Other trends besides the growth of ecommerce are also fueling retail media’s popularity. Advertisers need more places to access highly valuable consumer data and it is getting harder to do because of the new privacy regulations and technology changes that are altering the way that targeting has historically been done.

That’s why we’ve spent the past year reinventing our Retail Media Platform to give retailers, brands, and agencies the transparency, flexibility, and control they need to take their retail media programs to the next level.

Greene: If you look at more traditional omnichannel retailers, what they have that Amazon does not have is instore physical retail data. We spoke about how the trend of ecommerce is becoming a bigger part of overall product sales but for many traditional brands, it still represents only a fraction of their overall product sales. What they need to do is create a flexible budget and optimize in real-time (aka “on the go” strategy based on consumer behavior). As you start working through Q1 to figure out how to execute on campaigns throughout the year, I would absolutely recommend thinking about getting that mix right (between retailer-specific and overall brand objectives).

Q. How would you describe retail media and how is it different from traditional ecommerce ad channels?

Greene: To us, retail media is pretty straightforward. It’s the brand’s placement of ads on retailer sites and apps. That can take on a lot of different formats such as a display banner (as you would see on any traditional publisher) to native ad units (that are highly ingrained into the ecommerce experience). Almost every major retailer that sells third-party merchandise is doing it today. I think retail media is one of the biggest trends in ecommerce and it doesn’t seem like it is going to slow down anytime soon.

Q. Why is retail media gaining in popularity?

Beginning in Spring 2019, we set out to reinvent our technology to support the open retail media ecosystem of the future. After a year in development, the new Criteo Retail Media platform is here.

From a measurement and attribution perspective, how does ecommerce shopping behavior influence instore purchases? Brands need to look beyond the last click model and explore opening up their attribution methodology and consider sophisticated attribution methods. Think about not only how ads impact ecommerce sales but also how they impact instore purchases.

While sponsored products and display ads have traditionally coexisted in parallel universes, the future of Retail Media is one where retailers, brands, and agencies can address the entire shopper journey—from product discovery to loyalty—with one platform. By unifying our sponsored products and display platforms, retailers and brands can now utilize any ad format, targeting method, and media pricing model from one platform. Additionally, we’re introducing flexible attribution models and new data visualization and reporting capabilities to enable retailers and brands to measure campaigns on their own terms.

Greene: Retailers need tools to efficiently manage all the campaigns they sell, as well as the ability to seamlessly integrate third-party demand—all while preserving the shopper experience. Likewise, brands and agencies need to streamline retail media execution across all of their major retailer partners, without getting bogged down navigating individual walled gardens and comparing apples-to-oranges metrics.

Q. Do you have any recommendations for how to go about getting started in retail media?

Retail media—advertising on ecommerce websites and apps—saw a meteoric rise in popularity in 2020 and shows no signs of slowing down in 2021. So where should your brand be? (Spoiler alert: it’s no longer just Amazon.)

We spoke with Michael Greene, VP, Strategy for Criteo Retail Media on the rise of retail media and what opportunities could be right for your brand.

The second pain point that large and global brands run into is taking what they are doing in one market (for example, the US) and beginning to scale and apply that success with other retailers in different markets. Criteo operates globally but even within the countries we operate, we see vast differences in retail maturity and retail media programs. For many of the global brands we work with (who have global standards for everything that they do) finding that they can’t implement those strategies as easily is certainly a challenge.

As consumers are spending less time in physical stores and more time buying things online, a lot of ad and marketing dollars that have traditionally gone towards supporting the sale of products in physical retail stores have begun to move towards retail media and digital channels because they need to follow where the consumers are at the point of purchase.

Q. What are the opportunities for the Walmarts and Targets of the world to differentiate from Amazon’s ad ecosystem?

Greene: I think there are a couple major drivers for the increased interest and investment in retail media.

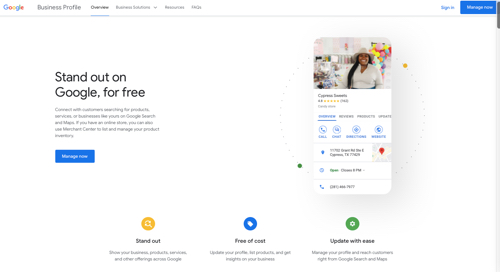

We saw recently IOS 14 in the news for privacy changes, ultimately making it harder for third parties to gather data and target consumers. And as we all know heading into 2022, the use of third-party cookies will no longer be accessible at the same scale for advertisers to target consumers. What all of this means is retailers are now some of the most data-rich publishers out there. They are in a prime position to capitalize on the trend of marketers wanting to have highly relevant data to target consumers in a highly relevant environment. And given their deep understanding of shopping and purchasing behavior and their ability to leverage first-party data (from a targeting perspective), retailers and retail media are well-positioned.

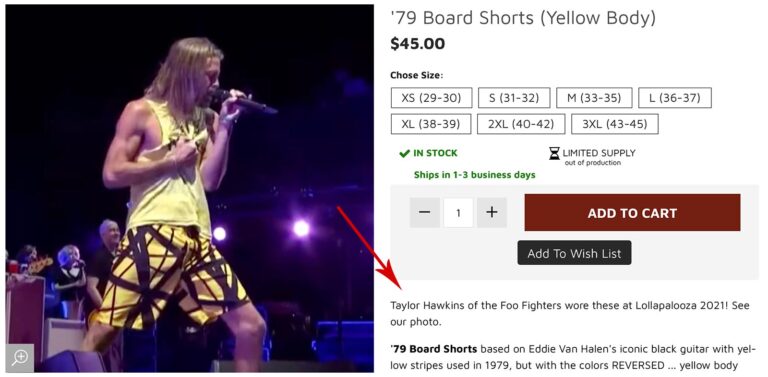

Greene: For brands who are smaller / mid size and haven’t made significant investments in the retail media space before, the first place to start is to look for retail media opportunities that have high accountability for your sales dollar and will provide consistent performance for you. The advertisers we work with (just starting out in the space) look at us and often say: How can we work with sponsored products to reach customers at the closest point of conversion?

Q. What is the Criteo Retail Media Platform?

As advertisers seek to boost product discovery and to highly relevant audiences, retail media can yield high returns as consumers increasingly choose the convenience of online shopping. And as brands search for a reliable return on their ad dollars, retail media offers precise targeting and closed-loop reporting in real time.

You can learn more about Criteo’s Retail Media Platform here.

As you get more sophisticated, brands will invest in middle to upper funnel tactics. This can include takeover campaigns, traditional display units, or display units specifically designed for e-commerce which combine a brand’s creative assets with selected SKUs. Brands will start to layer in different targeting pieces. For example, “how do I segment my consumers based on past purchase behavior, past browsing behavior, and interaction with competitive products?”

From a targeting perspective, instore physical retail data opens up a whole new type of customer in the ecommerce channel. Ecommerce buyers are more valuable for many brands, and leveraging in store buyer data to influence an ecommerce buyer strategy is something that we often see.

Greene: The number one thing I hear again and again from brands is fragmentation, and by that I mean Amazon operates in its own ecosystem, Walmart operates in its own ecosystem, and so on. Being able to cross and connect through all of those platforms is definitely a major pain point today. And that has to do with the fact each channel has its own campaign workflow capabilities. One challenge is that each channel has its own campaign workflows, but an even bigger challenge is that metrics are defined in different ways. How do you judge the effectiveness of an investment when everyone is using different methodologies to measure success of the campaign? Being able to reconcile a pretty fragmented landscape is still a major challenge.

Q. What are some common pain points for brands as it relates to Retail Media?

Greene: I think it’s abundantly clear at this point that retailers have the opportunity to become some of the most important media companies out there. They have the combination of audience reach, high-quality data assets (first-party), and now with retail media technology like Criteo they have the resources to help brands execute across a wide variety of campaign objectives. For the first time, we’re seeing retailers such as Best Buy, BJ’s, Macy’s, Kohl’s, Ulta, Target, Walmart, Amazon, and beyond make true investments to become media companies in and of themselves. I anticipate that will only accelerate this year.

Greene: Every brand is entering the new year with new budgets and new plans but think about how you want to balance budgets against retailer-specific budgeting that is more focused on how to achieve overall brand objectives. If you look at how a lot of brands utilize our platforms today, we see brands running campaigns that are dedicated to an individual retailer with the objective of growing sales, launching a new product, and gaining market share through a specific sales channel. But we also see a lot of brands who are bringing a new product to market and don’t necessarily know which retailer is going to be successful with it and don’t know where consumers will flock to find it.

It can get pretty complex. Our advice is to start simple with the basics but as you get comfortable with the retail media landscape, you should definitely think about expanding beyond your current strategy to achieve a wider range of your objectives.

Q. Any expert tips for brands (as it relates to Retail Media) in 2021?

The third challenge (and this is mostly for retailers) is the important shift with retail media from the brand being the seller and the retailer being the customer to retailers being the seller and the brand being the customer. It is a shift in the power dynamic happening in this industry that I think is causing some friction for some brands / retailer relationships. But as retailers grow in their retail media experience, brands get more accustomed to these changes.

Instore physical retail data plays two important roles:

Q. What do you envision for the future of Retail Media?

Most major retailers today offer some kind of version of this program (the most notable include Amazon, Target, Best Buy, Meijer, Costco, Walmart, Target, Walgreen’s, CVS, and Sam’s Club). If you are just getting started, you don’t necessarily need advanced creative capabilities or advanced targeting levers. You just need to know what products you want to promote and the goals you are trying to achieve.