Case in point, Cart.com. This ecommerce data visualization and analytics firm had raised more than 0 million in funding from its inception in November 2020 to March 2022. Perhaps recognizing the gap in the ecommerce software market, investors were eager to give money to the company.

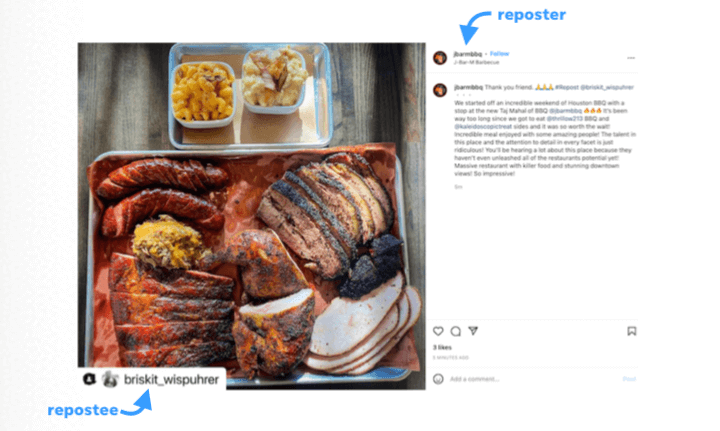

Another ecommerce business, perhaps further along in its growth, might want to know which channels — ads, organic search, affiliate, email newsletters — produce the most valuable customers. Do the folks arriving from an affiliate link spend more than those who click an ad or vice versa?

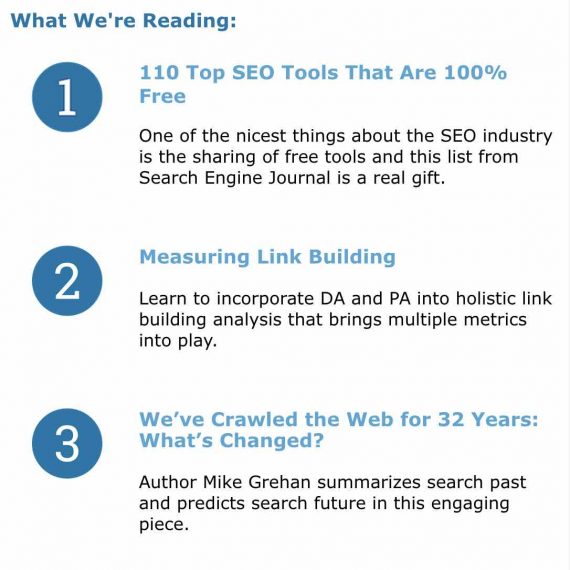

First, many data intelligence tools are available, including from Cart.com and Profitero. Businesses with the available funds could invest in these or similar providers.

The need to compete in a changing market exacerbates the data problem. Product sales were easier when ecommerce was new. But it’s now significantly more difficult.

As competition increases, which it almost always does, data-driven business insights can be a key competitive advantage. Ecommerce companies can use emerging software services or disciplined focus to employ data intelligence.

Problem

Given a choice, business leaders would rather make data-driven decisions about campaigns, products, and operations than rely on anecdotal customer information or intuition. This fact is giving rise to new data tools for ecommerce operators.

Cart.com launched as a data visualization and analytics firm.

Companies swimming in information are collecting data from numerous sources. They may have Google Analytics, cohort analysis from Lifetimely, ecommerce sales info, and ad performance data from Google Ads, YouTube, and more. Additionally, they might have a net promotor score to consider and offline data.

“We see now that large brands such as Procter & Gamble Company and Unilever are investing in sophisticated analytics to win on ecommerce. We see ecommerce and data analytics teams starting to grow at a great scale as they recognize the huge opportunity,” said Mike Black, the chief marketing officer at ecommerce analytics and intelligence firm, Profitero, during a May 2021 interview.

Competition

On the other end of the spectrum are companies starving for data. They lack accurate performance metrics or do not have sufficient models to understand and make decisions. As such, they wouldn’t know which campaigns drive sales or which products produce a profit.

Third, develop a data plan. Sometimes being in the sea of information or the desert of no data results from not knowing what should be measured and why.

The problem is understanding how this disparate data works together to impact the business, as these companies are drowning in waves of metrics and KPIs.

Solving for Data

The ecommerce data intelligence gap, if you will, can be solved in a few ways.

Too often, business owners and leaders find themselves in one of two data dilemmas: the sea of information or the desert of no data.

A mature ecommerce company might develop a KPI scorecard with just a handful of metrics, such as:

Second, expect ecommerce platforms to improve data analysis capabilities. Cart.com is also an ecommerce platform. One of the benefits of using its storefront service is its relationship to its data analytics platform.

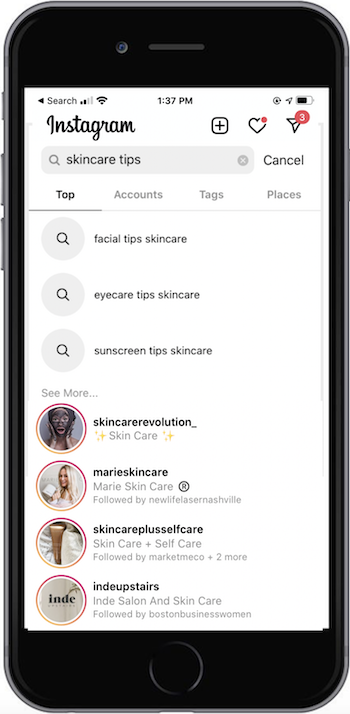

Here, a business can focus on its most crucial current need. For example, a new ecommerce business might want to know the source of its customers. It could concentrate its data needs on just that.

The funds allowed Cart.com to make eight acquisitions in less than two years. The company will likely build a platform to unify data collection and provide the insights necessary for data-driven decision-making. To be sure, Cart.com is not the only option. However, its rapid growth indicates just how acute the data problem is for some ecommerce companies.

- Percent of traffic from first-time visitors,

- Conversion rate,

- Repurchase rate.

Take Away

While this might be good news for the large brands Black describes, it is not so for many ecommerce businesses unable to invest in their own data analysis and growth teams.

![What is the Spotify Algorithm & How it Works [2022]](https://research-institute.org/wp-content/uploads/2021/04/what-to-know-before-you-sell-your-small-business-768x432.png)