Direct-to-Consumer (DTC) Best Practice Guide

Founder Marcia Kilgore has previously insisted that Beauty Pie won’t go as far as the likes of Glossier in terms of brand extension, which has famously built on its status as a cult brand, going on to sell a range of merchandise ranging from hoodies to water bottles. “We’re not going branch out into jeans, or yoga mats,” she said. “Given the size of the market, and how much the average woman spends, we think there’s a lot of room for organic expansion at the PIE.”

Disrupting the beauty industry through ‘sourcing as a service’

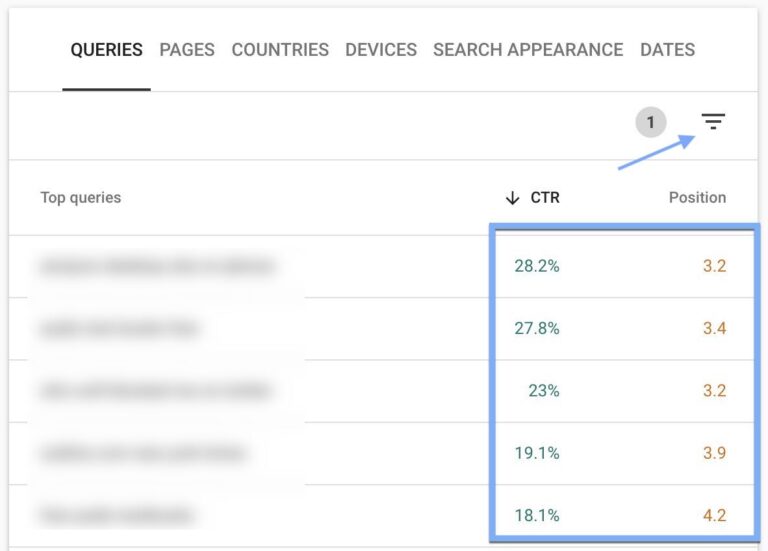

Beauty Pie’s removal of its former spending limits is evidence that members are coming back for more. Previously, the brand offered a multi-tiered membership model, which implemented a monthly spending cap. According to Glossy, however, a Beauty Pie survey sent to 3,000 customers in 2021 discovered that customers did not like limits on shopping and wanted to buy more products at once. As a result, Beauty Pie simplified its membership to just one option – £59 per year with a spending limit of £3,600.

The big benefit for customers, along with this access to lower-price luxury products, is that they are given greater control over their experience, with the ability to buy as and when they want rather than being locked into a monthly box of products (that they might not like or end up using). This remains a big challenge for other beauty subscription box brands.

This is also what differentiates Beauty Pie from other brands that are aiming to disrupt the pricing structure of the beauty and cosmetics industry. Skincare brand The Ordinary, for example, sells high-quality skincare at affordable prices, debunking the myth that luxury products must be expensive. It does this by using simple but high concentration formulas (with active ingredients) that come in simple packaging – again, no frills or unnecessary marketing. However, The Ordinary is deliberately minimal and almost clinical, targeting consumers that are also looking for its straightforward and no-frills approach. In contrast, Beauty Pie appeals to the ’beauty junkie’ – a demographic that buys into its brand as a lifestyle or secret club of sorts.

Beauty subscription boxes have been around for some time now, with the likes of Birchbox, Glossybox, and FeelUnique popularising the model. These examples offer customers a subscription for a monthly box of curated beauty and skincare, which typically include a selection of products from a range of brands and that are tailored to suit the individual.

Customers that eventually become brand loyalists

Many brands right now, including Netflix, are thinking about pricing. However, by asking consumers to ‘stop overpaying and start saving a fortune on your entire beauty routine’ – Beauty Pie’s value is a large part of its hard-won authenticity. The model at least gives the brand the option of altering the pricing of its products whilst keeping the subscription price static. With its disruptive strategy and growing customer-base, Beauty Pie is certainly a great example of what challengers to established luxury brands can do with ecommerce, reflecting the changing nature of the industry, driven by new consumer demands.

Whereas customers might discover a brand or product they love on other beauty retailers like Boots or FeelUnique – that doesn’t mean they will always buy it from that same retailer. With Beauty Pie, customers are invested.

What Beauty Pie is offering customers is something that we haven’t yet seen from other brands in the beauty industry, which is a laser focus on customer experience, and as a result, a brand-consumer relationship that inherently drives loyalty.

Sourcing direct from suppliers is the key to Beauty Pie’s business model. Founder Marcia Kilgore describes the company as a ‘sourcing as a service’ business. Essentially, this means that the company buys direct from labs. It is entirely transparent about what products cost to make, which is then reflected in its discounts for members.

Curated kits and organic expansion outside of core categories

While there are other CX pioneers within the beauty industry, such as Sephora, which uses technology (and personalisation) to enhance both the online and in-store experience – again, the vast amount of brands that it sells means that loyalty to the ‘Sephora’ brand can naturally waver alongside beauty trends.

Beauty Pie’s social content is a good reflection of this – it is chatty, intimate, and offers the chance to have a two-way conversation with the brand, with users often leaving feedback and product requests. This intimacy is enhanced with ‘behind the scenes’ elements too, with founder Marcia Kilgore often featuring in content to offer both beauty advice as well as ‘insider’ information about the company and its business model.

But while Beauty Pie has achieved high retention, loyalty is not always set in stone. With inflationary pressures, consumers are increasingly cutting back due to the high costs of living – and naturally, subscriptions are among the first to go. Even Netflix has reported its first fall in subscribers in more than a decade, as the company has yet again increased the cost of its monthly fees. It’s important to note, too, that Beauty Pie was among the many brands that found new customers on the back of changing consumer behaviour during the pandemic. Beauty Pie, in particular, appeared to capitalise on the surge in demand for premium beauty products, which Kantar says increased by 6%.

With a fresh round of funding, Beauty Pie is planning to further expand on its core categories of make-up and skincare. It has already done this to a certain extent, launching diffusers and candles, as well as supplements and a recent line of pyjamas. Again, this nicely feeds into customer loyalty, with Beauty Pie loyalists keen to get their hands on any new launches, regardless of category.

Beauty Pie raised 0m in funding last September to help further its expansion plans, which it says will involve “more warehouses, pop-up shops and a new membership model (for devotees).” This round of funding follows on from the huge growth Beauty Pie generated during the pandemic, with the brand doubling its number of members and turning a profit in the fiscal year 2021.

Beauty Pie is also strategic in how it aligns with this audience, using clever strategies such as its ‘Super Beauty Kits’ to aid discovery and purchase online. The kits encourage members to buy multiple products at once – each one is built around a specific product line or skincare need, such as the ’teenager kit’ or the ‘dry and sensitive’ skincare routine.

Members are buying into a ‘social contract’

In a December 2020 article, Index Ventures’ Danny Rimer described Beauty Pie’s relationship with its customers as a ‘new social contract’ – something that is built on a foundation of authenticity and trust, rather than transactions. “They are like a close and trusted friend – one who’s open with you, understands your quirks, knows when you want company but also understands when to give you space,” he explained.

Beauty Pie’s subscription model intrinsically drives brand loyalty. Naturally, there is the sense that you need to be getting enough out of it to justify a subscription fee just for access, but it also means that customers are essentially locked into the Beauty Pie ecosystem, with the model encouraging them to discover more products over time, so much so that they might eventually only buy from Beauty Pie.

Beauty Pie effectively entices customers to sign up for membership through its 60-day free trial, which gives customers a significant amount of time to try out products at a lower price point before they decide to commit.

Social media also feeds into Beauty Pie’s community, with the brand encouraging users to #postyourpie, and re-purposing this user generated content for their own social channels.

Can Beauty Pie sustain its success amid subscription headwinds?

While it still offers a subscription service, Beauty Pie differs from this traditional model – a direct-to-consumer membership is perhaps more of an accurate description. The brand calls itself a ‘buyers club’, as customers pay a monthly or annual subscription fee in order to get access to Beauty Pie’s own high-end beauty products, which can then be bought without luxury mark-ups (that often accounts for spend on marketing, middlemen, or expensive packaging). Customers can buy from the website without membership but will be charged regular retail prices. For example, members can buy the Beauty Pie triple hyaluronic serum for just £19, while non-members are able to purchase it for its retail price of £44.

So, what’s behind Beauty Pie’s success, and what does it mean in the context of today’s beauty industry? Additionally, in an increasingly fractured consumer climate – where loyalty is a challenge – how is Beauty Pie aiming to combat subscriber headwinds, and drive acquisition?

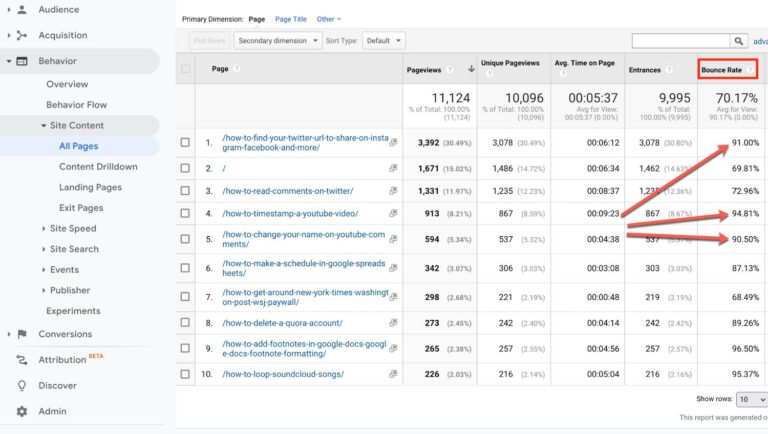

Beauty Pie’s relationship with its online community is one reason behind its impressive retention rates. Danny Rimer stated that “after only 48 months in operation, Beauty Pie’s annual and monthly subscriber figures are incredible – at Index, we’ve never seen customer retention like this before.”

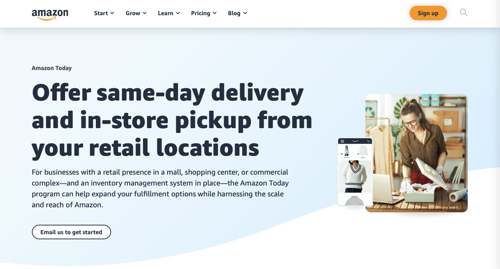

Beauty Pie has also created a pop-up bricks-and-mortar store in London’s Covent Garden, which is open for a limited period until July 10th. The store will undoubtedly attract existing members, giving them the opportunity to discover new products and receive advice from beauty experts. At the same time, the pop-up is designed to attract new shoppers, giving non-members the chance to experience Beauty Pie products in-person and immediately sign-up.

Its recent line of pyjamas show that Beauty Pie is keen to push this ‘organic expansion’ as far as possible, however, using the broad category of ‘wellness’ as an opportunity to do so. High demand from members – with initial launches quickly selling out – is clearly hard to ignore.

In light of this, Beauty Pie has recently become more focused on driving acquisition, by expanding its marketing into more mainstream areas as online acquisition costs no doubt rose. One example is its first-ever TV ad, which falls in line with its wider ethos of transparency, aiming to target consumers that are interested in accessible luxury rather than the unattainable quest for beauty.