Identifying the CLV-to-CAC ratio is the goal in a per-customer analysis.

Variable costs can describe the cost to produce or purchase the product, plus advertising expenses and even shipping in the case of ecommerce. If a widget carries .00 in variable costs, for example, we end up with a contribution margin of .00.

Per Unit

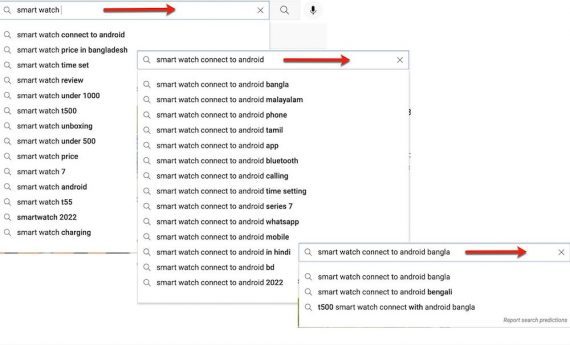

In June 2021, 25 percent of the customers in this cohort (new customers in May) returned and purchased at least once in June. This means that for all of the customers in the cohort, the average profit was 82 cents — note that we are creating an average profit for all of the customers in the cohort even though only 25 percent made a purchase. Thus, after two months the CLV for this cohort is .19.

When we use unit economics to consider products (or services), the goal is to identify the margin earned on each item sold, which is usually called a “contribution margin.”

A common practice in retail is to analyze groups of customers (cohorts) rather than all of them at once. Cohorts are then compared for their respective CLV and CAC.

CAC = Total Promotional Costs ÷ Number of New Customers

CLV = Average Order Value x Purchase Frequency x Margin %

.00 Revenue Per Unit – .00 Variable Cost = .00 Contribution Margin

Armed with this information you can start to generate helpful insights about your customer cohorts.

Per Customer

If an ecommerce or omnichannel business wants to build lasting relationships with shoppers, it can make sense to use a customer as the unit measured.

In May 2021, 100 percent of the new customers made a purchase, to state the obvious.

For this analysis, we need two metrics: customer lifetime value (CLV) and customer acquisition cost (CAC).

Contribution Margin = Revenue Per Unit – Variable Costs

Unit economics provides ecommerce and omnichannel retailers with foundational intelligence that can identify break-even points and long-term sustainability.

If your company’s CLV divided by its CAC is less than 1, you have a problem. An optimal CLV:CAC ratio is typically above 3. That sort of ratio would be a strong indicator of future success in most cases.

Here is an equation for calculating CLV.

Remember, there are two ways to approach unit economics: using products or using customers. The former can help select and price products. The latter assists with marketing decisions and knowing which areas to optimize.

Customer Cohorts

This example of unit economics is intuitive; many retail business owners and managers use it instinctively. These leaders know that a product with a high contribution margin is usually worth carrying. They also know that if they have a product with a .00 contribution margin and 0 in fixed expenses, they need to sell 100 units to break even.

In this equation, the “revenue per unit” represents the selling price of a single unit. If your business sells a widget for .00, then revenue per unit is .00. If we had the first-month CLV of .38, .40, and .45, we might note that profit was trending upward.

While we can get at the CAC with this one.

As the name implies, unit economics focuses on the value a single “unit” represents for the business. This unit can either be a product or a customer. Each of these reveals different, actionable information.

If we kept a similar record for a cohort of customers who made their initial purchase in June and July 2021, we could soon identify averages and compare.

The more cohort data we collect, the more opportunity for analysis. For example, if we collected 30-months’ worth of customer cohort info, 19 of the cohorts would have accumulated 12 months of data. If we average their CLV at 12 months, we get a customer’s one-year lifetime value (C1LV). This can tell how much we make on average when we keep a customer for one year. Imagine that in May 2021 the average order value for this cohort (new customers in May) was .50. The company’s gross margin was 45 percent, so you have an average gross profit of .38 for customers in this cohort.

The first method is to think of the unit as a product. In the ecommerce or omnichannel retail context, this approach might help a new business estimate its break-even point or help a purchasing manager decide on a new product line.

After three months, the CLV for this cohort is up to .85.

Products, Customers

For a basic example, consider new customers to a hypothetical ecommerce store for May 2021.

![Amazon Marketing Cloud 101 [A Powerful Asset for Understanding Audience Engagement]](https://research-institute.org/wp-content/uploads/2021/04/what-to-know-before-you-sell-your-small-business-768x432.png)