According to CB Insights, roughly billion flowed from investors to retail (brick-and-mortar and ecommerce) technology firms in Q2 of 2021, an increase of about 4% over Q1 2021 and more than triple the amount from Q2 2020. A funding frenzy has materialized, culminating in larger funding rounds and higher valuations for the technology start-ups.

Record Investment

CB Insights reports that the following companies valued at billion or higher received the most funding in the second quarter:

Talkshoplive is a live-stream social shopping platform out of California. Earlier this month, it raised million in follow-on funding from VCs and angel investors. Celebrities such as Oprah Winfrey, Paul McCartney, Garth Brooks, and Dolly Parton use the platform, as do small businesses that host their own shopping channels.

Top Recipients

Zippin, a California-based provider of cashier-less checkout technology, turned to equity crowdfunding site OurCrowd to raise a second round in May. Zippin’s customers include stores in sports stadiums and airports in the U.S. and Japan.

- J&T Express is an Indonesian-based delivery service valued at $7.8 billion. Total funding to date is $1.93 billion.

- Mollie, a Netherlands-based online payment company for ecommerce businesses, has a valuation of $6.5 billion. Total funding thus far is $934 million.

- Back Market is a France-based online marketplace for refurbished consumer electronics and appliances, valued at $3.2 billion. Total funding to date is $511 million.

- ContentSquare, also headquartered in France, provides analytics for ecommerce retailers and brands to track consumers’ behavior. It is valued at $2.8 billion.

- Meesho, an Indian online marketplace, allows merchants to sell via WhatsApp, Facebook, and Instagram. Its valuation is $2.1 billion. Funding thus far is $491 million.

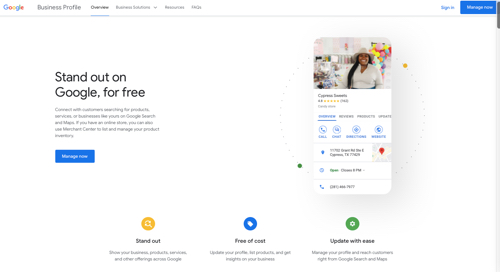

Platform Technology

Tapcart, also based in California, offers a platform for developing mobile shopping apps. Shopify merchants, for example, can develop their own mobile apps using Tapcart. The company raised a Series C million in May with Shopify as one of the investors.

Yalo, headquartered in California, received million in May to fund its conversational commerce products. Yalo already enables commerce on WhatsApp and other messaging apps.

Brick-and-mortar

Ecommerce-specific enablers were the recipients of the top five deals worth more than 0 million in Q2. Food and grocery delivery companies are major investment targets as they anticipate that people will continue to shop online. Technology that enables mobile commerce also experienced a boost. Tools that optimize warehouse operations, delivery routes, and most anything along the supply chain will continue to be an avenue for investment because of continuing stress in the system.

Via, in California, received million in Series A funding in June for its suite of mobile ecommerce tools.

In the brick-and-mortar arena, contactless checkout technology is receiving much funding as stores see this as a way to ease customer concerns about social distancing and to streamline checkouts.

Mobile

Locus, headquartered in India, raised million in June to further develop its last mile

logistics platform that provides real-time tracking, warehouse management, and vehicle

allocation solutions.

Retailers are deploying cameras and artificial intelligence to track foot traffic, demographics, shopper behavior, and in-store marketing.

Shogun, based in California, provides a platform to help ecommerce merchants design their own responsive storefronts. In June it raised .5 million in Series C funding. The money will be used to continue building out its two main products: Page Builder (a drag-and-drop tool for Shopify merchants) and Shogun Frontend (for headless commerce).

Logistics

Brinng, based in Israel, raised 0 million in June to continue developing last-mile delivery tools for dispatch and routing, click and collect, and fleet management.

The pandemic has posed obstacles for both brick-and-mortar and online merchants. Among the challenges are labor shortages, inventory problems, delivery conundrums, and the need for more personalization. New providers are addressing those needs, and venture capitalists and other investors are eager to fund them.