- Will customers who purchased groceries online last year continue to do so in 2021?

- Where should CPG brands be investing their ad dollars to meet the needs of consumers?

- Can we expect to see a surge in year-over-year CPC growth as advertisers (who may have pulled back on spending last year) return to the market?

For example:

How Vaccinations Influence Organic Search

Based on our organic findings, we decided to dig a little deeper into paid search trends with Andy Taylor, Director of Research at Tinuiti.

“Customers are also moving rapidly from thinking just perishable staples to adding shelf-staples and other CPG products like cosmetics, health, and of course, alcohol. If you are in-store at a participating retailer, then an Instacart ads program should be part of your media strategy.”

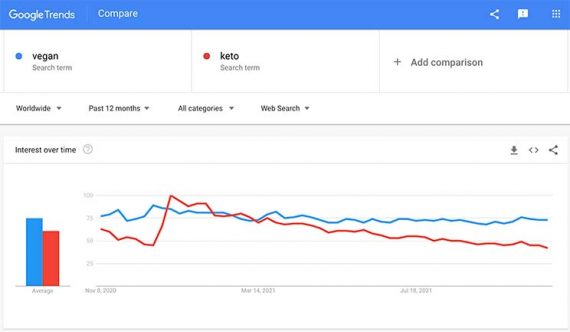

Based on the Google Trends Data below, we see a clear indication that:

- Vaccination searches including “covid vaccine” “covid vaccine near me”, “pfizer”, “moderna” all saw an increase in search volume starting in January 2021 (and continuing throughout April).

- There was a spike in searches for the keyword term “johnson and johnson vaccine” – likely a result of blood clot reports. The vaccination pause was later lifted on April 23, 2021.

‘Get location details’ clicks, largely attributed to ad clicks on Google Maps, rose 34% year over year in March as we lapped the start of the pandemic a year ago.

“Advertisers are already seeing the effects of US shoppers becoming more comfortable heading to brick-and-mortar stores as many businesses reopen and vaccinations rise,” Taylor said. “While many consumers will continue to shop online, marketers should be ready for increased brick-and-mortar demand moving forward, and measuring offline interactions driven by online spend will be key to fully valuing digital marketing as we move forward,” Taylor said.

Get location details click volume was 20% lower last March than last January as consumers started limiting movement, but in 2021 March click volume was 23% higher than in January.

Walmart also rapidly expanded its presence in Shopping auctions throughout Q1, and by the end of March its impression share against the median Tinuiti advertiser was 33%, up from 17% at the start of the quarter. By comparison, Target, another big-box titan, held roughly steady in impression share throughout the quarter.

Here’s what we found:

Aided by the pandemic, more than 40% of Americans tried food and/ or grocery delivery options for the first time in 2020. Even more interesting is that many consumers report they’d like to continue their behavior, post-pandemic. In Q1 2021, Paid Search CPC rose 15% year over year for Tinuiti advertisers, a significant acceleration from the 4% growth observed in Q4 2020 and the largest quarterly jump in years.

“I stayed within the realm of common searches, like ‘food delivery near me’, ‘grocery delivery near me’, and ‘restaurant dine in near me’. What’s interesting is ‘food delivery’, a broad search term that has not wavered since the beginning of the lockdown in April 2020. What this indicates is there has been a shift and the elevated search volume for this term is now considered the ‘new norm’ (compared to pre-pandemic numbers). This query specifically is something I expect we will continue to see have a higher popular presence moving forward – as a direct effect of Covid-19,” Bretaña said.

Paid Search Trends as the Pandemic Turns the Corner in the US

“Particularly given the aforementioned rising interest in brick-and-mortar shopping in the US, it will be fascinating to see how these two big-box retailers progress in digital after both showed huge gains in ecommerce during 2020,” Taylor said.

As America’s shopping habits continue to change after COVID-19, an Instacart advertising strategy should be top of mind–if you’re in-store as a participating retailer.

Increased brick-and-mortar demand moving forward

Today, Instacart remains the most popular grocery ecommerce service in North America. In 2020 alone, Instacart consumed 57% of the grocery ecommerce market and increased its order volume by 500%. Instacart is an undisputed opportunity for brands to acquire and retain online grocery shoppers.

According to the Centers for Disease Control and Prevention, more than half of all American adults have now received at least one vaccine dose. As adults and children begin the process of returning to work and school, Tinuiti decided to take a closer look at how search behaviors [organic and paid] shifted throughout the pandemic and post-pandemic and how we expect those behaviors will impact brands and advertisers.

Surges in year-over-year CPC growth

We spoke with Jasmin Bretaña, SEO Coordinator at Tinuiti to get a closer look at how vaccinations are influencing keyword data as it relates to organic search.

“For retail advertisers, not only are many seeing CPC growth rise as a result of softer comparisons from a year ago, but also as a result of giants like Walmart and Amazon increasing their presence in paid search auctions, particularly Shopping results. In the case of Amazon, by the end of March, its impression share against the median advertiser nearly matched its mid-December holiday shopping season high. This comes after Amazon was forced to pause ads in late March last year as it was pummeled by online demand in the early goings of the pandemic,” Taylor said.

Many marketers are also finding surges in year-over-year CPC growth, as we lap year-ago comparisons in which ad pricing slipped with so many advertisers pulling back or exiting ad auctions at the beginning of the pandemic.

“The search for “covid vaccine” has remained overall consistent as people continue to try to gather as much information as possible. But what stood out to me was how people were searching throughout this pandemic, specifically as it relates to food and groceries,” Bretaña said.

In the following article, we teamed up with our top experts to answer these questions and more.

Make room for Walmart and Target

“Regardless, the rest of 2021 is shaping up to be a very competitive time in digital marketing, and many advertisers will likely find that ad pricing becomes more expensive. This is particularly true of year-ago comparisons in Q2, when average CPC bottomed out for many brands last year before rebounding in the second half of 2020.”

“Instacart’s marketplace is becoming an enormous opportunity for brands that can get on the platform early. High conversion rates, average order values, repeat purchases, and lower CPCs are all positive signals for brands, in addition to reaching shopper households all across the US,” Elizabeth Marsten, Senior Director of Strategic Marketplace Services at Tinuiti said.

According to a study by Mercatus/Incisiv, 90% of e-grocery customers are expected to continue shopping online. Once more drastic shelter-in-place orders are lifted, only 7% of online grocery shoppers said they will return to brick-and-mortar stores.