And this is especially important to know with Google Ads, Bing Ads, and other forms of search advertising. As one of the most effective paid media channels, it’s also one of the most competitive, so it’s important to keep your performance in top shape.

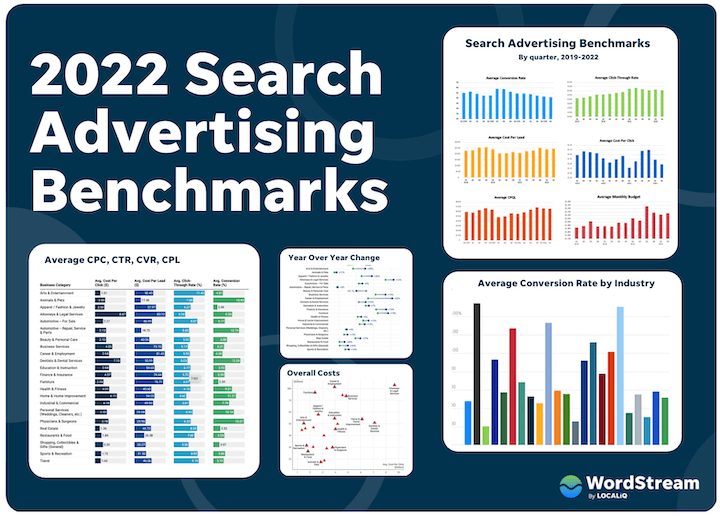

In this report you’ll find 2022 search advertising benchmark data across four important performance metrics and for over 20 different industries, along with key takeaways and tips to improve your performance. This data is pulled from over 18K LOCALiQ client campaigns, advertising over the past year and into Q1 of 2022. Use these results to better assess, manage, and maximize your search advertising campaigns and budgets.

If you’re confident that your offer or product is the right one, focus on landing page optimization. Are you making it easy for visitors to take the next step? Perhaps you’re asking them to complete too many fields in your form, or your site doesn’t work well on mobile? Test your landing page layout, copy, CTA, and other elements. These are some of the key ways you can influence your conversion rate.

All of this goes to show how the variation in purchasing behavior by industry results in varying benchmark profiles—which is why it’s so important to understand performance norms in your industry specifically in order to get a true gauge on your performance. For more help with determining and managing your overall costs, check out our guides on how much Google Ads costs and how to use the Google Ads budget report.

The pandemic continues to impact the advertising space. This should come as no surprise since consumer priorities shift as the situation evolves. “I think that the pandemic is at play here more than anything else,” said Katia Hausman, VP of Ad Products at LOCALiQ. “If we look at the data by quarter and layer it over COVID waves, they match the dips in CPC and the spikes in CTR.”

Table of contents

The typical cost per click for a search ads in 2022 is in the range of to . As has been the pattern in years past, industries with the highest average cost per click include Attorneys & Legal Services, Dentists & Dental Services, and Home & Home Improvement at -8 per click. This is not surprising as click-through rates for these industries tend to run lower than others, which can drive up CPCs. These are competitive industries with higher marketing costs and longer decision cycles, but also a higher value placed on each individual conversion, since these services tend to be more expensive.

2022 search advertising benchmarks, all metrics

“We’re really excited to release our new search advertising benchmarks,” said Mitchell Leiman, Sr. VP and General Manager of Digital Marketing Solutions at LOCALiQ. “This is a complicated time for digital marketers, between the economic volatility and a changing landscape for digital advertising with privacy. That said, done the right way, search advertising remains one of the most effective forms of marketing for our customers. We hope this data helps you evaluate your results!”

Average cost per click for search ads by industry

The chart below illustrates how the relationship between cost per click and cost per lead varies by industry. In particular, we can see that high cost per click doesn’t necessarily equate to high cost per lead. If you’re seeing a higher cost per click than your industry average, check to see if you can improve your Quality Score by making your ads and landing pages more relevant. Keyword research, Negative keywords and a proper account structure can help with this. For more tips, refer to our guide on how to lower your cost per click.

Looking at the data in aggregate, we see some clear patterns. Year over year, cost per click has remained relatively stable, while click-through rate has increased. What might be leading to the increase in cost per lead across multiple industries? Here’s our explanation.

For more help keeping costs low, check out these tips to save money in Google Ads.

How does your cost per click compare?

Average cost per click (CPC) is a simple measure of how much an advertiser is paying each time a user clicks one of their ads. Many factors, including your industry and the competition level of the keywords you’re bidding on, can affect your CPC. You can learn how cost per click is determined in Google Ads specifically with this infographic.

Average click-through rate for search ads by industry

Also keep in mind that higher budgets typically lead to higher CPL (but also a higher number of leads!).

Cost per lead (also known as cost per action, cost per conversion, and cost per acquisition), is calculated by dividing the total cost of a campaign by the total number of conversions.

Your conversion rate is a measure of what percentage of users who click your ad go on to “convert,” or take the desired action you want them to take, whether it’s making a purchase or becoming a lead. Conversion actions might include signing up for a free trial of a product, or filling out a form to get a quote for a service.

How does your click-through rate compare?

Year over year, we’ve seen increases in CTR nearly across the board, suggesting that ads are feeling more relevant to users, which could be due to changes on both the advertisers’ side and the search engines’ side (such as more advanced AI and matching algorithms). The only industry that decreased in click-through rate was Shopping, Collectibles, & Gifts—by 13%. The highest increase in CTR was in Sports & Recreation at 14%, potentially due to post-pandemic consumers feeling more comfortable returning to fitness centers.

The average conversion rate in search varies widely across industries, from Apparel/Fashion & Jewelry and Furniture at around 2%, all the way up to 15% for Animals & Pets and Physicians & Surgeons. Dentists & Dental Services isn’t far behind at 13%. These were the same industries with the lowest and highest conversion rates in last year’s 2021 search advertising benchmarks report.

Average conversion rate for search ads by industry

Plus, click-through rate is much higher for Arts & Entertainment, as people do more exploring of their options here while for Dentists & Dental Services, the consumer has a clear picture of what they need. It’s also worth noting that Beauty & Personal Care saw a 22% decrease in cost per lead, from to .

You may also want to take a look at which keywords and ads are leading to conversions at lower costs, and consider funneling more of your budget to those more cost-effective keywords, which are likely higher-intent. And, if you’re only running paid search campaigns in Google, remember that costs tend to be lower in Microsoft ads. Advertising across multiple search engines can be a more effective use of your overall budget.

How does your conversion rate compare?

Also consistent with years past, the industries with the lowest cost per click include Real Estate, Arts & Entertainment, and Travel—all under . These industries all have generally high click-through rates.

The biggest change in cost per lead year over year is in Career and Employment, increasing 52% from to . This makes sense as it’s one of the industries with the highest increase in click-through rate (10%). Higher click-through rate can result in a lower conversion rate, causing cost per lead to go up. The labor shortage may also be at play here.

Average cost per lead for search ads by industry

If you’re looking to improve your conversion rate, start by thinking holistically about whether your ads and offers have strong intent match with your keywords and audience. Are you providing an irresistible answer to their question or a clear solution to their problem? “We’ve seen a trend toward more aggressive monetization of traditionally less commercial, more informational SERPs,” said Elisa Gabbert, Director of Content and SEO at LOCALiQ. “This reduces organic CTR, and could lead to a situation where advertisers are getting high CTR but lower conversion rates, because the visitors don’t always have conversion intent.”

CPL tends to be a more nuanced metric than CPC, and while a low cost per lead is of course desirable, industries with high customer values can afford to spend more per lead. The industries with the highest cost per lead are Attorneys & Legal Services and Careers, at just over . The Furniture, Finance & Insurance, and Business Services industries are not far behind at around . The industries with the lowest cost per lead (under ) include Animals & Pets and Automotive Repair, Service, & Parts.

For example, while Dentists & Dental Services has a much higher average cost per click than Arts & Entertainment (.00 vs .50), they both have an average cost per lead of . This is because the average conversion rate for Arts & Entertainment (5%) is much lower than for Dentists & Dental Services (5% vs 11%). Why? A person is more likely to book a dentist appointment they can always reschedule or fill out a contact form than to book, say, a non-refundable ticket to a show.

How does your cost per lead compare?

Most businesses have increased their advertising budgets. Compared to 2020 and early 2021, most advertisers have increased their digital advertising budgets in the past year as the economy recovered from initial pandemic conditions. Higher budgets lead to higher costs per acquisition. This is a trade-off most businesses are willing to make for a higher number of leads to grow their business.

You can find the charts from this report as well as our 2021 benchmark data in interactive format in our benchmarks hub page, which we will keep updated as we come out with new data.

Marketers and business owners are always asking us how they can be sure they’re doing a good job with their advertising, and rightfully so. Because, sure, your conversion rate may have gone up compared to last month, but is it a good conversion rate? Are your competitors seeing better results? Worse?

If your click-through rates are lower than what you’re seeing for your industry, you might want to refine your keyword list and make sure the keywords you’re targeting are truly relevant to your business. Further, consider experimenting with different approaches to your ad copy to see which features, benefits, and emotional framing resonates best. Refining your targeting to more specifically cater your messaging can help as well. Get more tips on improving your CTR (and lots more PPC metrics) here.

Overall search advertising costs by industry

Average click-through rate or CTR is an indicator of how relevant your ads are to the audience they’re reaching. Simply put, CTR is the ratio of ad clicks to ad impressions. A CTR of 1% means that 1 out of every 100 people who see your ad click it.

A high cost per lead can be the result of lots of clicks that aren’t ultimately converting. Prequalifying users with your ad copy and targeting more specific keywords are two ways to improve your PPC lead quality.

Keep in mind, however, that it’s not always necessary (or effective) to strive for the lowest possible cost per click. Some keywords have higher intent and higher value than others, so in some cases you need to bid higher to get more clicks and conversions. So while cost per click is important, it’s only one piece of the puzzle. Year over year, there were some industries that saw bigger changes in cost per click than others. Beauty & Personal Care and Finance & Insurance CPCs saw the biggest decrease (by 17% and 11%, respectively) while Travel and Furniture saw the biggest increase (16% and 12%, respectively). The increase in Travel cost per click can likely be attributed to increased competition as COVID restrictions eased during 2021 and people began traveling more frequently.

It’s encouraging to see that average conversion rate for Arts & Entertainment saw a 34% increase—likely due to changing habits during the pandemic. Shopping, Collectibles & Gifts and Fashion, however, both decreased by over 50%. It’s possible that as people venture out more, they’re researching online but buying in store or even researching while in the store—which speaks to the growing importance of an omnichannel marketing strategy. Keep in mind, however, that while a higher click-through rate can lower cost per click, it will drive up cost per lead if your clicks aren’t relevant. So just like cost per click, it is just another piece to the puzzle.

What does it all mean?

For accessibility purposes, the data in this report is included below in HTML table format to make the data readable on mobile devices as well as by search engines and screen readers.

This makes sense since people seeking dental services and business services both have a clear idea of what they need, so they do less exploration than Arts & Entertainment seekers, meaning lower average CTR. But since the B2B buying process often involves more than one decision-maker, there are more barriers to taking action for a business services customer—and thus a lower conversion rate—than for a dental customer.

This report is based on a sample of 18,364 North American-based LOCALiQ client campaigns in the outlined business categories that were running search advertising across all search engines between Dec 17, 2020 – Feb 17, 2022. Each business category includes a minimum of 72 unique active client campaigns. “Averages” are technically median figures to account for outliers. All currency values are posted in USD.

None of these trends change the fact that search advertising is one of the highest ROI paid marketing channels there is, with 32% of marketers naming paid search as their top performing marketing channel, and PPC typically returns for every spent. If you’re not totally satisfied with your search ad results, try the Google Ads Performance Grader to get a free report card with tips on how to improve.

However, while high click-through rate is commonly associated with lower conversion rates, low click-through rate doesn’t necessarily mean higher conversion rate. For example, Business Services has the same (relatively low) average CVR (5%) as Arts & Entertainment, but a much lower average CTR (5% vs 11%). And while its average CTR is the same as Dentists, its average CVR is much lower (v% vs 13%).

WordStream by LOCALiQ has come to be known for our digital advertising benchmarks reports, and this year, we’ve dug into the data once again to bring you updated benchmarks, now in a new, improved format that will make it even easier for you to see how your business measures up.

In the below table, you’ll find the average cost per click, cost per lead, click-through rate, and conversion rate for search ads across 23 different industries. Click on a metric name to sort the list by that metric.

Most of the industries we looked at have average click-through rates in the 6-7% range. Outliers are consistent with previous years—with Attorneys & Legal Services lower than average at 4% and Arts & Entertainment higher than average at 11%. As search expert Mark Irvine has pointed out in the past, there are unique advertising restrictions in the legal industry enforced by both search engines and government organizations, which have historically driven down CTRs in that industry, though this metric has also improved for legal advertisers over the years.

The search space continues to be competitive. Search advertising puts businesses in front of consumers when they have the highest intent to purchase. In fact, 89% of customers begin their buying process with a search engine. Its success rate as a paid channel is also what makes it so competitive. As more businesses use this channel, and as more businesses recovering from the pandemic return to this channel, advertisers have to bid higher to keep up.

“They know there is option and variety now so they do more searches and look across more options before making buying decisions.” As a result, ads get more clicks but fewer conversions as people explore their options. This will lower conversion rate and drive up cost per lead over time.

About the data

The SERP is changing. Another potential factor contributing to higher click-through rates is that the SERPs for queries with less commercial intent have more ads now than in years past.

The buying funnel is evolving. The overall trends also point to changes in search behavior. “People search differently now than in years past,” explains Stephanie Scanlan, Vice President of Client Success at LOCALiQ.

All data, mobile-friendly view

Average search ads cost per click in 2022

| Industry | Search Ads Average Cost Per Click |

|---|---|

| Arts & Entertainment | $1.51 |

| Animals & Pets | $2.86 |

| Apparel / Fashion & Jewelry | $2.66 |

| Attorneys & Legal Services | $8.67 |

| Automotive — For Sale | $2.27 |

| Automotive — Repair, Service & Parts | $3.13 |

| Beauty & Personal Care | $3.10 |

| Business Services | $4.85 |

| Career & Employment | $3.94 |

| Dentists & Dental Services | $7.10 |

| Education & Instruction | $3.94 |

| Finance & Insurance | $4.57 |

| Furniture | $2.39 |

| Health & Fitness | $4.01 |

| Home & Home Improvement | $6.11 |

| Industrial & Commercial | $4.18 |

| Personal Services | $3.32 |

| Physicians & Surgeons | $3.78 |

| Real Estate | $1.36 |

| Restaurants & Food | $1.84 |

| Shopping, Collectibles & Gifts | $2.25 |

| Sports & Recreation | $1.73 |

| Travel | $1.63 |

Average search ads cost per lead in 2022

| Industry | Search Ads Average Cost Per Lead |

|---|---|

| Arts & Entertainment | $50.40 |

| Animals & Pets | $17.46 |

| Apparel / Fashion & Jewelry | $57.97 |

| Attorneys & Legal Services | $83.10 |

| Automotive — For Sale | $46.99 |

| Automotive — Repair, Service & Parts | $18.73 |

| Beauty & Personal Care | $40.04 |

| Business Services | $73.70 |

| Career & Employment | $81.45 |

| Dentists & Dental Services | $50.91 |

| Education & Instruction | $54.60 |

| Finance & Insurance | $74.44 |

| Furniture | $76.71 |

| Health & Fitness | $45.60 |

| Home & Home Improvement | $54.05 |

| Industrial & Commercial | $49.90 |

| Personal Services | $29.08 |

| Physicians & Surgeons | $29.96 |

| Real Estate | $44.70 |

| Restaurants & Food | $26.58 |

| Shopping, Collectibles & Gifts | $30.27 |

| Sports & Recreation | $31.50 |

| Travel | $46.06 |

Average search ads click-through rate in 2022

| Industry | Search Ads Average Click-Through Rate |

|---|---|

| Arts & Entertainment | 11.43% |

| Animals & Pets | 7.08% |

| Apparel / Fashion & Jewelry | 6.27% |

| Attorneys & Legal Services | 4.24% |

| Automotive — For Sale | 8.67% |

| Automotive — Repair, Service & Parts | 5.65% |

| Beauty & Personal Care | 5.92% |

| Business Services | 5.17% |

| Career & Employment | 5.93% |

| Dentists & Dental Services | 5.03% |

| Education & Instruction | 6.17% |

| Finance & Insurance | 5.70% |

| Furniture | 6.01% |

| Health & Fitness | 6.15% |

| Home & Home Improvement | 4.62% |

| Industrial & Commercial | 5.61% |

| Personal Services | 6.95% |

| Physicians & Surgeons | 6.25% |

| Real Estate | 8.55% |

| Restaurants & Food | 7.60% |

| Shopping, Collectibles & Gifts | 5.50% |

| Sports & Recreation | 8.82% |

| Travel | 9.19% |

Average search ads conversion rate in 2022

| Industry | Search Ads Average Conversion Rate |

|---|---|

| Arts & Entertainment | 4.81% |

| Animals & Pets | 15.45% |

| Apparel / Fashion & Jewelry | 2.06% |

| Attorneys & Legal Services | 9.33% |

| Automotive — For Sale | 5.77% |

| Automotive — Repair, Service & Parts | 12.74% |

| Beauty & Personal Care | 6.88% |

| Business Services | 5.31% |

| Career & Employment | 4.58% |

| Dentists & Dental Services | 13.33% |

| Education & Instruction | 5.93% |

| Finance & Insurance | 5.59% |

| Furniture | 2.59% |

| Health & Fitness | 9.21% |

| Home & Home Improvement | 11.21% |

| Industrial & Commercial | 7.78% |

| Personal Services | 10.18% |

| Physicians & Surgeons | 15.07% |

| Real Estate | 3.52% |

| Restaurants & Food | 5.54% |

| Shopping, Collectibles & Gifts | 3.07% |

| Sports & Recreation | 5.86% |

| Travel | 5.19% |

![[VIDEO] The Quick (and Easy) Start to Omnichannel Optimization for Your Business](https://research-institute.org/wp-content/uploads/2021/07/video-the-quick-and-easy-start-to-omnichannel-optimization-for-your-business-768x576.jpg)

![What are CNAME Cloakers? [And is Apple coming for you?]](https://research-institute.org/wp-content/uploads/2021/04/what-to-know-before-you-sell-your-small-business-768x432.png)