It’s tempting to view all visitors equally for purposes of conversion optimization. But that’s a mistake. The motives are different. Shoppers landing for the first time on a product detail page from social media typically have low purchase intent, often swiping up for entertainment. But returning visitors who browse the page repeatedly are much nearer to pulling the purchase trigger.

The losses are now greater. In 2013 brands lost on average for every new order, compared again to today. But orders from returning customers are now more profitable — per order in 2022 versus in 2013.

Acquiring new customers is expensive, often wiping out profits entirely from first-time purchases. But three-quarters of conversions come from first-timers.

Thus one of the best ways to lower acquisition costs is to focus on what happens after shoppers click on an ad.

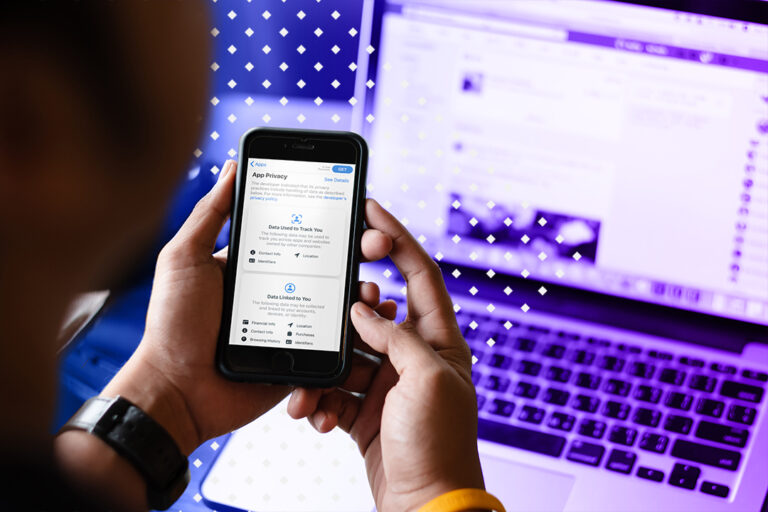

Cookieless browsers, iOS privacy changes, and global privacy legislation make profitability more difficult and the second sale even more important. In 2022 and beyond, focus on owning data from shoppers and obtaining their consent to market.

Reduce returns. Online fashion brands often experience return rates of 50% or more. Tools to reduce returns — accurate sizing charts, live chat, realistic photos and videos — can make a big difference.

Thus altering the message for new versus repeat visitors is key. Nudge nervous prospects to return with reassuring brand messages, best done with retargeted advertising. Segmented emails also work, provided you can capture visitors’ addresses. Nonetheless, securing a second sale is vital for many brands. I first addressed it in 2013. Much has changed in nine years, and a lot hasn’t. Key profitability metrics are unchanged. New customers weren’t profitable in 2013, and they still aren’t.

3 Tactics to Increase Profits

Certainly performance varies among brands. For this post, I’ve assumed a gross margin of 40% and ignored customer lifetime value estimates.

Hence the costs to acquire new customers increased, but so has the profits from retaining them.

Those findings and more come from a recent study by my firm of ecommerce conversion data from Forrester, National Retail Federation, Shopify, and Kibo, the personalization platform. What follows are findings from that study.

Capture identity. Fewer than 1% of first-time visitors buy. But conversions from second-time visitors increase nine-fold. This reflects the reality of modern shopping, which spans not a single visit but often a sequence (to multiple sites).

In contrast, the quarter of conversions from returning customers generates 43% of brands’ revenue and 100% of the profit. This is not a surprise. Repeat customers spend more and are more profitable than new ones when assuming acquisition, fulfillment, and ancillary costs are borne solely by the first purchase.

Almost half of pure-play ecommerce brands in 2022 are running at a deficit, losing on average for every new customer order. In recent years, customer acquisition costs have increased by as much as 60%, with more brands chasing the same groups of buyers.

Consent

Reduce customer acquisition costs. Social media is now a primary advertising channel for acquiring customers. It’s where many journeys begin, what I call shopping on the edge. Journeys that start at the edge often suffer from disconnects when would-be customers click from social media to brand sites. Common disruptions include broken links, out-of-stock products, and confusing navigation.