However, CPC rose in Q1 for other industries as well, such as education and financial services, where Amazon isn’t a factor. Softer year-ago comparisons stemming from the pandemic also played into this growth.

Its impression share is now very nearly back to those mid-December levels, though does still lag late-2019 impression share meaningfully.

Amazon Impression Share in Google Shopping Auctions Closing in on Holiday 2020 Peak

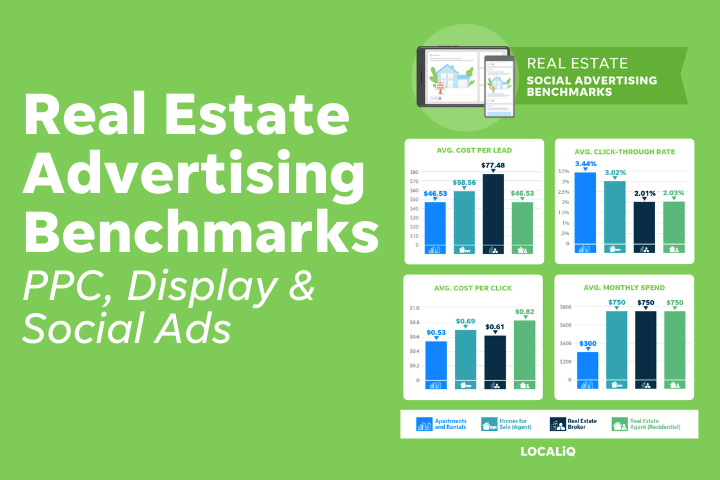

When Amazon first reentered Shopping auctions in June 2020, its impression share in ad auctions was fairly modest in comparison to previous levels. It ramped up through the end of summer, however, as well as during the winter holiday shopping season, peaking in mid-December before fading in the final weeks of 2020. There’s been a modest increase in impression share for Tinuiti Retailers, rising from 38% at the beginning of January to 42% by the end of March. Amazon’s share went from 34% to 49% over the same time frame. Changes to the auction such as adjusted ad placements can sometimes have an impact on advertiser impression share, such that there might be movement in impression share values without any change in advertiser strategy. However, comparing Amazon’s impression share to the median Tinuiti competitor over the start of 2021, it seems clear that Amazon’s recent surge indicates Amazon is becoming more aggressive in ad auctions relative to many competitors. The last year has brought a lot of interesting twists in the saga of Amazon bidding on Google Shopping ads, a format the eCommerce giant didn’t start wading into until December 2016 in the US. With the pandemic bringing a surge of demand to Amazon’s doorstep last March, it chose to shut down both Shopping and text ads for twelve weeks, reactivating in June and remaining active through the end of the year.

CPC on the Rise, but Much More at Play than Just Amazon

In Q1, Google paid search CPC rose a whopping 15% year over year for Tinuiti advertisers, up from a 4% increase in Q4, and accelerated across all device types. Amazon’s presence in ad auctions is certainly part of this equation for retail advertisers, as the eCommerce giant is one of the few advertisers that can single-handedly shift auction dynamics across essentially every product category with changes in its strategy.

Taking a look at recent trends, it’s clear that Amazon is now reestablishing itself as a dominant force in Google Shopping auctions across many product categories.

The ad auction has many moving parts, with Amazon just one of those, albeit a gigantic one. We’ll be unpacking these and other trends with greater detail in our upcoming Google Ads Benchmark report, set for release later this month.