While a focus on the customer experience (CX) has always been important, 2020 threw its necessity into even sharper relief.

Adidas, for example, has seen a 35% increase in ecommerce sales thanks to the ad spend it has invested in reaching Generation Z and Millennial customers on channels like Snapchat. In June 2020, Adidas was one of the brands to partner with Snapchat on the launch of its new Dynamic Product Ads feature, alongside retailers like Topshop and Farfetch. Dynamic Product Ads (DPAs) were designed to “simplify the consumer purchase journey and drive measureable ROI”, and after testing the beta version of DPAs, Adidas reported a 52% growth in return on advertising spend.

In May 2020, Sephora brought some updates to its loyalty programme to offer money off on purchases at checkout and expanded free shipping; it also promised that once social distancing restrictions were lifted, members would be able to exchange their points for experiences like a facial from a skin-care expert or a one-to-one meeting with a brand founder – giving additional incentives for customers to join and save points.

“We came at our [D2C] offer from a design principles’ standpoint, where trust, transparency and authenticity were a key part of the process. We acknowledged that creating a trade where what we were providing needed to be valuable enough for the consumer to be willing to share their data with us. […] It was really focused on how we could build a relationship through providing utility to the customer.”

Putting CX front and centre

“There is that recognition by many brands that a big attraction of their in-store experience is the experts who offer the advice, recommendations, and information to customers,” said Saunders. Capitalising on that expertise is therefore one way to set themselves apart in a competitive ecommerce environment and ensure that customers will still receive a great experience whether they shop online or offline.

Perhaps even more desirable and useful than first-party customer data is what has been termed ‘zero-party data’, which consists of data that customers have proactively shared in order to set preferences and tailor their experience. This differs from first-party data in that first-party data infers preferences based on a customer’s interactions with the brand; with zero-party data, no inference is needed.

One retailer putting both of these attributes front and centre is beauty brand Sephora. As early as 2017, Sephora removed silos internally to bring together digital, in-store and customer service into one team, recognising that the internal organisation should reflect how the customer experienced them – as one brand.

Hotel Chocolat’s VIP.Me customer loyalty programme has given it an extensive amount of customer data to draw on, which smoothed the way towards transitioning to selling online during the pandemic. Image: Hotel Chocolat

Here are some of the key trends that they explored.

While there will always be aspects of the offline shopping experience that ecommerce cannot substitute for, the Covid-19 lockdowns saw many brands finding ways to replicate an ‘in-store’ feeling online while branches were closed. Retailers from John Lewis to The Perfume Shop, Libertines and Ted Baker began offering virtual consultations or sales appointments, which connected the customer to a brand expert or sales specialist via video link in order to receive personalised advice and recommendations.

New ecommerce channels

“When designing the offer, Gatorade followed certain principles,” explained Keen. “These were that it must offer enough value so that the customer was willing to exchange their data for it; [and] that it must offer something different from traditional retail. This helped both protect those retail relationships and focused the team on creating something truly unique.

Amidst the ongoing crackdown on third-party cookies, many brands are moving to shore up their stores of first-party data in order to tailor and target their marketing without any of the associated issues with permission or privacy. However, as consumers are more aware of their privacy rights – and thus more reluctant to share data – than ever, brands need to have a real value proposition to offer in exchange.

What are the biggest challenges and opportunities facing retail brands over the coming two years, and what trends and innovations are set to shape the space in response?

A value exchange for customer data

One stand-out example of this is Hotel Chocolat, which has greatly invested in building up its customer database over the past few years. “They’ve focused very much on their VIP.Me customer loyalty programme – and that’s really been key to their success, particularly online,” said Saunders. The scheme, accessed via Hotel Chocolat’s app, offers members a range of perks such as 30% off any drink, ice lolly or ice cream; a ‘birthday treat’; invitations to exclusive previews and events; and entry into monthly prize draws for customers who shop with their VIP.Me card.

“We’re seeing how ecommerce is moving away from branded sites, driving companies to embrace new channels – such as social media platforms,” said Saunders. “They’re wanting to be present where their audiences are. These are becoming more than places for discovery – they’re driving transactions.”

Speaking to Econsultancy for the Future of Marketing report, Chris Hintermeister, who was Senior Manager of Innovation at Gatorade and later Director of Ecosystems and Digital Platforms, said of Gatorade’s D2C offer:

Additionally, said Keen, “it must be driven by trust, transparency and authenticity. In this case, that meant being really clear in the communication of how that data would be used.”

When it comes to meeting CX expectations over the coming two years, respondents to Econsultancy’s Future of Marketing survey believed that “Empathy for the customer and a deep understanding of their needs” will be most important for businesses, with 59% ranking this as “Critically important”, and 34% ranking it as “Important”. “Having a joined-up approach to the customer experience across different internal teams” ranked a close second, with 52% of respondents considering this “Critically important” and 38% considering it “Important”.

At our virtual conference Econsultancy Live: The Future of Ecommerce, Senior Analysts Rose Keen and Lynette Saunders gave an insight-packed presentation that looked at the major changes and disruptions taking place in online shopping – drawing on findings from Econsultancy’s Future of Marketing and Digital Trends reports – and how retailers can respond to them. Along the way, they highlighted some stand-out examples of brands that are doing great things with customer data, personalisation, and the online retail experience.

Even with lockdowns lifted in many parts of the world, the virtual selling trend is expected to stick around. Doug Bushée, Senior Director Analyst at Gartner Sales, says that virtual selling is “expected to continue being an important capability of sales organisations in a post-Covid-19 era”, and retailers have explored new models for their stores – such as opening earlier and closing later – in order to accommodate virtual selling and appointments. John Lewis has progressively expanded its virtual services throughout the pandemic, first with the launch of a ‘virtual services hub’ in May 2020, followed by a virtual personal shopping service pilot in August 2020. In October 2020, the retailer announced that it would invest in and expand its digital, virtual and delivery services in order to “adapt rapidly to changing shopping habits” and “get closer to customers”.

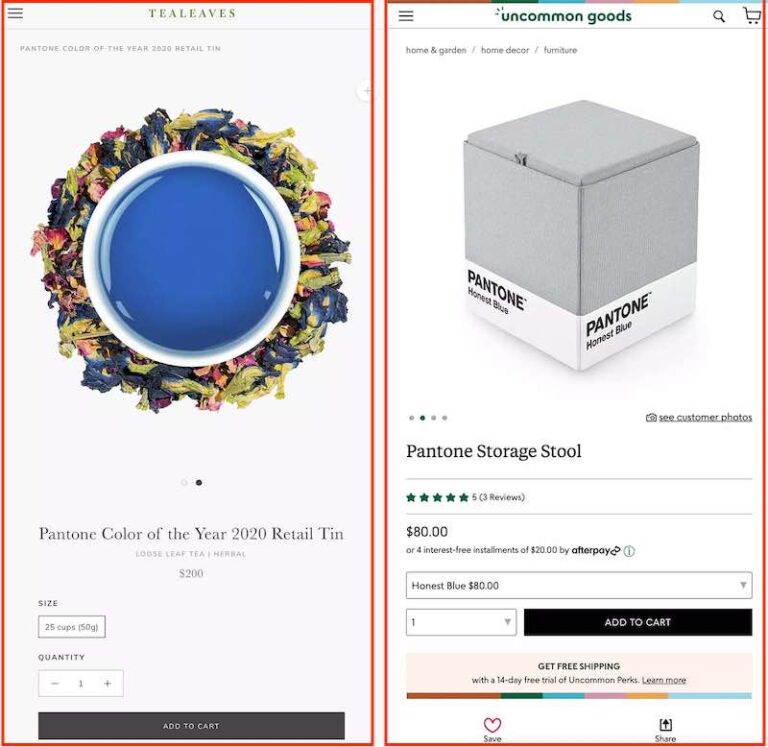

A second strong example of value exchange for customer data and loyalty is Gatorade. Through the Gatorade Gx product line, software platform and recommendation service, customers can receive sports-science-based, personalised recommendations for hydration and nutrition, based on data from their fitness tracker or fitness app, or from a Gatorade sweat patch that analyses the composition of a user’s sweat. The result of this is a customised ‘formula’ pod, sold direct to consumer, that can be added to water to create a sports drink.

Thanks to the VIP.Me programme, Hotel Chocolat already had 1.5 million physical retail customers in its database when the Covid-19 pandemic took hold, who were then encouraged to transition to shopping online with the brand. Digital acceleration throughout 2020 saw Hotel Chocolat’s VIP.Me database swell to 2.1 million members, and the brand also launched two new subscription offerings in October and November 2020 a bid to further lock in loyalty.

“As the user’s special date approaches, they will get a reminder from the app – ensuring that the user does not forget that important date, and also making it very easy for [the brand] to market … a Bloom and Wild delivery.” This is a good example of how brands can encourage users to volunteer data that will enable them to receive a more personalised and relevant experience while also giving the brand opportunities to sell – again, at a time when the consumer is receptive to it, which is an effective win/win scenario.

Zero-party data

Meanwhile, L’Oréal has been benefiting from increased online traffic not only from its own branded sites, but also major retailers like Amazon and Walmart. The cosmetics retailer quickly shifted its marketing and advertising spend online with the onset of the pandemic, increasing its digital investment from 50% of total spend to around 70%. As of June 2020, the Financial Times reported that L’Oréal’s own branded sites, Amazon, and Walmart had begun to make up 20% of its revenues; and in December, L’Oréal revealed that ecommerce had grown 65% during the pandemic to represent 25% of revenue – expected to grow to 50% by 2023.

Levi’s has also jumped on the social commerce bandwagon through a partnership with TikTok, becoming one of the first retailers to use the platform’s new “Shop Now” buttons in April 2020 – which doubled the denim brand’s product views at a crucial time during the pandemic.

Creating an ‘offline’ experience online

“Furthermore, this philosophy has informed their approach to both data collection and personalisation, facilitating highly personalised ecommerce experience and recommendations and optimising in-store journeys,” said Keen. The company is known for its Beauty Insider loyalty programme, which has built a community around the brand and allowed Sephora to send tailored communications like personalised emails using data from the programme.

“A clever example of zero-party data gathering that provides both value to the customer and targeted marketing opportunities to the brand comes from Bloom and Wild,” said Keen. “Users of the online florist’s app are encouraged to save special dates, such as Mum’s birthday or an anniversary into an in-app calendar.

According to the Digital Trends Report 2021, produced by Econsultancy in partnership with Adobe, more than 70% of CX leaders – organisations with a “very advanced approach to customer experience, where strategy and technology are aligned to a successful effect” – outperformed their sector in the last six months of 2020, and were three times more likely to have “significantly outpaced” their sector than mainstream organisations.