Allbirds is known for having tussled with Amazon over the ecommerce giant selling a pair of cut-price shoes that looked strikingly similar to Allbirds’ Wool Runners, and is unlikely to ever sell its brand through Amazon. However, it has a very different relationship with Alibaba, with Erick Haskell, who spearheaded Allbirds’ expansion into China as the then-President of International, telling Footwear News that,

How did Allbirds manage to adapt to China – particularly amidst the onset of the coronavirus pandemic – and what lessons can be taken from its success for other brands looking to do the same?

The Ecommerce Quarterly

In China, however, sustainable products are much less of a draw, and Allbirds’ emphasis on simplicity and minimalist design – which has been a hit with western consumers – is also less to Chinese tastes. This led Allbirds to search for other ways to communicate its brand ethos in a country where it had no existing name recognition.

Launching in China, especially for newer, direct-to-consumer brands like Allbirds, is often seen as a litmus test for a brand and its ability to go global – the world’s largest ecommerce market presents a big opportunity. Launching in China as an overseas brand is also significantly easier than it once was thanks to changes in global ecommerce and tariff regulations as well as the ability to partner with major platforms like Tmall and WeChat, which are forums not only for online shopping but also for entertainment, media and chat.

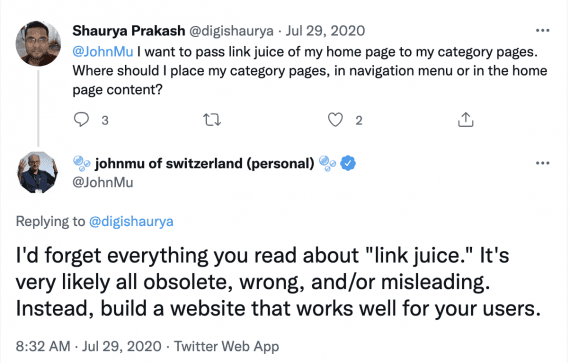

D2C versus Alibaba

“Pre-Covid-19, that may not have been an option because there would have been too many consumers in our stores. Now, we’re trying to figure out operationally how to preserve this feature when the stores become busy again.”

“We used various technologies, including technology from Alibaba, so when consumers asked questions of a certain nature – like “What do I wear Allbirds shoes with?” – that would prompt the customer service team to ask if they’d like to speak to someone in the store through video chat,” Haskell told Alizila in April 2020. “Consumers could then see what our staff were wearing with their Allbirds as well as our different shoes and colors.

The sustainability of the brand in particular has been a big draw among increasingly eco-conscious western consumers, even though Allbirds’ founders deliberately didn’t call attention to the company’s sustainable ethos when they first launched, partly because of the reputation that sustainable products have for being of inferior quality, and partly because they didn’t want to seem as though they were using sustainability simply as a marketing or PR tactic.

One thing that hasn’t changed in Allbirds’ approach between west and east is its desire to gather feedback from its consumers and act on their input. In the west, Allbirds values the “feedback loop” with customers that the direct to consumer model allows, and between 2016 and 2019, reportedly made more than 35 changes to its original Wool Runner that were based almost exclusively on customer concerns and experiences.

However, launching in China as an established, overseas brand meant that Allbirds had to change up its usual modus operandi. Very little traffic in China makes its way directly to brand websites, with consumers being much more likely to engage with a brand through super-app WeChat, conduct research about which brands to buy through online forums and reviews, and buy from ecommerce sites like Alibaba-owned Tmall, JD.com or Pinduoduo.

For Allbirds, this meant giving up the control over its distribution model that it prizes in the west and partnering with Alibaba’s Tmall to sell its products. This was important in getting Allbirds over the ‘brand awareness hurdle’ that it faced in China, where it was completely unknown.

Since launching with a single product, the Wool Runners, in 2016, Allbirds has built its brand around a steadfast commitment to quality and sustainability and become one of the fastest-growing shoe companies in the world, with a valuation of .4 billion in October 2018. Its sneakers have been toted by A-list celebrities and Silicon Valley entrepreneurs, and the brand even has Leonardo DiCaprio as an investor and celebrity endorser.

However, as the brand has become better-established and sustainable shopping has evolved into an ever more meaningful movement, Allbirds has put more emphasis on its sustainability and use of natural materials, with slogans such as “Made From Nature, For Nature” and product names such as the Tree Dasher, a running shoe made from eucalyptus trees and the company’s trademark sugarcane foam.

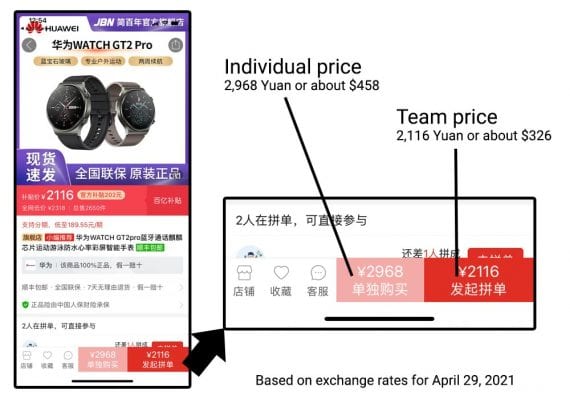

Taking part in China’s massive 11.11, or Singles Day, shopping festival, Allbirds was surprised to discover that the day was about more than just discounting products. Erick Haskell told Quartz that the brand used Singles Day 2019 “as an educational tool to let consumers know what Allbirds is.” Allbirds told the story behind the design and materials that made up each shoe, explaining that the wool uppers were milled at the same Italian factories that produce wool fabrics for luxury brands – a detail that carried a lot more weight with Chinese consumers than the shoes’ minimalist appearance.

He also noted that Chinese consumers are becoming more focused on their health, wellbeing and fitness in the wake of the Covid-19 pandemic, which will surely shape the approach that Allbirds takes to its messaging in China – and most likely the rest of the world in turn.

Education and storytelling

However, in the midst of a strong period for Allbirds in China after its first, highly successful Singles Day, the impact of the Covid-19 pandemic began to hit, forcing the brand to make changes to how it dealt with consumers in order to safeguard the health of its staff. Most of its store employees shifted to supporting ecommerce fulfilment through Tmall, but Allbirds also devised a way to connect customers at home with the expertise of its store staff via video chat – an innovation also employed by many retailers in the west, such as luxury brand Sana Jardin, fragrance brand The Fragrance Shop, and Dixons Carphone.

Six months after its launch in China, Allbirds also carried out a comprehensive survey of Chinese consumers’ views on its brand, which allowed the company to understand what parts of its messaging and product Chinese consumers valued most. Haskell told Alizila:

Breaking into the Chinese market is a notorious challenge for many overseas brands, despite the appeal. Here’s how D2C footwear brand Allbirds has adapted to China.

Econsultancy’s D2C articles and reports

It’s also important for brands to be sure that they have a market in China before making the decision to expand. Allbirds decided to expand into China after noticing that purchases were being made with Chinese credit cards on its ecommerce site, and that tourists from China were visiting Allbirds’ stores in the US. The brand also believed that many of the same values such as a concern for the planet and a desire for comfortable footwear would be present in China – though this, of course, turned out not to be the whole story.

Ecommerce: Third-Party Marketplaces for Retailers

Again as demonstrated by Allbirds, listening to and acting on consumer feedback is vital, as is using the tools at your disposal to tell a brand story that will connect with Chinese consumers and persuade them to buy your particular brand over one that they might be more familiar with. Companies that have done things by halves, trying to launch in China without committing to building a strategy and approach that feels native to the market, have tended to fail – even when they have the clout and resources of Amazon.

Getting input from consumers

Combined with a very different set of consumer behaviours and expectations, it isn’t an environment where brands can just replicate the same strategy they used to launch in the west – no matter how well it has served them there. Overseas brands are liable to need a native team in China, as well as a local agency and PR firm, in order to navigate the market and avoid alienating consumers with an unfamiliar approach. Having a commerce partner to handle logistics can also be beneficial.

In the west, Allbirds has succeeded in building a reputation as a brand that ‘does things differently’, with its commitment to quality and comfort as well as style and environmental sustainability, and listening to its consumers’ wants and needs. “At this point, our community has helped us more than double our initial contribution, leading to a donation of over million worth of shoes to healthcare workers globally,” said Haskell.

But after Allbirds weathered a tumultuous year in 2020, China is on track to become its top market in the Asia-Pacific region, ahead of Japan and South Korea, with ecommerce sales in 2020 set to be more than double those of 2019. It’s a gamble that is paying off, after a lot of work.

Allbirds talks about its expansion into China and why the market is key to its goal of becoming a “globally beloved brand”. (This content was originally published on Alizila, Alibaba Group’s corporate news website)

In 2019, Allbirds began to launch its brand in China – a country where luxury and overseas goods are hugely in demand. But even with its rapid growth and acclaimed reputation in the west, Allbirds has had to work to break into the Chinese market, which has a very different set of values, priorities and ecommerce distribution channels.

Speaking at the National Retail Federation conference 2020 Vision: Retail’s Big Show in January 2020, Haskell said that the importance of the Chinese market had been a key lesson for Allbirds, noting that the brand had gone on to expand further into East Asia by opening a store in Japan not long after its China launch. “Until very recently, a Western retailer would not make its entrance into Japan nine months after going on the market in China,” he said.

Learning from China during the Covid-19 crisis

How does the ecommerce experience in China differ from the west?

However, western brands launching in China also need to be committed. As demonstrated by the example of Allbirds, a product that has been carefully designed, tested and found to resonate with western markets may face a completely different reception in China, which means that brands ought to design their marketing and product strategy for China from the ground up, without any preconceived assumptions about the Chinese market. They will also face different competitors in the Chinese market than the ones they are used to in the west – competitors that might be local, and have a much more innate understanding of the market and how to navigate it, as well as a stronger foothold.

It’s part of a category that has been dubbed ‘anonymous luxury’ due to its direct-to-consumer sales approach – cutting out the omnipresent hovering salesperson – and stripped-down approach to style.

Allbirds’ direct to consumer (D2C) model has served it extremely well in the west, giving it a direct connection to its customer base that it uses to learn about their preferences and act on feedback. Co-founder Joey Zwillinger says the model has also allowed Allbirds to invest the money it would have paid to a retailer into keeping its price point lower than what consumers might expect to pay for a premium-quality shoe, funnelling profits directly into shoe production and improvements.

Allbirds Wool Runners for sale on Alibaba’s B2C platform, Tmall. (Image: Tmall.com)

Then, when the crisis began seriously impacting the US, Allbirds launched a programme to donate 0,000 worth of shoes to US healthcare workers, later repeating the move with the NHS in the UK. Following suggestions from their customers on social media, the brand expanded this to a ‘buy one, give one’ programme that allowed customers to help Allbirds donate shoes to frontline workers by buying a pair themselves.

“…That was a big “aha” moment for us locally, and we realized that when we talk to Chinese consumers about Allbirds to really position us as an innovative company.”

Launching in China as a western brand: a learning experience, but not one to do by halves

Allbirds has begun to more prominently emphasise its sustainable ethos and the natural materials that make up its shoes as the sustainable shopping movement has increased in prominence. (Image: allbirds.co.uk)

Experiencing the Covid-19 crisis first in China also shaped Allbirds’ response to it in the west, particularly from a humanitarian perspective. At the “peak” of the Covid-19 crisis in China, the Allbirds team noticed a consumer was buying Allbirds shoes for frontline medical staff in Wuhan, wanting them to have comfortable shoes while they were constantly on their feet. Inspired by this, the team decided to ship additional shoes to a hospital in Wuhan to help the doctors there.

Unlike in the west, where Allbirds launched as a digitally native brand before venturing into brick and mortar retail, Allbirds was an omnichannel brand in China from the word ‘go’.

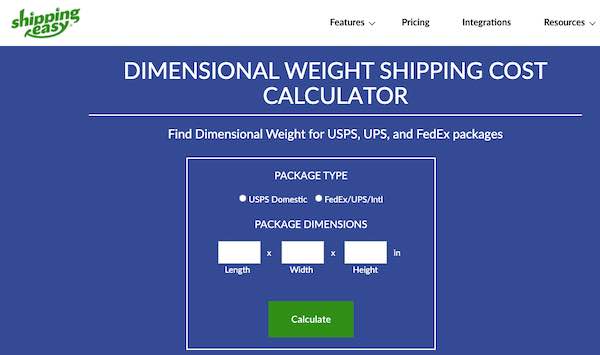

Tmall has even assisted Allbirds in opening physical stores in China. Rather than positioning itself as an ecommerce site, Tmall considers itself to be a technology company that focuses on “helping brands build their businesses, online and offline”, and reportedly offers a number of technology solutions that can help drive customers into physical stores. In the first six months of its partnership with Tmall, Allbirds was able to open four brick and mortar stores in China, in Shanghai, Beijing, Guangzhou and Chengdu.

A successful China launch is one that will equip western brands to take on greater challenges, and will also allow them to reap the rewards of being present in a massive, booming consumer market – but an unsuccessful launch will be costly, and may lock brands out of the region for some time, or else give them much bigger reputational hurdles to overcome when they do want to try again. Planning, research, and open-mindedness are key in that respect – to know what you’re getting into, and also be able to adapt when things don’t go as expected.

Environmentally sustainable shoe brand Allbirds has made a splash in the west as a disruptive, direct to consumer challenger brand, earning a cult following for its eco-friendly and stylish wool footwear, which is marketed as “the most comfortable in the world”.

“What we heard repeatedly from consumers was that they viewed our shoes as a new technology, an innovation.

In China, despite the lack of a D2C model, Allbirds has kept up this commitment to hearing from its consumers, using data from Tmall as well as consumer feedback on the platform to inform changes to the look and feel of its product and marketing. For example, as Haskell explained in a video for Alizila, in its marketing throughout most of the rest of the world, Allbirds focuses its product imagery on the shoe itself. However, through Tmall, the brand learned that Chinese consumers wanted to see “the whole look – they want to see how the shoes are styled and how they’re paired with apparel. So, that was an early learning and something we changed on the site right away.”

![The 18 Best Keyword Research Tools for Every Need [Free & Paid!]](https://research-institute.org/wp-content/uploads/2021/11/the-18-best-keyword-research-tools-for-every-need-free-paid.png)

![Amazon Experts Share Inventory Preparedness for Holiday Shopping [Q4 Update]](https://research-institute.org/wp-content/uploads/2021/04/what-to-know-before-you-sell-your-small-business-768x432.png)