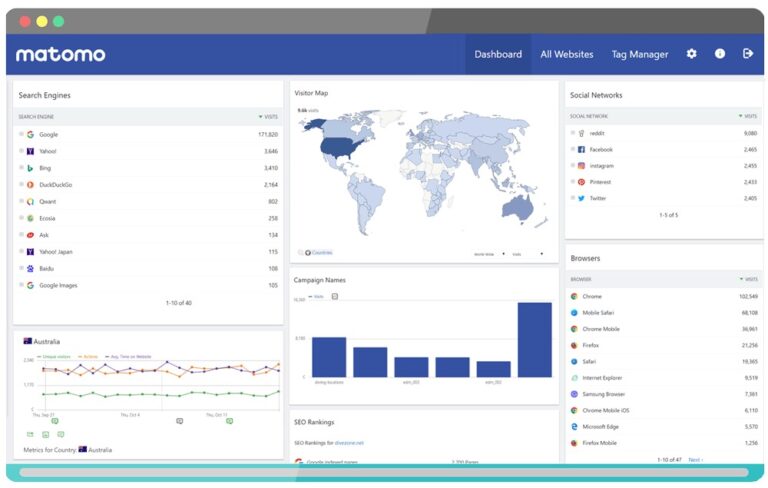

The second pillar, AirAsia Delivers, focuses on ecommerce and grocery services including a duty-free shop, food delivery, grocery delivery (AirAsia Fresh), beauty products and a ride-hailing service. Finally, the third pillar, AirAsia Money, is comprised of financial products including sister company BigPay, a debit card-powered mobile wallet; a currency change platform; Big Rewards, a loyalty platform; and insurance services, offered by sister company Tune Protect.

AirAsia’s journey to super app-dom began in 2019. As the largest LCC (low-cost carrier) in Southeast Asia, AirAsia flew more than 600 million passengers to 160 destinations that year – but it was also embarking on what Chief Technology Officer Pablo Sanz called “a transformation”.

“We decided to start a transformation; enter into other markets that could bring ancillary revenues to the airline,” said Sanz. This began with acquisitions and partnerships with companies that operated in the realm of activities and hotel bookings, but the airline also had bigger ambitions. “At the end of 2019, when Covid started, we were already in the process of creating something bigger. … That mission was to create a super app,” said Sanz.

Next up with an airline Super-App is..@BreezeAirways according to CEO David Neeleman. Will allow booking, servicing, non-air products like hotels and car rental, as well as order in-flight food. Technology will be key for the airline #AviationFest

Delivering a consistent digital experience proved to be a particular challenge, because as Sanz put it, “we were a little bit of a Frankenstein. We had different offerings with different capabilities, different payment methods, different UI, different user experience – so, one of the first things we needed to tackle was to unify the experience”.

The components of a super app

Should more travel brands follow in AirAsia’s footsteps?

Within East and Southeast Asia, it isn’t unusual for companies to set out to develop a super app, although AirAsia is the first airline to have done so. Its closest competitor in the travel sector is probably Traveloka, an Indonesian unicorn company that originated as a flight comparison engine before expanding into ticketing services, hotel reservations, finance and food. In 2019, it launched Traveloka Xperience, a “one-stop” platform combining all of its services together with 15,000 bookable activities and experiences, a move that has prompted many to label it a super app – though Traveloka executives reportedly do not like the term.

- A consistent user experience

- Payment functionality

- Messaging functionality

- Single sign-on

- Partners

Super apps often originate as transport, delivery or payment apps – WeChat, although it started out life as a chat app, launched a digital wallet called WeChat Pay before embarking on the road to becoming a super app – as the underlying infrastructure lends itself well to expanding into other services like finance, groceries and other types of ecommerce. However, super apps can originate from any industry – as demonstrated by Malaysian low-cost airline AirAsia, which recently became the first airline to launch a super app.

2021 Digital Trends – Travel & Hospitality in Focus

However, as AirAsia’s Pablo Sanz illustrated in his presentation, there are a number of hurdles to overcome for companies that set out to build a super app: particularly achieving single sign-on and a unified user experience. While these are desirable goals from a customer experience standpoint independent of the super app concept, and some brands are already implementing them – such as Emirates Airline, which made a deliberate decision to combine all of its key services within a single app for customers’ convenience – implementing single sign-on is already a challenge for many companies without the addition of complexities like configuring mini-applications.

A super app is the name given to a type of app that allows the user to accomplish a number of different things in a single ecosystem, by housing a range of ‘mini’ applications under one roof.

Orienting around verticals

Meanwhile, OTAs Trivago and Booking.com have both made recent announcements that they are expanding into the realm of experiences, with Trivago acquiring Germany-based startup Weekend.com to offer weekend getaways and partnering with TUI-owned Musement to sell activities and attractions, and Booking.com partnering with Viator, which is owned by Tripadvisor, to offer tours and activities.

“From the sourcing layer, to the publishing layer, to the exploration layer, to the customer experiences, to the checkout and engagement pieces – all of them are owned by AirAsia, and powered by our data,” said Sanz. “We are building all this in a way that means we can own our future.”

There has been a definite uptick in interest in the concept of super apps within the travel sector specifically. At the Virtual World Aviation Festival, Expedia Group’s Greg Schulze fielded a question from the audience during his keynote interview about whether Expedia had plans to develop a super app. Schulze responded by saying that Expedia “already has a super app” (meaning ‘super’ in the sense of ‘very good’), but others are considering the idea more seriously. Serial airline entrepreneur David Neeleman, whose “tech-focussed” airline Breeze Airways is due to begin flying in the United States this summer, told the festival that he plays to develop Breeze Airways’ app into “a super app that can do whatever you want”, including booking hotels and ordering in-flight food.

In the meantime, however, I think we will see more gradual shifts in the travel sector towards all-in-one experiences that combine everything a traveller needs to book a trip, as brands vie with one another to win customers by offering convenience and a smooth experience. This, whether or not it ultimately leads to travel companies launching super apps, would undeniably be a positive outcome for consumers.

“We really believe that [these three verticals] have synergies, and we try explore new verticals constantly that can fit with our business case,” said Sanz.

Other major Southeast Asian super apps are also eyeing up the travel sector. Grab, a Singaporean super app that originated as a ride-hailing service similar to Uber, launched hotel bookings in 2019; while in the same year Indonesian super app Go-Jek launched Go-Travel, a travel booking service, in partnership with OTA Tiket.com. But is there a case for travel super apps outside of East and Southeast Asia?

Airlines like AirAsia and Breeze Airways have a particular incentive to enhance their app experience, since this will encourage customers to book directly with the airline rather than through a flight comparison website or OTA – meaning that the airline takes a bigger percentage of the revenue, and can also own the customer data.

For a major corporation like Uber, which is already mid-expansion into a variety of other sectors, building a super app to unify the experience of accessing its various services makes sense, while a new company like Breeze Airways can ensure that single sign-on functionality is built into its app from the word ‘go’. It will be worth keeping an eye on both of these projects (and others, since Facebook has long been rumoured to be moving towards super app status) and their reception, which may indicate whether there is an appetite for super apps among western consumers.

The case for travel super apps

Despite the setbacks that the travel sector has experienced due to Covid-19, these figures will almost certainly now be higher, as consumers have spent more than a year becoming accustomed to doing everything via digital channels. High-quality digital experiences were important before the onset of the pandemic, but they will now be paramount, and the travel brands that can offer the slickest experience in this regard – particularly in terms of seamlessly switching between complementary services like hotel booking, health insurance, ticketing and vehicle rental – will undoubtedly have an edge.

AirAsia also moved its payment infrastructure off its passenger service system and onto a custom-built order management system that can handle the sale of both digital and physical goods, and through the implementation of a messaging system, has created a “chat community” with a focus on travel.

AirAsia achieved this by implementing its own design system, Phoenix, which made it possible to create a cohesive look and feel for the app’s different verticals. “It has the same components, whether you are buying flights or buying perfume – the experience of the user is unified,” said Sanz. The company also shifted its mindset away from product-oriented thinking towards what Sanz called “playing the platform game” – treating the super app as a single, interconnected platform.

With all of this functionality, it’s important to AirAsia that it owns the underlying infrastructure. Sanz pointed out that most airlines will outsource the IP that underpins their systems, such as check-in and booking engines, but although AirAsia has sought help from a few small and medium-sized companies in building its ecosystem, it has kept everything in-house. This means that AirAsia can retain ownership of, and control over, all the first-party data from its many and varied services, which power its recommendation engine, its customer intelligence insights, its growth engine and more.

A diagram illustrating the three pillars that make up AirAsia’s super app: AirAsia Travel, AirAsia Delivers, and AirAsia Money, each consisting of a range of different products and services.

AirAsia CTO Pablo Sanz gave a keynote presentation at the World Aviation Festival Virtual in April on how AirAsia went about expanding beyond travel into complementary areas like healthcare, lifestyle and finance, and how these different ‘pillars’ interact within AirAsia’s super app. At an event where super apps were a frequent topic of conversation, Sanz’ presentation was a worthwhile insight into how a super app could serve the needs of a travel organisation – particularly as many airlines and OTAs are expanding into other verticals to diversify their revenue following a challenging year.

Sanz laid out five key attributes that typically make up a super app, and which AirAsia set out to incorporate into its own offering:

Breeze Airways is not the first western company to go on record about its super app ambitions. Earlier this month, Uber CEO Dara Khosrowshahi told CNBC, “We think we can be the local super app”, stating that the company plans to target “fast and frequent” services like grocery, alcohol delivery and pharmaceuticals. But there may be a particularly strong case for super apps in the travel sector. A 2018 survey by Travelport found that found that US leisure travellers were using between seven and eight different apps throughout their travel experience, while more than three fifths (61%) had booked and paid for travel using their smartphone within the past year.

— Paul Byrne (@PaulByrne66) April 19, 2021

Ultimately, there needs to be a very strong use case before companies outside of regions like East and Southeast Asia, where mobile penetration is extremely high and already the primary channel for accessing online services, consider developing a super app. If they set out to build one, they need to be confident that the investment will pay off – and while there are many arguments for creating a seamless mobile experience that houses a number of complementary services, it is possible to develop a feature rich app with excellent UX without necessarily launching a super app.

“We are doing very unique things – we are bringing batiks from Indonesia into Thailand; we are connecting Penang with Valencia; we are bringing people together with people,” said Sanz. “So, we needed to create a space for these communities to chat and create links among themselves.” In addition, implementing chat functionality within a super app helps to “bring frequency to the ecosystem” by encouraging regular usage.

The format was pioneered by chat app WeChat (Weixin in China), which introduced a feature called ‘mini-programs’ in 2016 that allowed users to download and run a variety of third-party applications, from shops to games, all without leaving WeChat. The concept achieved huge popularity, and has since been adopted by a number of major companies, most of them in East and Southeast Asia – such as Baidu, Alipay, Bytedance, Grab and Gojek – but also in countries like Russia, where search engine Yandex has launched Yandex Go, widely hailed as Europe’s first super app; and Colombia, where delivery giant Rappi aspires to become the largest super app in Latin America.

While playing host to third party apps and services is not necessarily a requirement to be considered a super app, the more services a super app can house under one roof, the ‘stickier’ and the more indispensable it will be to users. Thus, AirAsia has created APIs to enable the integration of third-party services, such as Naluri Food Journal, a source of dietary and health advice that appears as a mini-app within AirAsia, and “tallies very well with [AirAsia’s] health ecosystem”. The API infrastructure will also aid AirAsia in implementing ride hailing, a service it plans to roll out this month.

AirAsia’s super app is built around three ‘pillars’, or verticals, with a media layer consisting of chat and TV entertainment that operates across all three. The first, AirAsia Travel, involved AirAsia expanding to sell not just its own flights, but those of other airlines as well, partnering with flight search platform Kiwi to create a co-branded experience. Other services that AirAsia has developed in order to compete more effectively with OTAs include Snap, which offers low-priced flight and hotel bundles; Ikhlas, a platform aimed at Muslim travellers; and AirAsia Health, which caters to the booming medical tourism market focused on Thailand and Malaysia.

We are already seeing a number of airlines and OTAs expand into new areas to generate additional revenue streams and present a more attractive proposition to customers. Malaysia Airlines, for example, upgraded its online store in August in a bid to encourage customers to shop for duty-free goods online, while Singapore Airlines launched an online concept store on its flagship ecommerce platform in the early months of the pandemic, curating products that would help Singaporeans work, play and relax more effectively from home.