Consumers are focusing on basic goods. Moreover, many are turning to buy-now, pay-later for groceries. Grocery chains Albertsons, Kroger, and Safeway have partnered with BNPL provider Zip, allowing consumers to make four extended payments for their purchases.

Apparel sales have experienced a drastic reversal in the past three months. According to Adobe Analytics, global apparel prices were down 1% year-over-year in July while falling 6.3% from June. It comes after 14 consecutive months of substantial price increases. Ecommerce prices for electronics — the largest online category with an 18.6% share of spend in 2021 — fell sharply in July, declining 9.3% year-over-year in response to sluggish sales.

Inflation

The Adobe Digital Price Index is based on data from Adobe Analytics and analyzes 1 trillion visits to global retail sites and over 100 million SKUs across 18 product categories. In July, according to the Adobe DPI, global consumers spent .7 billion online, 0 million less than the prior month. Year-over-year ecommerce spending in July grew 20.9%, mostly attributable to Prime Day sales. Retail ecommerce consumer spending reached 5.4 billion online thus far in 2022 according, again, to Adobe. However, July online spending decreased compared to May’s .8 billion.

Lagging consumer demand has created a surge in excess inventory. This warehouse is owned by Liquidity Services, a liquidation company. Click image to watch video.

Now, as the supply chain issues resolve, retailers are holding large inventories with declining demand. Both merchants and logistics companies are scrambling to locate space to warehouse returned goods, unsold out-of-season stock, and new merchandise for the upcoming holiday season.

In short, unpredictability makes planning for the remainder of the year difficult for both brick-and-mortar and online merchants. Furthermore, the U.S. Federal Reserve’s intent to raise interest rates could make consumers hesitant to take on holiday debt.

Inventories

Global retail volatility has been rampant over the past 18 months. During 2021 and the first quarter of 2022 strong consumer demand was impeded by limited inventory due to supply chain problems. Then discretionary purchasing stalled as inflation took a toll on consumers.

Financial analysts continue to argue whether we are in a recession. U.S. inflation thus far in 2022 has exceeded 8%, but the price increases mainly affect essential goods such as groceries and fuel. Prices for non-essential items have declined.

Brick-and-mortar retailers, direct-to-consumer merchants, and marketplaces must decide whether to deeply discount the goods or sell them to a liquidation business, often for pennies on the dollar. Liquidity Services, a liquidation company founded in 1999, benefits from the excess inventory. It collects and resells surplus and returned goods from retailers such as Target and Amazon.

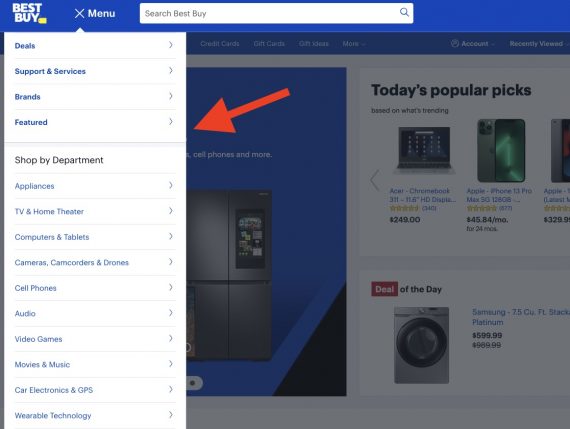

Major retailers — Bed Bath and Beyond, Best Buy, Nordstrom, Target, Walmart — have mentioned price declines in earnings calls or 2022 financial guidance. Walmart stated that it expected operating profits for the year to fall by as much as 13% because of marked-down inventory that isn’t selling.

Peloton, the manufacturer of expensive tech-connected exercise bikes, suffered heavy losses this year as people returned to public gyms and stopped buying luxury exercise equipment. In the quarter ended June 30, 2022, the company lost .2 billion. Its stock plummeted. In August Peloton announced that it would sell its entry-level bike on Amazon, a departure from selling direct to consumers online and in its physical stores. Peloton said it would close many of its U.S. stores next year.

Prologis, the global warehouse leader by square footage, stated in a recent market analysis that it anticipates a need for an additional 800 million square feet of warehouse space beyond earlier projections to handle excess inventories.

Retailers are looking to add storage capacity, both for holiday items now reaching distribution centers and to guard against holiday stock-outs. Yet they are also stuck with out-of-season apparel and high-ticket items that consumers have stopped buying.

Unpredictable

Hence consumers’ use of BNPL has moved beyond big-ticket purchases to recurring expenses. Food (including restaurant orders) accounted for about 6% of the .9 billion in online BNPL charges in 2021, according to data analytics firm Global Data. BNPL provider Klarna reports that more than half of the top 100 items its users buy is now grocery or household items.