with their internal team to go beyond for larger buys.

Aggregate Reporting

And while it happened in 2018, their acquisition of Great Call (a senior-focused tech company with assets such as the Jitterbug phone and medical alerts) is set to benefit the company not only in the long term (per the plan) but in the short term as well (as retail media growth accelerates). Technology, organizations, and hierarchy have to match the shift in retail media to audiences and the channels that host them. And that kind of change is harder and takes longer than six months, especially in legacy organizations that might have thought they had more time to adapt. The acceleration from COVID-19 is estimated to have moved up this timetable two years, which will put additional strain on these needed changes and adaptations.

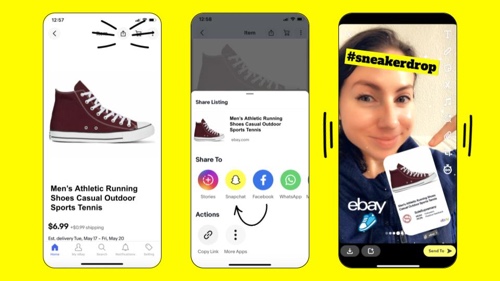

After a dip in 2019, the original marketplace experienced significant growth in 2020 (largely due to the influx of online shoppers during the pandemic). Key categories continue to be a focus especially for new items like footwear, watches (accessories), and electronics. If you think of it at the retailer or channel level—are all those audiences created equal? (For example, lapsed brand purchasers at Walmart versus Target or the social audience of CVS compared to Ulta). They are all charged at different rates, have different reaches, and perform at different levels.

7. Kroger

There’s no one tool or answer to help you compare and contrast that isn’t Excel or a custom database type solution. While you might only have a handful of flights under your belt today, it won’t always be that way. Getting things out into a format where you can review CPMs, average ROAS, audience types, and then cross-reference that against other retailers will give you a much better sense of the audiences as they move around and helps you decide where that next dollar is best spent. CVS launched the CMX Media Exchange, an advertising network that allows advertisers to target ads across channels using a myriad of placements, in late summer 2020 and is looking to join the fray with their ExtraCare loyalty program first-party data. While CVS.com might not be how the majority of their customers shop today, customers most certainly use that ExtraCare card, offline and online. Add in Instacart for delivery, sponsored product options with Criteo, and the ability to do programmatic display onsite, offsite in their private network and social media options, and depending on your category, you may find yourself a fan. The next rabbit hole of retail media is: How do you connect an in-store transaction to an online ad on a regular basis? Ah, Costco. The only retailer where the primary demographic is male, not female. Costco has intentionally not invested heavily in marketing/advertising spend but is now collecting some of its own retail media revenue through networks like Criteo.

The biggest takeaway for Instacart advertising is how incredibly qualified the traffic is: a user must sign in, enter geography, is presented with a marketplace of stores available in that area, choose, and then perform a search in the store. You can’t get lower in the funnel.

Why Invest In Digital Retail Media?

Some retailers are a bit behind on the technology front. How do they close the gap? After all, they are retailers, not technology companies. It’s expensive to employ a team of software engineers, data scientists, and wizards, as well as the infrastructure needed to host, maintain, and innovate to keep up with demand and differentiate.

Wayfair’s sponsored product offering has been around since circa 2019 and is a homegrown solution. It’s fairly straightforward and if you’re one of many brands selling through their home goods marketplace, it could be the boost you’re looking for, especially around key dates like Way Day (COVID delayed this year) and Cyber 5.

Power to the First Party

Retailer Relationships

Budgets

Though far behind in volume and revenue compared to the next largest online advertising retailer (Amazon), Walmart has developed and launched a host of programs geared toward “omnichannel.” The company is seeking to combine in-store and online/app-based shopping as seamlessly as they can, including in-app enhancements to guide in-store experiences (like product location and checkout) to adding web-based reviews and ratings to physical product shelves in the store.

Digital retail media has been ramping up for several years. Retailers recognize the need to not only offer experiences and convenience to compete with other ecommerce sites but to meet the needs of brands to reach consumers in those digital spaces (not previously permeated with advertising).

Where is the money going to come from? The most common concern I’ve heard. It’s important to know that some budgets may be tied into different groups within a brand. I have also seen budgets that simply didn’t happen due to COVID-19 (for example, if you were planning on having samples in-store). If you haven’t started the conversation for 2022 budgets, the time is now.

Make Friends or Buy New Ones?

What they all have in common is that those gains have largely stemmed from expanded ecommerce offerings, which have accelerated the growth of a channel that’s always been there — Retail Media (that has now come into its own in a digital format).

Retail Media is technically nothing new. It’s the near point-of-purchase techniques of sampling, loyalty cards, coupons, and featured placements within a glossy paper catalog. Remember those? (R.I.P. Ikea paper catalog) Today, this includes digital marketing as well.

So why are you hearing so much about retail media right now? To be frank, the industry’s revenue has recently exploded in terms of growth. The gains the industry was expected to see in two years have been crammed into the last six-month period. This is partially due to the COVID-19 pandemic and the need for contactless payments and delivery, but it’s also thanks to advancement by major big-box retailers like Walmart and Target following in the footsteps of Amazon.

Here are some recent changes they’ve implemented to support ecommerce efforts:

Another stay-at-home winner, the Home Depot enabled house projects and improvements with buy online/pick up in-store and, of course, advertising on-site via PromoteIQ for sponsored products, banners, in addition to email services through WorldData, a third party partner that enables a partial self-service capability.

We’re now starting to look at audiences over channels. A single customer can exist in all channels (social, programmatic, Google, email, local) but how do you reach them at an efficient rate? How do you retain them and engage them? Is it to have eight different budgets and make a wish? Or is it to think about how a customer’s journey takes place and to create touchpoints for when and where they are? (Hint: it’s the latter)

The Bottom Line

This chart sample is an accumulation of high-level info to give you an idea of the offerings, programs and partnerships for comparison.

So, you buy existing technology, dig deep to make it, or strike strategic partnerships with the latter two emerging as the path forward for now. Every week there’s an announcement of an acquisition, a preferred partner, or a chain of software platforms to execute on a media type. For example, PromoteIQ, Criteo, and Quotient—all working directly with retailers of all shapes and sizes to enable different types of digital media, most commonly, sponsored or featured products. Makes sense. Building an ad network is not a small undertaking.

Unless you’ve been living under a rock, you’ve probably seen the news reporting substantial gains for big-box retailers like Walmart, Target, and Amazon as well as specialty retailers such as Ulta and Best Buy, in addition to marketplaces including eBay and Etsy.

Also, are massive changes to Personal Identifiable Information (PII), the buying/selling of data, privacy concerns in recent legislation, and cookie crumbling playing a part in this as well? Sure. But that’s the long and slow game. That’s not a growth game. That’s a compliance game.

3 Expert Retail Media Recommendations:

Retail media is advertising to consumers at or near their point of purchase, or point of choice between competing brands or products.

Recent headlines for Best Buy included a partnership with Instacart (yes, you can get that TV delivered today) and an uptick in sales in Q3 2020 (this was thanks in part to the curbside pickup option).

Target’s slow and steady growth brought them into the Top 10 this year, pre-pandemic. Since then they’ve created a superstar curbside pick-up offering and bolstered membership-based service Shipt, a 2017 acquisition, fulfilling store-to-door services, in-store orders, and delivering to consumers (not just for Target but for other retailers including Peapod, Costco, Petco, and CVS.)

Pretty much everyone with an ecommerce site and a brick-and-mortar store seems to be in the Retail Media game today offering at minimum onsite placements like Sponsored Products. But let’s stick to the emerging players, as shown below. (And without Amazon since they far outpace the competition).

Smaller or more specialized retailers like Target, Kroger, CVS, Best Buy, and Home Depot have found their path forward by staying the course as a go-to destination but also integrating with partners, building on their first-party data/audiences, and diversifying their offerings to include social media placements, private marketplaces for programmatic, email placements, search engine advertising placements and onsite offerings through those partnerships. (Walmart does have some of these as well.)

Retailer relationships are tricky sometimes. Do the math, push back if the audience size/return seems too good to be true. Have a general idea of what is possible and what is an “investment” and always ask for more in the metrics department. They’ve never done this before, so don’t assume that it’s not available because it’s not important. Assume it’s not available because no one else asked yet.