Personalised messaging and content takes into account psychographics (actual user behaviour as they interact with your digital touchpoints) as well as more straightforward user interest around specific products and services.

According to Benoit Bouteille, VP of Customer Experience at Tinyclues, the best signals lie within first-party data sets. “Implicit signals—those that don’t indicate explicit intent like past purchase or website visits—are actually the strongest indicators that a customer is in the market for a product at a given moment,” he says. “By utilising owned demographic, transactional, behavioural, web and search data, marketers can build look-a-like audiences based on those who have purchased similar products.”

During 2020 the ecommerce market went into overdrive. US online shopping saw ten years’ worth of growth in the three months up to April 2020. And it was a similar story across global regions as lockdowns hit and consumer habits changed.

We know that, increasingly, consumers expect experiences that are tailored to them. Last year, Salesforce found that 66% of customers expect brands ‘to understand their unique needs and expectations.’ Prior to this, Epsilon found that as many as 80% of consumers are more likely to make a purchase from a brand that provides personalised experiences.

With CAC costs and tough competition from market leaders—as well as the impending deprecation of the third-party cookie by Google—we can really begin to see why nurturing the customers you already have is so important.

So why is customer nurturing important?

This approach is vital for brands seeking to nurture the relationships with their existing shoppers. It means they can accurately invest in appealing to and engaging with their highest value customers:

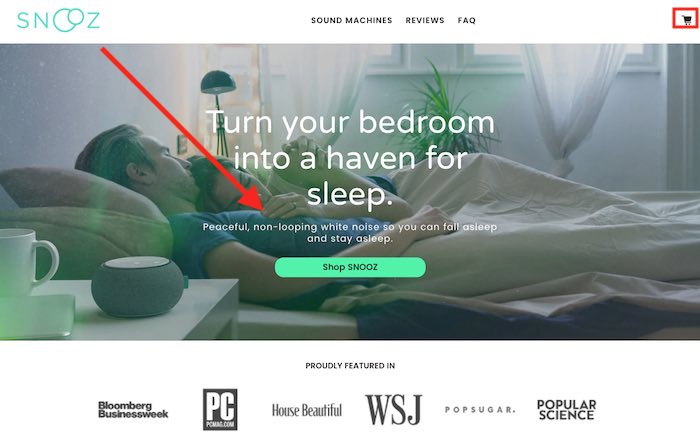

Customers not interested in specific seasonal products wouldn’t be contacted about the promotion, while those who were likely to be receptive received the relevant messages. It was a huge success – seeing an 83% increase in conversions as a result.

With advertisers vastly increasing the proportion of their marketing spend that goes online, there’s now much more competition for the available inventory. What’s more, Google and social platforms such as Facebook, Instagram and TikTok are increasingly working to keep users on their channels and clicking on paid ads, rather than surfacing brand and retailer content in feeds organically.

The pandemic has cast this into sharp relief

The case study highlights that brands using their first-party data to optimise personalised experiences, and to nurture the relationships with their existing customers, are set to make great gains in an increasingly digital—and increasingly competitive—context.

Stats roundup: the impact of Covid-19 on ecommerce

The campaign initially leveraged Wunderkind’s Identity Network technology to grow Clarins’ email subscriber list by 5x. With an enriched CRM database, the brand then deployed Tinyclues’ audience-building and targeting tools to understand which customers would be most receptive to seasonal Christmas messaging around Clarins’ new Spa at Home collection.

So how do brands retain their customers?

Here are five takeaways to shift your mindset from acquisition to nurture:

A campaign carried out by performance marketing engine Wunderkind and Tinyclues for leading skincare brand Clarins sought to optimise the brand’s ability to target certain customers within their existing database.

But there is data which directly draws a line between better personalisation and customer nurturing too.

Owned channels + personalisation = a winning retention formula

But the report also warns that the end-goal for brands should not be optimising their CLTV simply to extract maximum revenue whenever customers make a return visit.

Globally, we’ve seen online leaders like Amazon shift funds quickly to target in-demand products across paid search (not to mention that a staggering 74% of US consumers reportedly start their product searches on Amazon in the first place).

Here in the UK, leading supermarkets were able to ramp up their delivery and collection services almost overnight when the first Covid-19 lockdown hit. But across some product lines, it is nearly impossible to compete with industry leaders when it comes to acquiring new customers at scale.

Regardless of the driver of the original purchase, the key to cost-effective retention— bringing customers back to make subsequent purchases, without having to reacquire them through paid channels—lies in leveraging owned channels.

This ensures your customers are seeing what they want to see—whether it’s deals, promotions, engaging content—when and where they want to see it.

Customer nurturing is a long-term strategy. It is about ensuring that your products, services and experiences are so good that those who have shopped with you before will return again and again in years to come.

Harness data to understand the long-term value of customers

Consumers are expecting more and more from the brands they purchase from, and there are myriad factors that may influence whether a one-time visitor or shopper becomes a repeat customer—including practical things (‘the basics’) like an appealing product range, availability of convenient payment and delivery options, and visibility of social proof and customer reviews.

Acquiring new customers is getting tougher and tougher. Research from Profitwell found that customer acquisition costs (CACs) grew by around 60% in the half-decade up to 2019.

According to the CMO Council, “LTV can help marketers justify spending on marketing campaigns targeting particular customer segments.” Their Humanizing and Analyzing Relationships To Drive Revenue, Retention And Returns report also states: “LTV can show that these groups will generate the most amount of sales over their lifetime.”

- They can target and promote deals these shoppers really want to see.

- Existing, big-spending, customers can be the first to hear about exclusive products that really appeal to them.

- And brands can ensure their path to purchase is optimised across the channels they really love to use.

US ecommerce data from Anadot shows competitive pricing to be the key reason for picking one retailer over another among 57% of consumers. But site usability is almost as important, with 53% saying an ‘easy-to-use website’ will increase the likelihood they’ll make a purchase.

With these changes in consumer habits in mind, it might look like getting new digital converts is the answer to scaling up a business today. Customer acquisition is certainly still a big priority for a lot of brands, but returning shoppers are now more valuable than they ever have been, and the benefits associated with these consumers should not be overlooked.

Using data to better target segments within your existing customer base

Best practice, here, is about ensuring the customer experience during and after purchase makes consumers excited to return to you in the future, as well as improving the chances they will become advocates for your brand down the line.

Working out Customer Lifetime Value (CLTV) has, traditionally, looked at demographics and past purchases. This approach provided a rather crude outcome. But with businesses increasingly capturing first-party data, and having better access to predictive analytics tools, CLTV can be forecast with greater accuracy.

This means marketers have to spend more on ads and content to convert increasingly ad-weary consumers. And with CACs climbing ever higher, the biggest brands—with the biggest budgets—are the ones succeeding in capturing new customers.

According to Invesp, 56% of online shoppers are more likely to return to a website that recommends relevant products, while SmarterHQ has found that those who shop more often find personalisation more helpful. Brand loyalty among millennials, in particular, increases by 28% if personalised communications are used.

For the first time, many customers turned to digital channels to track down products they had previously bought offline.

A deeper understanding of the long-term value of your customers

In short, if you’re deploying personalised experiences, both on-site and in inboxes, you are nurturing those customer relationships – and increasing the chances that those shoppers will come back again and again.

- Acquiring new customers is always going to be vital for brands, but past customers, who already know and understand your brand, are just as—if not more—vital for long-term business success.

- Customers want and value personalised experiences. They are more likely to return and be loyal to your brand if you tailor the experience to their needs.

- CLTV is essential for customer nurturing. It means you can truly understand which customers are most likely to be high-value over the long term, and which are most worthwhile investing in.

- The lesson with CLTV is not about (immediately) extracting value. Businesses need to be asking how they can improve the customer experience so consumers want to come back and be advocates for the brand. The financial returns will follow.

- Campaigns run by brands such as Clarins (operating in the extremely competitive beauty vertical) are already seeing success here – using implicit signals to segment out and target existing customers who are most likely to be receptive to particular offers.