Previously, many merchants couldn’t sell products on Google Shopping because Google required merchants to have a website. Google needed the ability to crawl and index merchant websites to validate their pricing and availability info.

Time will tell if Google’s removal of commission fees makes a big impact in terms of getting more merchants onboarded to Google Shopping.

Google rolled out Unpaid Product Listings earlier this year.

Google announced a major update to the Shopping Actions marketplace program they’re now calling Buy on Google.

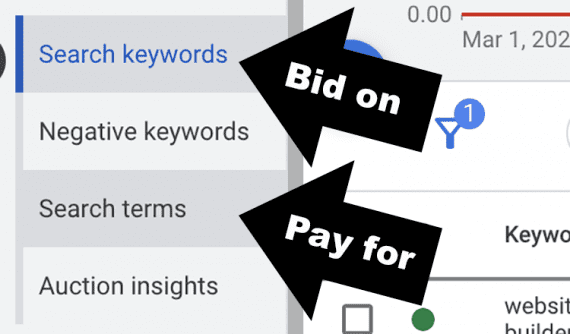

Google’s Paid Shopping Ads Program Is Not Changing

Google did not announce any major changes for ad inventory on its main search engine results page.

As mentioned earlier, merchants with no website will benefit the most from this new program.

— Evan Kirkpatrick, VP of Shopping & Feed Management at Tinuiti There’s no debate that small businesses are struggling due to COVID-19. This announcement (like the announcement of the unpaid listing back in April) is targeted specifically toward SMBs and website-less merchants that frequently sell products on Amazon. The announcement is less intended for medium-to-large merchants that are already using Google Ads.

More importantly, Google’s announcement doesn’t highlight any huge value-adds for existing merchants that are already running both Shopping ads and Google’s unpaid organic listings.

While there is no commission or advertising fee, merchants will still need to allocate technical development hours to set up order management. Google is also tweaking their marketplace program so merchants will handle customer support and returns. In the previous iteration, Google handled support & returns.

Free Buy on Google Listings Will Empower Merchants Without Websites

Shopping ads continue to be a huge driver of Google’s ad revenue and the Shopping carousel format continues to show consistent year-over-year growth–even during the Covid 19 pandemic. We don’t expect this update to change this trajectory and anticipate continued growth as we head into Q4.

Even with Google making it easier to onboard, it could still take a lot of time and effort for merchants to add a new platform for order management and a new workflow for customer support.

— Josh Brisco, VP of Growth Media at Tinuiti

Larger Merchants Likely to See More Success With Unpaid Shoppings Listings

It is refreshing to see Google taking steps to help merchants here though. Their marketing message isn’t “this program is going to make us better than Amazon and Walmart.” Instead, it includes: “we also plan to add a new small business filter on the Google Shopping tab and will continue adding features to help small businesses participate in online commerce.”

There are still significant obstacles for Google. Amazon has a massive head start here with Prime’s stickiness for ecommerce as Google’s stickiness still lies within Search, Gmail, YouTube — not as an eCommerce Shopping destination The shipping speeds for Buy on Google lag far behind Amazon and it’s not close. Amazon is still one of the most successful distribution/warehousing companies in the world. Walmart has stores and a local presence. Google doesn’t have warehouses or physical locations to distribute products.

The new Buy on Google listings will exclusively show up on the less prominent Google Shopping tab.

It’s clear they are going to keep investing time and resources to woo merchants away from Amazon and the other marketplaces.

Here’s how Buy on Google works, what it means for Shopping advertisers, and some of our tips for businesses interested in the program.

Now, Google will let merchants without ecommerce websites promote their products on Google Shopping as long as they have PayPal, Shopify, or any of the other eventual eCommerce platforms and payment providers that Google integrates into their marketplace program. Merchants don’t need to have a website and Google doesn’t need to check a website for information.

If you want to learn more, read the full Shop on Google announcement here. Free Buy on Google marketplace listings and free unpaid organic Shopping listings will help merchants. Even if there isn’t a ton of volume on the Shopping tab for these new formats, these listings are still free avenues to drive sales during a pandemic. None of the other platforms are waiving their commission fees and offering up anything similar.

While Google often conducts experiments on the Shopping property/tab, we’ve been told that the inventory at the top of the page will be reserved for Shopping ads. Below those ads, there will be a mix of Google’s recently-announced unpaid organic Shopping listings & the new free Buy on Google listings denoted by a blue cart icon.

Google Still Has A Long Road Ahead To Catch Up With Amazon

“We are recommending unpaid listings as the better option for most merchants. The unpaid listings will send customers directly to a merchant’s website where merchants can build direct connections with customers and collect valuable CRM info.”

Google will waive the 5-15% commission fees for merchants selling products through Buy on Google marketplace listings. Amazon, eBay, Walmart, and other marketplaces typically charge merchants 10-15% for their commission fees.

If more merchants list products, consumers could have more products to choose from. Google can upsell advertising to merchants that sign up for Buy on Google and unpaid Shopping listings. More merchants who decide to run ads could drive up the price of Shopping ads for existing advertisers on Google Search. Google can collect valuable information (like product prices) if merchants start to submit Amazon feeds to Google.

We’re excited to see Google Shopping evolve here and we will continue to follow along closely as Google explores new ways to bring customers and merchants onto their platform.

They’ve always pushed their marketplace program as a more retailer-friendly platform than their competitors’ programs. This is another example of that not just being an empty sales pitch.

When checking out from a Buy on Google listing, customers will have a checkbox they can check or uncheck to give merchants their customer info for marketing purposes.

Google also announced integrations with PayPal and Shopify to improve merchant onboarding, a common pain point for new merchants. Google is even going to let merchants submit their Amazon product feed as a way to get started on the Google marketplace.

Besides that, merchants with poor websites could justify doing the program too. If a Buy on Google listing converts customers at a higher rate than a merchant’s website and offsets any potential loss of CRM info, it could make sense to entice customers to checkout directly on Google instead of a merchant’s website.