DTC brands sell directly to shoppers. DNVBs sell DTC but also integrate manufacturing.

In the past five years, DTC has become a channel for brands to grow and survive. This was especially true during the pandemic when many folks shopped online rather than in a physical store.

In 2016, I wrote that one of the challenges retailers would soon face is that brands would sell against them.

Digitally Native and DTC

Likely the pandemic has accelerated retail’s digital transformation for at least a few reasons.

“Beyond a few notable outliers, DNVB doesn’t scale. Nor does DTC. And the future demands embracing that reality,” wrote Aaron Orendorff, vice president at Common Thread Collective, an ecommerce agency.

To be clear, this trend is not new. It has been happening for years. The question is how the pandemic affects it.

Along the way, each business profited.

The distinction between direct-to-consumer ecommerce and traditional retailing has been vanishing for years. But in a post-pandemic 2021, the convergence could be accelerating.

- Brand. Manufacturer or marketer of a specific consumer product. Popular brands include Nike, Carhartt, and Tide. In most instances, brands are wholesalers.

- Retailer. A business that sells products from several brands to shoppers via a physical store or ecommerce.

- DTC. A sales channel whereby a brand sells directly to a shopper, via the brands’ websites or, often, the Amazon marketplace.

- DNVB. A company that manufactures its own products and sells them directly to shoppers, focusing on consumer marketing and promotion.

Convergence

“Many small online stores buy products wholesale from manufacturers or distributors to sell at retail. This is the classic business model for retail stores,” I wrote.

What’s more, shoppers might not care. For all of the attention on how brands, retailers, and DNVBs are getting mixed up, shoppers buy products they like from sellers they like.

One might define the retail participants as follows:

Covid-19 is one of the most significant global events since World War II. It will have a lasting impact on economies, governments, and individuals.

Retailers have been converging too. Amazon, Walmart, Target, and seemingly all major retailers have developed private label brands to sell against their traditional suppliers.

Take Wildology pet foods, for example. The brand is a partnership of approximately 40 farm-and-ranch retail chains in North America. The resulting product rivals something from the leading traditional pet food brands. Customers of Purina and Blue Buffalo just became competitors.

“As evidence of scale’s adversity, many of DNVB’s founding parents — names like Bonobos, Casper, and Happy Socks — have entered wholesale either by way of acquisition or alliance. Traditional outlets like Walmart, Target, Macy’s, and Amazon are happy to serve as the middlemen that ‘vertical’ once cut out,” Orendorff wrote.

A group of approximately 40 farm-and-ranch retail chains created Wildology, competing directly with the national brands they also sell.

Even DNVBs are doing it.

“Unfortunately, ecommerce’s low barrier to entry has encouraged many manufacturers to start selling directly to consumers. This means that the same company that sells your products may also be your competitor. As an example, Danner Footwear … sells not just wholesale to retailers but also directly to consumers on its website.”

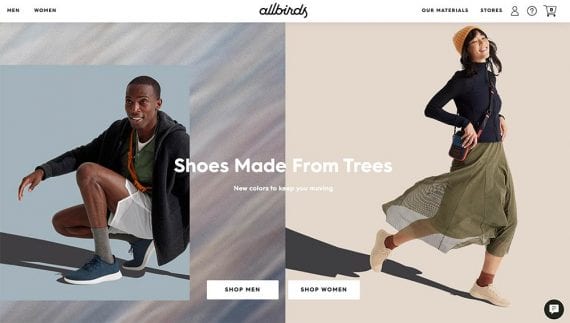

Allbirds is an example of a digitally native vertical brand.

Post-pandemic

All things considered, expect fewer distinctions between wholesale brands, retailers, and DNVBs in 2021 and beyond.

Prominent DNVBs include Allbirds (shoes, apparel), Casper (mattresses, bedding), Dollar Shave Club, and Warby Parker (eyeglasses).

Here is the context. Traditional retail is layered and complex. The product on the shelf in a local brick-and-mortar shop may have been purchased through a network of intermediaries that started with a manufacturer in China and then included one or more distributors or the occasional manufacturer’s rep. Eventually, the product arrives at a traditional retailer’s own warehouse or store.

- Shopping habits changed. The pandemic forced consumers to shop differently; it’s unlikely that those shoppers will completely return to a pre-pandemic purchase pattern.

- Technology investments. Many brands and retailers invested in software and infrastructure to provide online shopping, curbside pick-up, and similar.

- Competition. The pandemic has forced sellers ―brands, retailers, DNVBs ― to embrace omnichannel selling, resulting in more and better experiences for consumers.

Increasingly in the past few years, entrepreneurs have launched digitally native vertical brands (DNVBs) and direct-to-consumer (DTC) sales channels, challenging traditional retail.