Gurd said that Primark’s venture into click and collect is not an example of innovation, however, but that it is a retailer which has been steadily maturing its digital strategy and aligning a challenging operational system (i.e., a vast store base). “I’m still surprised it has taken them this long but there’s often a story of systems and process complexity in large retailers that slows down time to market,” he stated.

The shift in demand for click and collect happened in key markets during the pandemic as consumers sought out greater convenience. Gurd told Econsultancy that retailers have since continued to invest in their omnichannel capabilities, “improving order management integrations using existing ecommerce platforms, or re-platforming to enable these capabilities.”

While Primark is just beginning, many other big retailers are expanding on their existing and well-established click and collect services, too. Ikea, for example, has recently announced a partnership with Tesco that will enable customers to pick up orders from within their local Tesco car park. This follows on from the launch of Ikea’s click-and-collect locker service in London earlier this year, which enables customers to pick up their furniture items from a locker location closer to home.

End-to-end CX includes rethinking the store environment

As Gurd stated, however, retailers must ensure they have the correct processes in place to effectively manage logistics. Otherwise, they risk negatively impacting operations and CX. Primark’s decision to roll out a test run in just 25 stores could be a sensible move.

Click and collect will account for almost 11% of UK online retail sales by 2025, according to new research, as shoppers increasingly display a demand for hybrid retail services. Other research also predicts solid growth, with the global BOPIS market (‘buy online pick up in store) expected to reach 3.18 billion by 2027, on the back of continued adoption since the pandemic.

We’ve seen many retailers invest in and expand on click-and-collect in recent years. Most recently, Primark, which has announced that 25 stores in the northwest of England, Yorkshire, and north Wales will offer click-and-collect by the end of this year.

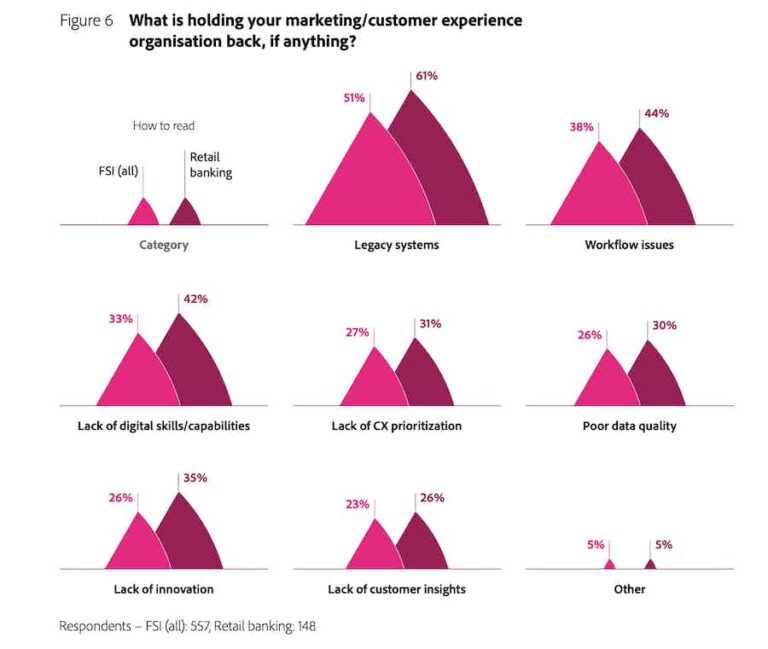

Gurd also says that difficulties can arise for retailers that are still battling with legacy systems, particularly when POS isn’t integrated with ecommerce.

Without this type of strategy, friction can easily occur, ultimately leading to a more convoluted and frustrating customer experience – the antithesis of what click and collect aims to achieve. Retailers need to be aware of ways to combat this, such as queuing systems or different ways to regulate store flow when it is particularly busy (such as alerting customers ahead of time).

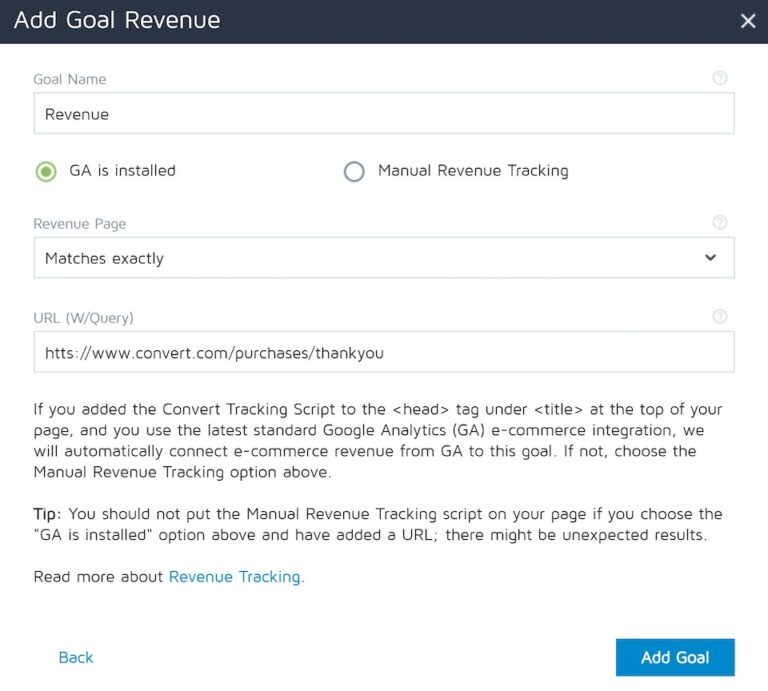

“Some retailers opt to use an in-store version of their ecommerce storefront, for example a web app on an iPad, so store staff simply login to the same back end, simplifying order management. Platforms like Shopify offer a POS solution to keep it within the platform and most have integrations with 3rd party POS specialists.”

Retailers are introducing, expanding on and innovating click and collect offerings in order to take advantage of this growth. However, executing click and collect effectively is not without its challenges.

“Primark is doing this because it needs to offer customers this level of service and convenience, but it won’t necessarily lead to a spike in customer acquisition. I’d also expect to see the basket size and LTV (lifetime value) of existing shoppers increase, with more browsing at home or on their mobile to pick up in store.”

Greater convenience may not boost customer acquisition

Whether this will spur on Primark to make its website fully transactional in future is uncertain, given the economics of delivery.

Ecommerce Best Practice: Strategy and Operations

What are the potential obstacles to a successful click and collect strategy, and how can retailers address them? We spoke to James Gurd, owner & ecommerce replatforming consultant at Digital Juggler, for his thoughts.

“[Rapid click and collect] will potentially help with DIY shoppers who aren’t brand loyal and who need something ASAP, which could then in turn lead to future purchases,” he said. “[But] from experience, the biggest challenge Wickes has is the in-store collection process, stock file accuracy, and state of the in-store stock items.”

“Retailers need to map out the full customer lifecycle for a click and collect order to determine how fit for purpose the current store environment and technology is, then define a plan to address gaps and exploit opportunities to deliver what customers want.”

Retailers will no doubt continue to invest in click-and-collect as consumers demand greater convenience and choice. The benefits are apparent, with retailers able to make more efficient use of store networks, increase footfall, and improve the overall customer experience.

The move could help Primark get back to growth. The retailer is still struggling to catch up to pre-pandemic sales volumes, recently announcing that like-for-like sales at Primark for Q3 were 9% below what they were three years ago. Click and collect marks a huge step for Primark, as it is the first time that customers can use its website to find out which items are in stock in specific locations, forgoing browsing time in Primark’s large stores.

Addressing operational inefficiencies

James Gurd told Econsultancy that the move is likely to be huge in terms of instant ecommerce revenue. However, “I’m less sure how much will be substitutional,” he said.

Another key benefit for Primark’s investment in click and collect is data and customer insight. “[This means] how does browsing correlate to sales, what are people adding to online baskets, what is being collecting, what is being returned etc. This will fuel marketing personalisation and on-site merchandising,” said Gurd.

Wickes is also doubling down on fulfilment, recently launching an under-30-minutes click-and-collect service. But do consumers really need or indeed want this level of rapid collection?

It’s not quite as simple as supply and demand, however. Gurd explains that operational processes remain a big challenge.

In short, he stated, “shoppers want convenience and that means options; click-and-collect growth is a reflection of this need.”

“I’ve regularly experienced delays as staff try to find what I’ve ordered and then inform me there isn’t sufficient stock, or some items are damaged. I’ve stopped using their click-and-collect because I find it easier and more reliable to go to the store and pick from the shelves.”

Gurd says that additional collection options are always helpful, but that some retailers are investing in click and collect without figuring out key aspects of the service (or rather, where their gaps in operational efficiency might lie).

“Physical locations not designed with click and collect in mind need to engineer an in-store collection process without disrupting the standard checkout experience, as click and collect can’t adversely impact standard store sales,” he explained. “This requires an end-to-end CX view and alignment of technology to handle order updates, in-store queuing and issues like refunds and returns.”