A few pros of selling your business in this scenario are:

Let’s take a few hypothetical scenarios for the affiliate website business example we discussed above. After explaining the scenario, we’ll analyze the pros and cons of selling the business for each one.

Last month yielded your highest revenue ever as the niche continues to grow, but you’re starting to feel burned out and aren’t as invested in the business anymore.

Maintain your company’s records

Suppose you’re regularly positioning yourself to potentially sell your business according to the steps above. You’re prepared to face virtually any changing circumstance that could impact that decision.

Deciding whether to sell your small business is a complex process that impacts not just your professional life, but in all likelihood, your personal life as well. After all, you’ve devoted time, effort, and resources to build, grow, and promote your business.

Estimate your business’s value

Now that you understand the common reasons for selling or holding a business, you’ll be able to identify those factors in your decision-making process.

Once the business isn’t as lucrative or requires more maintenance to keep up with industry trends, it may be time to consider selling it. Joanne Camarce is a digital marketing expert specializing in SEO, ecommerce, and social media. She loves meeting new people and embraces challenges. When she’s not wearing her marketing hat, you’ll find Joanne fine-tuning her art and music skills.

Monitor economic and industry trends

With the possibility of student loan forgiveness on the horizon, you expect to see an increase in revenue in the next few years, but you’ll likely need to increase your time commitment to the business.

To make it as easy as possible to sell your business quickly, prepare for your ideal sale as early as possible. Here are a few things you can do regularly to prepare for a potential sale.

If you prepare for the possibility of a sale from the earliest days of your business and keep an eye on both your business and its industry, you’ll be better positioned to recognize the right time to sell when it comes.

If that’s the case, hold on to the business for as long as it fulfills your professional needs and goals.

Common reasons to hold or sell your business

To help you best assess the state of your business and whether it makes financial and business sense to sell or hold, we’ve put together this list of questions you can use to guide your decision.

If you have an AI-related business, you can see that your industry is on the rise, which may impact your decision to sell or hold. Training yourself to pay attention to these kinds of changes will make it much easier for you to spot the opportune time to sell.

You’ll pay some brokerage fees, but considering the advantages, hiring a business broker is well worth the cost.

Reasons to hold on to a small business

If there is still plenty of room to grow, that’s not necessarily a sign that you should hold. You may not be willing or able to invest the resources needed to keep up with trends. But holding for a year or two while the industry continues to grow could mean a higher sale price down the line.

- To maintain your steady stream of income.

- To allow the business time to increase sales or revenue.

- To let industry or economic trends play out.

- To wait for a qualified buyer.

Your affiliate website has held steady in search engine rankings, but declining interest in the niche leads to lower traffic and revenue each month.

A few cons of selling your business in this scenario are:

Once you identify opportunities for change, decide if you’re willing to invest the time and money into implementing them. If you’re not ready to do the work, it might be time to sell to someone who is.

Strong competitors are emerging regularly, and you’re not sure if you want to seek an investor to boost the website or a buyer to take it off your hands.

Questions to ask when deciding whether to hold or sell your business

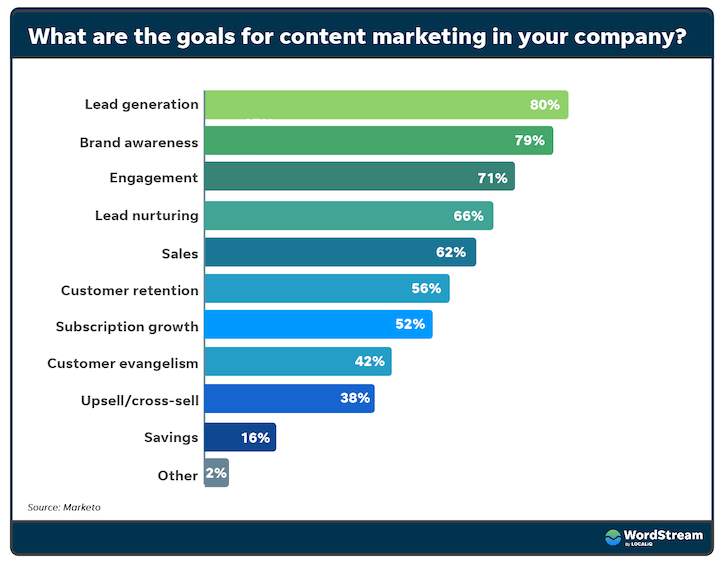

For a simple way to monitor search trends, especially if you’re looking to sell a web-based business, you can use a tool like Google Trends. In this example, you can see how interest in the term “AI” has been steadily increasing for the last five years.

While we can’t offer one single list of criteria to help everyone decide when they should sell or when they should hold, we can walk you through all of the critical things to consider when deciding whether to sell your business.

1. What are your current and projected profit margins? Are they improving or declining?

First, consider looking for a business broker. According to Quicksprout, “Business brokers help you get the best possible price and sell your business faster than you could do on your own.”

It’s important to consider all your options before you commit to selling your small business. It’s not an easy decision to undo.

In the case of our affiliate website, holding on to the business makes sense as long as you have a steady revenue stream that is easy to maintain.

2. Do you see room for growth in your current industry/business model?

A few pros of selling your business in this scenario are:

A small business sale doesn’t happen in a vacuum. There are dozens of external factors that may impact your decision to sell or hold a business.

Do you still feel invested in your business?

Once you decide to sell your business, you’ll need to have an official business appraisal. But in the meantime, it’s a good idea to calculate an estimate yourself. By understanding your approximate business value, you’ll be able to see when the timing is right to get a reasonable price from a buyer.

You may have decided that the time is right to look for a buyer for your company. Once you make this decision, there are a few things to do.

If your profits are increasing while your work input remains the same, don’t sell just yet. Maintain your business growth and try to anticipate industry changes. Then you’ll be able to sell your business at or near its peak.

As a small web-based business, this site is an excellent example of commonly bought and sold businesses. It likely doesn’t have a large staff or many overhead costs, and it also requires minimal maintenance.

More questions to consider with regard to selling your business

If profits are declining, determine what you may be able to do to turn it around. Does your business need to increase marketing efforts, modify existing products and services, or develop a new business logo and branding to keep up with digital transformation?

- How is your business doing compared to competitors? Are you struggling to keep up with them, or are you outdoing them?

- Is your business prepared to adapt for digital transformation? Will your IT support team be equipped to handle the changes?

- Do you have employees that the sale of your business would impact?

- Are you looking for a way to free up time or money to put toward other business opportunities?

- Is the current state of your business a good fit for your skills, interests, and goals?

- Are your business model and industry quickly learned by newcomers or less experienced workers?

- Do you plan to stay involved in business operations after the sale? If so, for how long?

- Are you prepared for a potentially lengthy or expensive sales process?

For a business like the nursing program affiliate site above, it might make sense to hold onto the company for a while. Here are a few common reasons why you may want to hold off on a sale:

Pros and cons of selling your small business

From day one, keep detailed and organized records for every key piece of paperwork. This includes everything from your business registration paperwork to your latest cash flow statements.

Scenario #1: Steady revenue, minimal work

But, if you still care about the work you’re doing in your small business, don’t feel pressured to sell just because the market conditions seem favorable.

Maintaining your records saves you a lot of time when you’re ready to transfer business ownership. You’ll already have a clear system for providing the new owner with everything they need.

This is perhaps the most critical question to consider. Running a business can be a considerable investment, and ultimately your interest in it has a huge impact on its success or failure.

Keep an eye on both industry and economic trends that may positively or negatively affect you. This could be the emergence of new competitors, a change to policies impacting your industry, or national and global events that impact the business.

- More free time to spend on other opportunities.

- A cash payout you can use to reinvest or take time off.

- The possibility of a higher selling price due to changing industry trends.

Keep an eye on both industry and economic trends that may positively or negatively affect you. This could be the emergence of new competitors, a change to policies impacting your industry, or national and global events that impact the business.

- A high likelihood of securing a good price for your business, thanks to your commitment and its current performance.

- Liquid assets that you can use to take time off or search for a new opportunity.

- Ease of finding qualified buyers since your business is in an attractive position.

A few cons of selling your business in this scenario are:

- Missing out on potential future revenue growth because you sold too early.

- Losing the opportunity to see your business through to its peak.

Scenario #3: Declining revenue, emerging competitors

A few cons of selling your business in this scenario are:

- A lower payment than if your site was performing at its peak.

- Uncertainty or instability for your employees.

- Personal financial risk if the sale price isn’t as high as expected.

What to do when you’re ready to sell your small business

From the business’s performance, to external market factors, to your feelings toward the company, there’s plenty to consider when deciding whether to sell or hold — and those circumstances can sometimes change at a moment’s notice.

Consider how the future of your industry looks. Is there still a lot of growth and innovation, or are things becoming more stagnant?

Thinking through these questions and possible scenarios should help you identify the most important factors as you decide whether to sell or hold.

A few cons of selling in this scenario are:

Here’s a quick list of what you should consider:

- Compile and organize all of your business paperwork and financial records. Work with an accountant to make sure everything is in order.

- Record all of your company’s assets. This will help your broker or appraiser determine your business’s value more quickly and accurately. While physical assets such as computers are often the main focus, don’t forget digital and other intangible assets too. Online content like explainer or animation videos can be critical assets, especially if they bring in revenue.

- Work with your broker to find the right asking price. You don’t want to ask for too much or too little. Ensure you and your broker are on the same page about how much your business is worth.

The decision to sell your small business is entirely yours

Your affiliate website has seen large gains in the past year, thanks to your significant investment of time and resources.

When valuing your business, it’s important to apply your real-world knowledge to the numbers you’re crunching. If you know that certain assets or revenue streams will change soon, but it’s not yet reflected in your paperwork, begin making that assumption yourself for the most accurate business value estimate.

As the business owner, you spend about five hours per week maintaining and marketing the business, but you aren’t particularly interested in the work.

About the author

One thing is clear: deciding whether to sell your small business is a complex decision influenced by dozens of factors.