The rise of mobile commerce and the elevated expectations of post-pandemic shoppers necessitate payment flexibility. Paying quickly, directly, over time, or via nontraditional currency is attractive to many buyers. The result for merchants is more conversions, higher order values, and fewer abandoned carts.

Cryptocurrency has advantages over standard credit card and mobile payments processing:

And those checkouts must accommodate how shoppers want to pay.

Buy Now, Pay Later

One such obstacle is limited payment options. The ecommerce sophistication of post-pandemic consumers lit the pathway to single-page checkouts that convert in seconds.

Mobile payment options include wallets such as Apple Pay and WePay as well as “contactless” payment apps such as Venmo, PayPal, and Zelle. All offer benefits to both consumers and merchants, especially for checkout speed and security, as the payments rely on passwords and single-use tokens, eliminating a customer’s need to enter a credit card number for each transaction.

Mobile Payments

Buy now, pay later is booming, with nearly a third of Generation Z (ages 15 to 35, roughly) reportedly preferring it. The popularity of BNPL skyrocketed in 2021. And the lack of risk — most providers (i.e., Klarna, Affirm, Afterpay, many more) pay merchants upfront — makes up for the slightly higher fees.

Consider accepting cryptocurrency if you’re eager to serve loyal, tech-savvy consumers. While there are risks, most can be thwarted by managing crypto’s volatility and conversion into fiat money.

Accepting alternative methods requires a processor that supports mobile payments. Most merchant account providers manage at least a few, and many shopping carts include plugins for the most popular options. Stores running on Shopify can also implement Shopify’s own Shop Pay, which finalizes payment using a customer’s email address.

To boost sales, incorporate BNPL options on product pages and at checkout.

Cryptocurrency

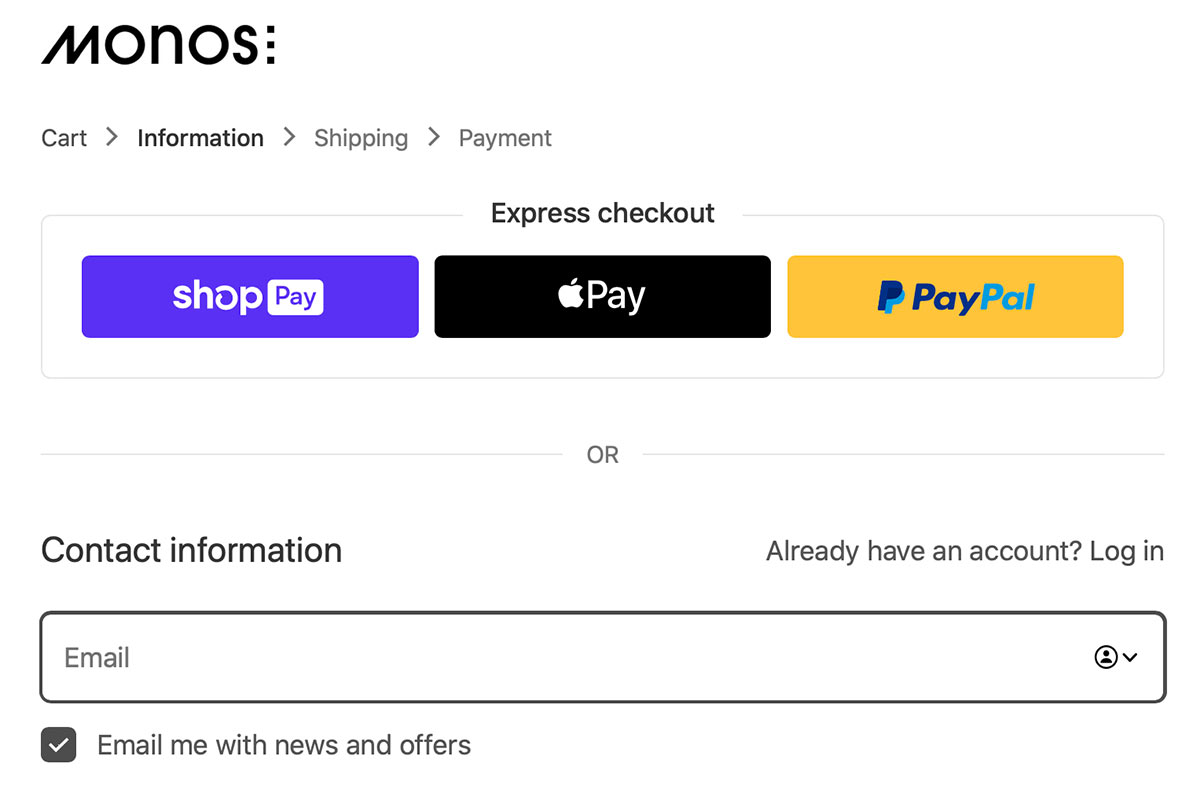

Monos, a luggage retailer, uses a single-page checkout that supports Shop Pay, Apple Pay, and PayPal.

- Acceptance fees are typically less. In many cases, the currency is held in a wallet, so you only pay fees when the crypto is withdrawn or converted.

- Crypto transactions are immediate and irreversible. While you could face backlash from the crypto community for not providing excellent service, you can avoid chargebacks entirely. Thus merchants selling unique, high-value items could benefit.

Essential features for many online stores in 2022 include enhanced chatbots for high-end customer service, virtual product sampling, and real-time order tracking. But what happens once shoppers reach the checkout page is equally important. Plenty of issues can interrupt the process, driving cart abandonment.

Nonetheless, merchants should still utilize fraud protection services for mobile payments. Moreover, minimizing fraud and keeping consumers safe calls for up-to-date shopping carts and order processing systems.

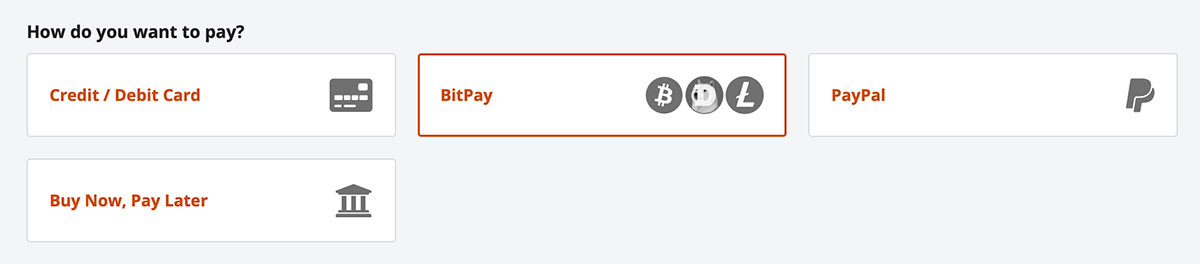

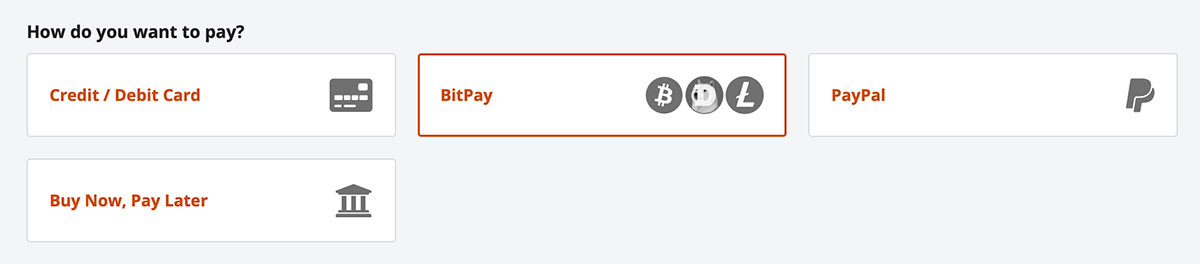

Newegg supports paying via credit card, crypto, PayPal, and BPNL.

Convert More

But, again, accepting cryptocurrency has downsides. It requires additional layers of security to protect consumers. Stores with legitimate higher return rates may want to avoid the payment method altogether. And uncertainties about future regulation should also be considered.