That’s especially the case if a social channel links directly to the product detail page. In a bygone era, shoppers arrived directly on the brand site or via a search engine. Merchants funneled that traffic, typically from the home page to a category page to, finally, the product detail page with a single call to action, add to cart.

For years consumers have extended their shopping journeys across multiple channels. A Salesforce study in 2019 found that consumers interact with brands across an average of 7.6 touchpoints.

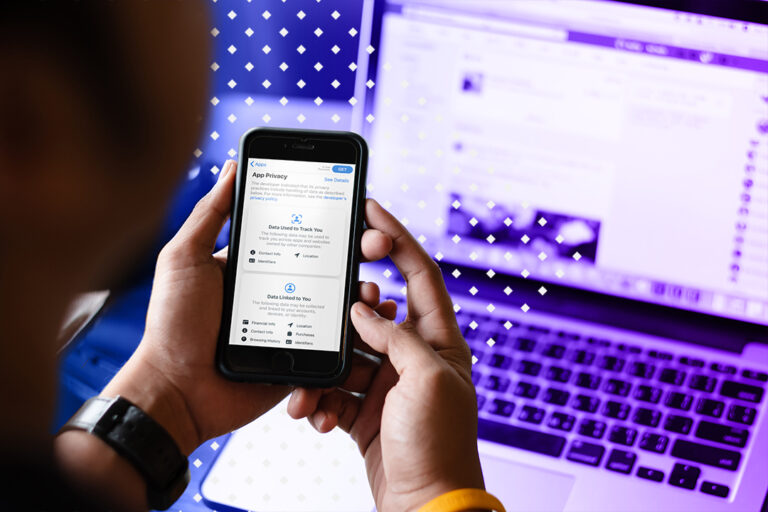

Shoppers increasingly use social media to discover products. But new research shows that shoppers overwhelmingly prefer to check out on the brand site, not on social.

This confirms a familiar pattern of discovering on social, perhaps via influencers, and then clicking to the brand site to buy. But there’s a problem. In our survey, 81% of shoppers had encountered poor experiences on a brand site. Problems include out-of-stock products, broken links, site errors, and inconsistent context.

Social Commerce

But in 2022 product detail pages are often where visitors land, with bounce rates upwards of 72% higher than other pages. The result is a huge revenue leak.

Social media is the most important of these edge channels and an important source of customer acquisition for brands. Many now spend one-quarter or more of their advertising budget on social. This is not surprising. A shopper who crosses channels often sees a break in the experience. Going from social to a brand site is no different. But the stakes are higher on the brand site as shoppers expect to consummate the purchase there. Thus brand-site problems hurt revenue and reputation.

Hence merchants should adjust tactics to accommodate edge shoppers.

Shopping has shifted to the edge.

That trend has accelerated. Consumers no longer head directly to the brand site or Google to discover new products.

My company surveyed 501 U.S. consumers in February 2022, inquiring about their use of social media for shopping. The results we compiled in a report titled “State of Social Commerce 2022.” Our survey found that roughly half (48%) of online shoppers think social is “a great place to learn about new products,” but only 13% prefer to buy there. Almost three-quarters (71%) of respondents prefer to check out on the brand site.

- Emphasize the experience. Shoppers overwhelmingly prefer to check out on the brand site. Carefully consider where you refer this traffic and the overall social-to-brand experience.

- Keep an eye on inventory. A top consumer frustration is promoted products that are out of stock. Shoppers rightly expect those goods to be available. Inventory data on social is notoriously out of date. Don’t post fast-moving, low inventory items on social, and keep a close eye on all promoted inventory stock.

- Fix your product detail pages. If you’re referring traffic directly to your product detail pages, create versions for landing traffic and include a range of alternatives and best-selling categories. Monitor your bounce rates for that traffic and experiment with options to plug the revenue leak. Consider ways to continue the social experience, such as adding user-generated and influencer content. And the more you know about those visitors, the better to target them with personalized stories and offers.

A New Path

Social media is where consumers spend their time — 2.5 hours daily, on average. There’s a new path to purchase, where shoppers start their journeys at the edge but buy on the brand site. By understanding this customer preference and implementing a few simple steps, merchants deliver a better experience — and grow revenue.