The resulting inefficient marketing workflows can affect the ability to maximize customer data. Sharing data across the right teams in real-time can help alleviate inefficiencies. However, decentralised customer data management in silos prevents firms from delivering the most appropriate communications that link the network’s physical and digital parts.

Legacy providers understand the challenges ahead

Increasing the numbers here, particularly around algorithm & persona-based targeting, could help FSIs make a significant leap in digital experience maturity.

However, our research indicates that only 31% say that the digital experience is dynamically and automatically tailored for each customer using ML. Encouragingly, an additional 38% say that they use algorithm and/or persona-based personalization and experimenting with machine learning to improve segmentation and targeting.

Technology doesn’t just centralize customer data; it also analyzes and enriches it as a proven driver of competitive advantage. Linking data together across different platforms, both on and offline, is a challenge the world over.

In this respect, using machine learning (ML) and AI to plug gaps and target customers effectively would significantly shift organisations towards a more profound digital transformation.

Digital channels prioritized

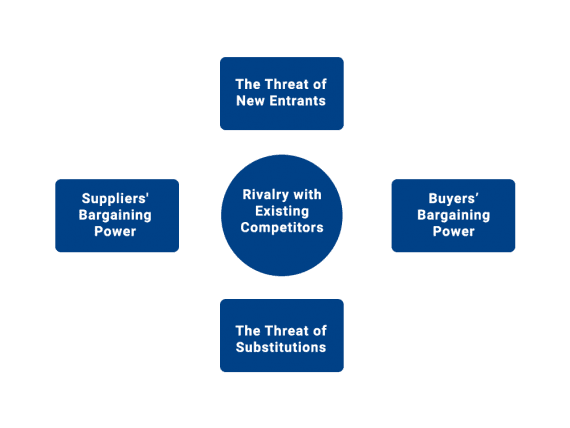

To compete strongly and more freely in an intense and evolving market, legacy businesses clearly need to transform their organisational setup and tech.

Given FSIs’ challenges regarding back-end integration and regulatory challenges, it’s perhaps unsurprising that only 31% have centralised customer data used for all digital and offline touchpoints. In this scenario, firms are more likely to struggle with data silos, which get in the way of enabling a single source of truth for customer profiles.

Centralization key to end-to-end customer journeys

With branch closures a continued trend in retail banking, it’s no surprise to see an intensified focus on digital channels amongst survey respondents. As illustrated in Figure 2, the top three channels that FSI executives plan to emphasize the most in the next 12 months are digital: social media and websites (both at 24%), followed by mobile applications (20%). By contrast, only 12% of the executives plan to emphasize their in-person channels.

It goes without saying that the past year has proven to be one of immense change across many areas of financial services.

Unfortunately, it’s an area where FSIs still lag compared to other industries. FSIs are less likely to agree that their organisation manages experiences end-to-end in a way that is “centralized, with designated owners to manage key stages actively” (FSIs – 38% versus Other industries – 52%).

Technology’s more profound role in transformation

While FSIs may have embraced technology to the degree it’s helped transform front-end UX, our survey indicates that integration at the back end may be a gnarlier problem. For example, compared to other industries, senior executives at FSIs are less likely to agree their organisation has martech stacks fully integrated with CRM and commerce platforms (28% versus 40%).

Experiences that address customers’ broader needs and work seamlessly across all channels are the key to differentiation in a crowded brand world. That means being able to recognise individual customers as they access providers across an ever-expanding range of touchpoints.

Even with the growth of the cloud and SaaS, optimization to support an organisation’s unique set of business capabilities and CX delivery expectations remains a challenge. In some cases, the quest for a comprehensive tech stack can result in a fragmented collection of technologies that are challenging to maintain and unable to evolve with changing business needs.

Optimize customer data to overcome necessary hurdles

And yet, customers still have high expectations. This was brought into sharp relief for insurers during the pandemic. Changes to customer lifestyles, notably the sharp reduction in miles driven during the various lockdowns, highlighted the inflexibility of traditional insurance premiums. In response, many carriers, including Geico, USAA, and Farmers, offered a limited-time premium reduction. Efficient customer data management will therefore be helpful in anticipating these shifts and to be proactive in taking actions changing circumstances for example in finding effective solutions with the lack of synergy between traditional insurance models and changing customer behaviour,

Positively, financial services executives (FSIs) recognise the need to address ever-increasing customer expectations (40%, see Figure 1). These heightened expectations have been undoubtedly partly influenced by the rapid shift from in-person towards digital experiences (regarded as an important change for a third of respondents).

Moving towards next-level experiences

Results in this report are also a reminder that, despite the gaps in customer understanding and lack of centralization, FSIs do not lack data or even technology solutions per se. Instead, they need to resolve the lack of connectivity between systems and silos to keep up with ever-evolving customer behaviours and needs.

The financial services industry is notable for having many IT-heavy players. HSBC, for example, has more than 20,000 employees in its IT group, more than well-known technology vendors. At the same time, it has made significant investments – .3bn – in AI and digital innovation.

In this respect, taking a centralized approach to customer journey management is a prerequisite for delivering true personalization at scale.

In partnership with Sitecore, Econsultancy has launched a new report – Financial Service Focus: Are brands meeting customers’ next-level digital expectations? – exploring challenges and opportunities faced by brands operating in the sector. Based on a survey of 201 financial services executives and 155 respondents working across all other industries, here are some key highlights.

Understanding the way forward

Retail banking finds itself on the front-line, serving customer needs as the Covid-19 pandemic hit finance and customer mobility. The insurance industry, already in the midst of a digital transformation, faces a hardening market and increased pressure to reduce costs. Whereas wealth management customers still seek improved, digital access to services as their appetite for self-service grows.