In 2021 Walmart had 11,443 stores worldwide, a decrease from the 11,501 it had in 2020, according to Statista. In the U.S., there are 5,342 Walmart stores and 600 Sam’s Clubs. Ninety percent of Americans live within 10 miles of a Walmart store.

Amazon’s first foray into brick-and-mortar started with bookstores and then small-format cashier-less grocery stores (Amazon Go). It then acquired Whole Foods Market.

Omnichannel Selling

In September 2021 Walmart raised its minimum starting wage to an hour from and increased all U.S. workers’ pay by an hour. That was the third wage hike in 2021. The average wage for hourly workers at Walmart is now .40. In contrast, Costco raised its starting hourly rate from in 2019 to in 2020 and in October 2021. Costco’s average pay for hourly workers is per hour. Target’s starting minimum wage is an hour.

For many years Walmart employed mostly part-time hourly workers who received no benefits and earned only a few dollars above the federal minimum wage. Walmart is now moving 67% (two-thirds) of its U.S. physical-store hourly jobs full-time. While that’s up from 53% five years ago, it is still below the 71% average for the U.S. retail and wholesale industry.

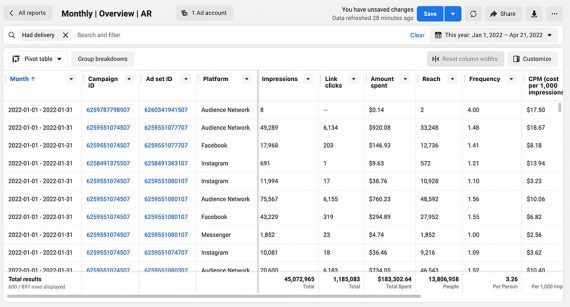

According to Statista, Amazon’s estimated 2021 ecommerce revenue was 7 billion versus Walmart’s estimated billion, up from billion in 2020.

Amazon believes it has to compete with Walmart on the brick-and-mortar front beyond groceries. According to an August 2021 Wall Street Journal article, Amazon intends to open physical retail stores in the U.S. of approximately 30,000 square feet. That size is less than one-third that of Walmart’s conventional stores and one-sixth the size of Walmart Supercenter outlets.

While Amazon will presumably never rival Walmart in the brick-and-mortar arena, physical stores can accommodate customers who wish to pick up or return online orders in person.

Physical Stores

Walmart’s regular Express delivery allows customers who buy online to reserve a two-hour home-delivery slot for groceries, pet supplies, and some electronics.

Currently, Amazon’s U.S. physical stores include 503 Whole Foods Markets, 12 Amazon Fresh grocery stores, two Amazon Go Grocery stores, 22 Amazon Go convenience stores, 24 Amazon Books stores, and 30 Amazon 4-Star outlets, which sell goods rated 4-stars and above online as well as trending items and top online sellers.

First launched in fall 2019, the service is now available to 6 million households across the U.S. Walmart says it plans to expand InHome delivery to 30 million U.S. homes by late 2022. The InHome service costs .95 per month. Walmart announced a partnership with electric vehicle and service provider BrightDrop, the General Motors subsidiary, for 5,000 vans. This will rival Amazon’s Delivery Service Partner Program, which utilizes a third-party network for last-mile deliveries.

Available in more than 600 cities, Walmart’s Spark Driver is a program whereby customers place an online order, and independent third-party contractors do the shopping and delivery.

Delivery

Two behemoths are locked in a battle for consumer spending and loyalty. For over two decades Walmart dominated brick-and-mortar retail while Amazon ruled online. Now they are on a collision course as each makes inroads into the other’s turf.

Members of the Walmart+ loyalty program get free delivery. For other customers, a order is required.

Amazon has almost 1.5 million employees worldwide, with 170,000 added in the first nine months of 2021. The company has significant employee churn. In 2019 Amazon hired more than 770,000 hourly workers. John Phillips, the former Amazon global head of workforce hiring, wrote on LinkedIn that 620,000 resigned or were fired.

Walmart will purchase 5,000 electric vans from BrightDrop.

Amazon’s entry-level hourly rate is , but in September 2021 it raised the rate for warehouse workers to an hour or higher, depending on the location. Amazon does provide a generous benefits package.

In August 2021 Walmart created a new line of business — Walmart GoLocal — a white-label last-mile delivery service for companies with large products or complex requirements. Home Depot is a customer.

Walmart has long lagged its brick-and-mortar rivals in employee wages and benefits. The Covid pandemic prompted mass worker resignations, pressuring all retailers to increase wages.

Employees

Walmart has 2.3 million employees worldwide — with over 1.6 million in the U.S., including those at Sam’s Club. Walmart is the largest U.S. private-sector employer.

What follows are comparisons of their operations and strategies.

Walmart is bolstering its delivery service to better compete with Amazon. Earlier this month Walmart announced plans to hire more than 3,000 U.S. delivery drivers and build a fleet of all-electric delivery vans to support its InHome grocery delivery service, which lets drivers access customers’ homes via a smart lock and place groceries bought online in refrigerators.

Wages

Fast delivery is an essential part of ecommerce. Amazon’s speedy delivery has been a competitive advantage. However, Walmart has added new delivery options, including the store pickup if needed immediately.

According to data and software provider FactSet, Amazon’s ecommerce sales (including those of third-party marketplace sellers) surpassed Walmart’s total sales (online and brick-and-mortar) in the twelve months ended June 30, 2021. In that period, Amazon raked in 0 billion from consumers. In comparison, Walmart took in 6 billion, marking the first time it has been outsold since 1990, after which it dethroned Sears as the largest American retailer.

Amazon Go is a cashier-less grocery and convenience store, such as this example in Seattle.

Financials

Both companies have embraced omnichannel selling. Walmart shoppers can buy online and have the goods delivered, like Amazon. Walmart customers can also pick up an online order, including groceries, in a store or curbside. Despite coming late to ecommerce, Walmart has rapidly progressed, first through the acquisition of Jet.com and then by beefing up its internal operations.

The first Amazon stores are slated for Ohio and California and are expected to showcase the company’s private-label goods — clothing, furniture, and consumer electronics. In early 2020 Amazon opened its first Amazon Go in Seattle. In March 2021, it opened its first physical store outside North America, an Amazon Fresh grocery in London. Since then it has opened five more outlets in England.