Two years on, with physical retail regaining traction, and wider issues such as inflation, online advertising prices and tracking issues coming into play – how can D2C brands remain competitive? I recently spoke with Polly Wong, president of marketing strategists Belardi Wong, to discuss the topic.

Wong concedes that wider shifts in the industry are affecting the potential long-term growth of brands.

D2C brands need more distribution channels

“It used to be that people thought less of a brand… if you were in a mall, you didn’t want to be at the Sears end of the mall, you wanted to be at the Nordstrom end. It was the same with discounts. It used to be that if you were a big promotional discounting brand, then you weren’t a good quality brand. But I don’t think the consumer has that perspective anymore at all. I think the consumer just wants great value for money and it doesn’t change the perception of the quality of the product or the quality of the brand.”

“As digital is becoming more expensive, competitive, saturated and promotional – D2C brands need to have more distribution channels,” she said. “Not only are they opening their own stores, but they are selling on Nordstrom, which is wholesale, and even considering selling on Amazon, right? You have to be where your customer is – you can’t just have your own website and think you can drive scale at this point.”

Direct-to-consumer (D2C) commerce surged during the early stages of the Covid-19 pandemic, as new brands capitalised on the shift to online shopping, and mainstream brands – such as Nike and Levi’s – doubled down on direct sales channels.

“We have seen a shift back to retail, even with the pandemic – I believe, right now in terms of total retail sales in the US, it’s still 78% in store,” Wong explains.

“A lot of D2C brands made you think that you could just have one product or five products and suddenly become huge, right? But there’s a reason why Stance and Bombas don’t just sell socks anymore. They sell t-shirts and underwear. The same with Allbirds,” she explained. “The best way to drive response rates is to have a range of product across categories and price points. The more products you have the more likely someone is to buy from you. You also increase your downstream lifetime value, which means you can spend more to acquire customers.”

Wider product assortment and more marketing channels is key to growth

“The cost of marketing is up in every channel, the cost of goods is up, the cost of distribution is up. Also, the funding market has really dried up. I know a lot of our clients, emerging DTC brands, are having a hard time raising money for that next chapter of growth.”

“Because you’re competing for more wallet share – consumers shop at both premium brands and Target, you see – the competition from the big box retailer is going to drive more discounting in the back half year than we historically see,” she explained.

“Additionally, if you’re in sporting goods, gardening, home decor, you’re going to have a hard time growing. But like I said, we’re seeing strength in apparel, accessories, fashion. People haven’t bought new clothes for fall yet, right? We’re still going to see that demand, and I am a little bit half glass full…”

The third option for customer acquisition is to expand product assortment.

“The affluent consumer was stuck at home spending a ton of money online [during the pandemic] – spending a lot on home and sporting goods and gardening and many other things. Those companies had huge, double- or triple-digit growth for two years in a row. Now you’ve got huge numbers to grow on top of,” she said.

“[Clients are] continuing to lean into social commerce and spend money against it, but the challenges at this point with tracking and measurement combined with the super high CPMs – it’s extremely expensive,” says Wong.

“It’s a challenging time for social. There’s actually less advertising inventory because there’s less free time, so when consumers start travelling and entertaining and they are distracted – less free time means less advertising impressions, which drives up the cost of the impressions. But at the same time, the marketing and the measurement and the tracking is not what it used to be, and so you’re seeing decreases of results.”

H2 to see more discounting

“The first is just increasing distribution channels, so selling your product on the Nordstrom floor. Wholesale is a tremendous growth opportunity.” Further to this, she says, “the number two strategy is basically activating more marketing channels. We see clients leaning into CTV, into TikTok, as well as leaning into print.”

As well as rising costs across the board, Wong says that it is increased competition – not just from big box retailers, but wallet share on experiences and services – that is becoming a challenge for D2C retail brands.

While the rate of growth might be slowing, Wong states that D2C brands are still seeing growth year-over-year, just at 10 to 15% instead of 85%.

“And honestly, I’ve got to believe that consumer sentiment in the US is absolutely tanking. We don’t see that the younger generations respond as much in their spending just based on consumer sentiment. But definitely, we’ve got a million data points that tell us older consumers become very reserved in their spending when consumer sentiment is low.”

“We see that consumers are willing to pay more for sustainability, and if the brand is giving back,” she said. “I always say a millennial can spot a manufactured brand from a mile away, and I think definitely authenticity is very important.”

“I also think it depends on category and on the consumer you are targeting – is it a low-ticket consumer or is it a high-ticket consumer?”

High costs are impacting investment in social

Though heavy discounting is often thought to erode consumer perception (particularly of luxury brands), Wong says that this is no longer an issue, with consumers across the board appreciating good value for money.

Finally, when asked about how the retail industry will evolve in the next 18 months, Wong was surprisingly positive – despite the ongoing issues related to inflation and distribution.

“You know, most people say that if we have a recession, it will be short and mild,” she said. “And so, I think that I expect probably by next spring everything will level out.”

Negative consumer sentiment is leading to reserved spending

Wong says that her company, Belardi Wong, is seeing its clients focus on three major growth strategies.

So, with growth presenting a big challenge, how do DTC brands go about acquiring new customers?

“Also, everybody from small brands to big brands has extra inventory, and so I think we’re going to see a pretty promotional landscape.”

Consequently, in the month of June, Wong says that Belardi Wong’s clients decreased their spending on social by 27% versus the same month last year.

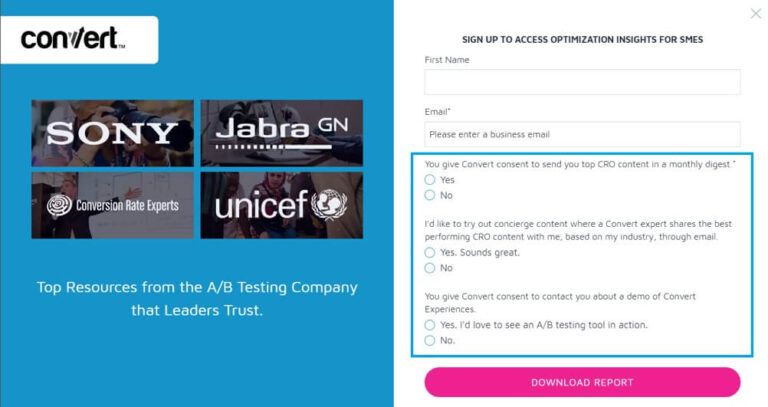

Direct-to-Consumer (DTC) Best Practice Guide

Even the best strategy does not guarantee success in today’s retail landscape, of course, with the priories of consumers continuously evolving. However, Wong says that authenticity remains a key factor for affluent, urban consumers in particular.

“Q1 was mostly very strong, and results started really softening in March and April. It’s spring break season and people are getting out into the world now,” Wong explained.

Wong does, though, predict that promotions will come to the forefront of retail in the rest of the year as inflation continues to impact consumer behaviour, with D2C brands – who are not typically very promotional – also offering discounts.

![EyeQ: The Lovechild of the Viacom and CBS Merger [An Exclusive Look at the Latest Approach To Video Buying]](https://research-institute.org/wp-content/uploads/2021/04/what-to-know-before-you-sell-your-small-business-768x432.png)