Thea Luca, Econsultancy:

Ben Potter, business development adviser and Non-Exec

In B2B, this re-focus on data strategies may be as simple as a rationalisation of first-party data, understanding what is actually useful and how it can be used, or as complex as implementing new martech to allow for known customers to be delivered relevant messaging across channels.

Content fatigue calls for competitive differentiation

On top of this, B2B buyers are wanting to self-serve online themselves and not see a sales person (up 10% to 66% – Forrester). Manufacturers are sceptical of Amazon where over 50% of product searches are conducted due to lack of data given back to them by Amazon and the high chance of product replication if it sells well.

But what do the experts foresee in 2021 in B2B marketing and commerce? We asked Guy Magrath, as well as Econsultancy author and agency new biz expert Ben Potter, and our own marketing manager, Thea Luca.

Automation backlash (of sorts) in outbound prospecting

Digital transformation in B2B continued apace in 2020. By the way, if you’re after a great B2B case study, Econsultancy published a piece back in September by Guy Magrath, former CDO at Electrocomponents plc, about the digital transformation of RS Components.

For me, the pandemic shone a light on an aspect of B2B marketing which is tough at the best of times: outbound prospecting.

Guy Magrath, non-exec director and digital consultant

Ben Davis, Editor, Econsultancy:

Here’s what they had to say…

Thea Luca, Marketing Manager, Econsultancy:

Simplification of the value chain as manufacturers ask ‘should we go direct?’

“For many,” he adds, “[this] has pushed data strategy back to the top of the agenda for 2021, and with the changes in compliance and tools it’s an ideal time to be revisiting what the key use cases are, for now and the future, and focusing efforts in on those.”

“For many,” he adds, “[this] has pushed data strategy back to the top of the agenda for 2021, and with the changes in compliance and tools it’s an ideal time to be revisiting what the key use cases are, for now and the future, and focusing efforts in on those.”

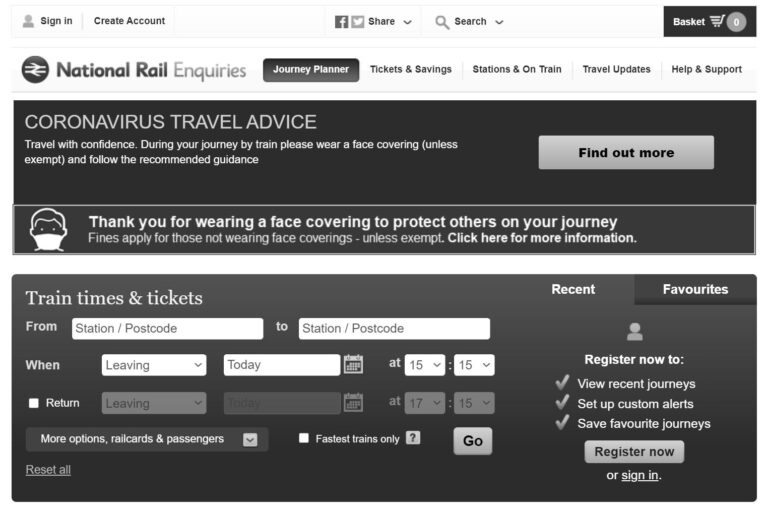

Aquarone adds that “Brands that succeed in customer experience often make a number of facilities available to customers so they can self-serve – any time, any place.” The demand for self-serve and for quick and easy ordering and support will only increase.

B2B retailers will have a tricky balance between stabilising the balance sheet, stocking down multi-outlet sites as demand reduces through waves of lockdowns, getting hold of stock in a disrupted global supply chain versus fulfilling demand quickly once the green shoots of recovery return. Those will a centralised distribution model and a strong digital presence will have a significant advantage.

B2B and B2C priorities converge – CX and data

2020 has opened a wide range of possibilities for virtual briefings, webinars and roundtables and much more, with global reach at a low cost when compared to face-to-face events. Even as we gradually look forward to a return to normal, there is for sure a great potential within this previously untapped opportunity of digital events delivery, so hopefully we’ll see this trend only increasing and companies coming up with a mix of creative deliveries.

Head to Econsultancy’s B2B hub for guides on account-based marketing, B2B content and social strategy, and B2B customer journey mapping.

Thea Luca, Econsultancy:

The other key outlet is the search networks (predominantly Google). Question – do you think manufacturers will take the plunge and shake up the established model and start going direct – giving them both market share gains and margin gains by not paying the distributors share? With customers self serving more and seeing the manufacture’s site as the oracle for accurate information on their product is this transition inevitable? On top of this there is the added benefit of data insights, owning your brand message and gaining a pipeline of new customers.

Whilst automation tools are great for efficiency, they’re not so good on empathy. LinkedIn was awash with complaints of sales emails and connection requests sent by tone deaf salespeople, reliant on technology, with a ‘throw enough mud at the wall and some of will stick’ attitude. Not good in ‘normal’ times, wholly inappropriate with a country in lock down and prospects facing quite different problems – professional and personal – than those listed in the salesperson’s near-useless personas.

The move to exclusively digital campaign delivery has led to an increase in user content fatigue and information overdose, with companies competing for the same audience attention as well as space. This very busy online landscape is also driving an increase in media costs, so careful campaign strategy planning, particularly when it comes to creative concepts and format delivery (video marketing, short format content etc) will be crucial in ensuring competitive differentiation. ABM is also seen as one of the main strategic paths in digital, ensuring a scalable but more personal approach to reaching and engaging with your audience.

Lastly, data strategies were placed under the microscope in 2020. Andrew Hood, Founder and CEO at Lynchpin analytics firm says the year “exposed for many the lack of critical foundations in place for many data strategies. Some businesses that needed to get on top of leading indicators as markets were disrupted quickly found that accurate and consistent data was either not in place or easily accessible at the right levels of decision making.”

We’ve some tough times ahead. Business developers and marketers must ask how they can add value from the very first interaction. They must help others ahead of helping themselves. This places the emphasis on research and tailored messaging, relevant and timely to each prospect. Self-serving sales messages, delivered at scale, will find cut-through even harder next year.

In B2B the established business model for manufacturers of products is to service the very large customers direct and use distributors to service the long tail of smaller ones. Post-Covid, manufacturers are re-looking at this model as many of the distributors are offline (shed based) and during the last year they have had limited access to the customer. Many are now asking ‘should we go direct?’.