To this end, Pinduoduo includes games on its platform. It offers team discounts when shoppers can gather a group of friends to purchase products collectively. It provides access to key products such as fresh produce. Like a social media feed, Pinduoduo shows shoppers products it thinks they will like instead of just letting them search on their own.

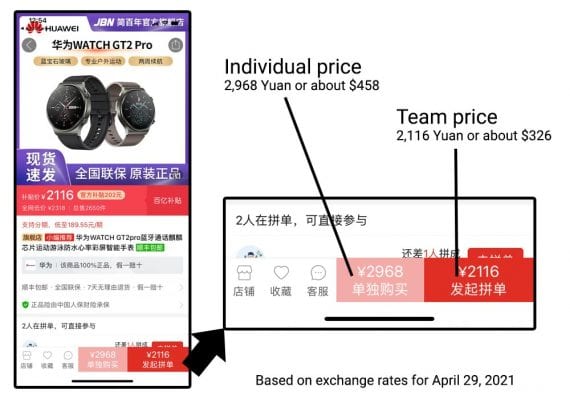

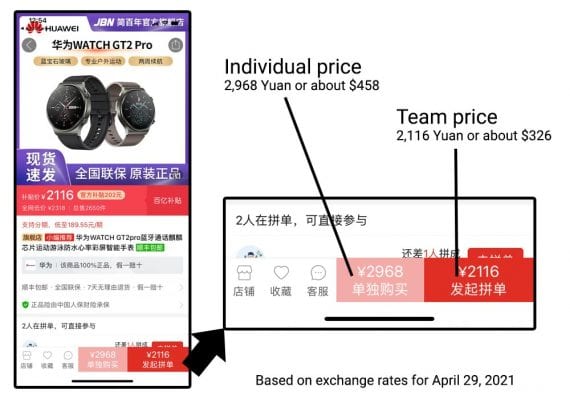

Pinduoduo shows two prices for every item: the individual (or standard) price and the discounted team price.

And that’s the final insight. Focusing on shoppers’ experience could be increasingly important for much of ecommerce.

Change with Customers

A key part of Pinduoduo’s success is team shopping. When she views a product on Pinduoduo, a consumer is shown two prices. One is a buy-it-by-yourself (or individual) price. The other represents a team discount.

Pinduoduo now has more active users than Alibaba’s brands, although less revenue.

Live streams abound on Pinduoduo.

Pinduoduo’s team prices leverage customer relationships. For the first few years of its existence, for example, the company did no advertising, relying solely on its customers to introduce new shoppers to the platform. This worked so well that when Pinduoduo was listed on the Nasdaq in 2018, it had a market capitalization in the billions of dollars.

Rather than competing directly with what Pinduoduo has described as “search-based” ecommerce sites, the company took a more social approach focused on customer behavior and the trend in China toward a consumer-to-manufacturer retail model.

Pinduoduo started with a lightweight form of C2M for the produce market.

Pinduoduo has made buying online feel a lot like entertainment. The site has a product feed that resembles social media more than a retail website, showing products it thinks you will like based on your previous browsing behavior.

Expand from a Niche

Remember Pinduoduo had 788.4 million users at the end of 2020. Alibaba with its various brands had about 779 million users. And Pinduoduo is not yet six years old.

Here the insight is that retail is not static. The industry is changing rapidly, and consumers are leading the way.

So Pinduoduo created a direct link. In 2018, it held a one-day “Pin Agricultural Goods” event in China’s Hebei province. The sale generated 47,000 orders for more than 165 metric tonnes or about 364,000 pounds of garlic in a single day.

Facebook, founded in February 2004, took about seven years to hit a similar number of monthly active users. This is not a perfect comparison, but it may indicate that Pinduoduo’s growth is more akin to a social network than a store.

“Shopping in real life is interactive because whether you’re grabbing the essentials or perusing the latest trends, you’re bound to interact with others, discover surprises, and maybe even enjoy some entertainment. So why can’t shopping online be just as fun and interactive?” asked Pinduoduo’s English-language explainer video.

Leverage Customer Relationships

First, in terms of consumer behavior, Pinduoduo is effectively social commerce.

This C2M model gives consumers desirable produce, like garlic, at a low price. The garlic sold for about 76 percent less than in a grocery store. Farmers get a good price, perhaps even better without their many distribution partners, plus a “large, predictable, and aggregated demand” for their products.

Using what it learned in the agricultural industry, Pinduoduo moved into more product categories. It picked a niche and grew from it.

At the end of 2020, the five-year-old Chinese shopping app Pinduoduo had 788.4 million users and more than billion in annual revenue. Pinduoduo’s incredible growth may provide some insights into the future of ecommerce.

In China, as in most nations, there can be several layers of distribution between the farmer growing garlic, for example, and the grocery store in a mid-sized city.

Pinduoduo also has many live streams. The presenters on these live videos are energetic and engaging. Finally, Pinduoduo offers games and intrinsic rewards that we might call gamification.

Focus on the Experience

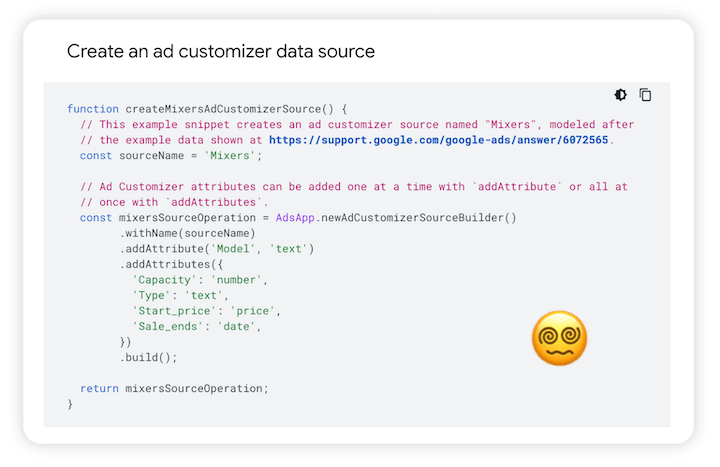

[embedded content]

Collectively, these elements have produced a compelling shopping experience if the number of Pinduoduo users is an indication.

Second, Pinduoduo has embraced the consumer-to-manufacturer (C2M) model, which uses the company’s platform and artificial intelligence algorithms to drive product development, product selection, and mass-customization at relatively low prices.

New buying teams have 24 hours to form, or it’s no deal.

“When Pinduoduo launched in 2015, there was little room for a new commerce platform in China. Two major ecommerce platforms, JD and Alibaba sub-brands Taobao-TMall, dominated online commerce in China, much like Amazon dominates in the U.S. During that same year, JD and Taobao generated a combined 3 billion of gross merchandise value. And yet, five years later, Pinduoduo is defying expectations,” wrote Anu Hariharan and Nic Dardenne for start-up accelerator Y Combinator.