On the other hand, the eventual easing of restrictions could result in spend on retail increasing, as well as sectors that previously struggled (such as travel or experience-focused retail) bouncing back.

Ecommerce sales increase, but overall retail falls

Ecommerce sales remained solid throughout the entirety of 2020, as consumers continued to shop online (even when restrictions in the UK eased over the summer months).

In order to avoid the fate of department stores like Debenhams, Hannah Atherden, Senior Consultant at Capgemini, suggests that mid-market retailers should look to further invest in digital experiences if they want to succeed.

Burberry is another retailer that now offers one-to-one virtual meetings with store associates. This is particularly effective within the luxury fashion space, where consumers tend to crave personal communication (before making high-ticket purchases). It could become the norm for all retailers going forward, with safety remaining front-of-mind for the foreseeable future.

We’ve spoken a lot of about retailers successfully adapting to the customers’ needs throughout the pandemic, but with the industry still navigating through these difficult times, it’ll be those that continue to do so who survive and potentially thrive in the months ahead.

— boohoo (@boohoo) January 14, 2021

Christmas lockdown drives demand for grocery retailers

Indeed, Boohoo’s success in these areas only serves to highlight other retailers’ lack of investment. In Econsultancy’s ‘Ecommerce Trends in 2021’, Parry Malm predicted that the market growth of companies like Boohoo will continue to have a negative impact on mid-market or ‘jack-of-all-trades’ retailers. “This is already happening – we’ve seen many not-small-but-not-big companies go bust, and department stores are on their last legs,” said Malm. “This trend will undoubtedly continue, if not accelerate.”

With the UK in lockdown until mid-February at the very earliest, it is easy to assume that the pattern will continue, i.e. that ecommerce will continue to boom in 2021. However, it is difficult to confidently predict what’s to come – particularly as we do not know how long disruption from the pandemic will last. Economic uncertainty could see consumers stem the ‘treat yourself’ mentality that we saw during 2020 lockdowns.

— Pandora Jewellery UK (@Pandora_UK) December 18, 2020

McKinsey research found that even among those customers who have been “very satisfied” with their experiences online, some still regard online grocery shopping as a temporary measure. Overall, however, McKinsey suggests that online sales will continue growing at a faster rate than before Covid-19, largely due to a percentage of new customers sticking with ecommerce. This might particularly be the case for older generations (who previously shopped in-store), having realised the convenience that online shopping can bring.

Tesco announced a record-breaking Christmas, adding £1bn worth of online grocery sales in the 19 week-period. Sainsbury’s enjoyed a fruitful Christmas period, too, recently announcing that grocery sales grew 7.4% during Q3 2020, with online groceries up 128%.

Reactive (and digitally savvy) retailers continue to thrive

Delivery remains a key factor, of course. In response to the ecommerce growth seen throughout the pandemic, businesses are increasingly relying on third party delivery and fulfilment providers to help meet customer demand. In January 2021, the logistics technology platform Bringg announced a partnership with Uber Direct to expand its customers’ delivery networks. This means that partner retailers will have access to Uber Direct delivery drivers, enabling them to provide same and next-day delivery services.

With sentiment around in-store shopping still uncertain, retailers need to ensure that there are tools and services in place to facilitate consumers – wherever they want to shop. Retailers including Pandora, Moss Bros, and Selfridges implemented appointment booking for in-store visits (prior to lockdowns), ensuring that customers feel safer when shopping in-person. To serve customers who still might prefer to shop online, retailers like John Lewis, Bensons for Beds, and Ted Baker are offering video chats with sales staff.

— Ocado Zoom (@OcadoZoom) September 3, 2020

“In the short-term, it’s really about retailers providing customers with flexibility and convenience and ensuring that the in-store experience marries with what they are experiencing online,” she says. This could be offering services like click and collect, or providing customers with product recommendations based on both online and in-store browsing.

What the in-store experience will look like remains unclear, though Capgemini’s Hannah Atherden believes that an alignment of the in-store and online experience will be key for retailers in ensuring that sales remain stable, particularly as consumers might be reluctant to return.

Primark refuses to sell online, of course, meaning that it has remained entirely stagnant through each lockdown period. Boohoo, by contrast, has further capitalised on the demand for online shopping, regularly promoting new and in-demand categories like lounge and sportswear, and using influencer marketing to appeal to a young and digitally-savvy target market.

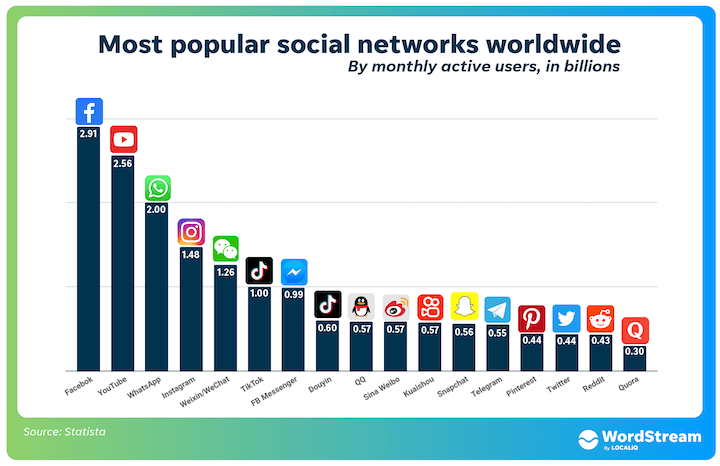

Would Primark be in a similarly strong position if it did operate online? Perhaps theoretically, but big operational costs remain the reason behind its resistance. The downfall of other multichannel retailers, including Debenhams and Arcadia’s Topshop, shows that it’s not enough to merely be present these channels. Boohoo’s success partly stems from an effective social and digital strategy: one that goes beyond just product to encompass clever branding, digital and social campaigns.

Fulfilment has been an area of focus for online retailer Very.co.uk as well. According to Internet Retailing, a new automated warehouse (opened in March 2020) enabled the online retailer to process 3.9m orders over the seven-week Christmas period, with automated technology allowing items to move from order to despatch in just half an hour.

It’s cold outside ❄️ Shop here: https://t.co/kejBcxE00w pic.twitter.com/HULVWBKn4Q

Investment in delivery and fulfilment ramps up

Stats roundup: the impact of Covid-19 on ecommerce

This strategy has also proven effective for beauty retailers like MAC. By training sales associates in ‘virtual selling’, MAC has been able to maintain the one-to-one communication that is vital within cosmetics retail. According to Sabrina Herlory, Managing Director for MAC, “70% of the customers who received advice remotely then moved on to a physical store.”

The final quarter of 2020 drove significant ecommerce sales, spurred on by events including Black Friday, Christmas, as well as UK lockdowns. November and December saw an online sales growth of 39% and 37% respectively. Overall, new data from IMRG states that online sales grew by 36% in 2020, which is the highest growth seen in 13 years. This is in contrast to overall retail sales, which fell by 0.13%, marking the lowest annual growth figure for 25 years.

“Even if your customers can’t purchase directly from you online, brands should think about having a strong social media presence and running data-driven digital advertising campaigns – potentially partnering with third party retailers on campaigns to enable data exchange. High street retailers need to ensure they’re investing in their in-store and online experience beyond just shopping.” she says.

So, what about brick-and-mortar retail? Paperchase is the first casualty of 2021, having filed a notice to appoint administrators due to the cumulative effect of store closures throughout the year. A heavy reliance on travel hubs has hit the stationery retailer hard, with online trading unable to offset the lost sales in physical stores.

Experiences could bring consumers back to retail stores

We have implemented additional safety precautions so you can feel reassured while shopping. pic.twitter.com/5pF4UDt8aL

“Once things start to become less restricted,” she explains, “stores will need to offer an experience to the customer. Pre-Covid, we saw brands like Glossier bring experiential store experiences to customers, where they could immerse themselves in the brand. This will set retailers apart.”

As Christmas approaches we want to encourage safe shopping ???? All our UK stores remain open, up until Christmas Eve where our store teams are ready to welcome you.

The Digital Transformation Monthly

There could certainly be more retail casualties to come, of course, but – unlike at the start of the pandemic – businesses have more reason to be more optimistic, with the vaccine rollout bringing about the possibility that stores might re-open and potentially stay that way later on in the year.

With the UK’s third lockdown once again forcing retail stores to close, here is an update on how online, brick-and-mortar, and multichannel retailers are faring.

Covid spurs on innovation in customer service

For more on retail explore our retail hub page, or the following ecommerce resources:

Most of 2020’s retail growth was driven by reactive multichannel retailers, who were able to meet the shift in demand to online channels.

Grocery saw the biggest surge, with an extra 5.7 million UK households shopping for their Christmas groceries online in 2020 compared to 2019. Overall supermarket sales also increased, which is perhaps due to consumers shopping less frequently and in bigger quantities, as well as stockpiling for Christmas and in preparation for potentially empty shelves.

Atherden also suggests that retailers might need to think more broadly in terms of the retail experience, with consumers more likely to see shopping as an event or destination experience post-Covid.

Looking ahead, the continuation of online supermarket growth is perhaps inevitable in the short term, with many consumers continuing the shift to online shopping due to safety concerns and the desire to comply with Covid regulations. However, this may be a forced shift or perhaps ‘artificial growth’ that could revert somewhat once lockdowns are lifted and Covid cases reduce.

It’s OK to play favourites when it comes to picking from over 1,000 M&S products. We’ve got a whole host of delicious products worth top marks in your next Zoom.https://t.co/5ppyKVa3JC pic.twitter.com/hxtmSdzGZC

It’s a tale of two halves in other sectors, such as fashion. On one hand, the likes of Boohoo are thriving – the fast fashion retailer saw its sales rise 40% during the four months to the end of December. On the other, there is Primark, which is expected to lose more than £1bn during the first half of its financial year.

The Ecommerce Quarterly