Lifelines works by giving VIP loyalty club members this unique type of loyalty point whenever they spend in spend in a store, Groom Room, or Vets4Pets practice. Customers are then able to choose from ten national charities or a local registered charity to support with their Lifelines. According to Pets at Home’s Social Value Report 2021, £2.9m has been raised by VIP members, contributing to a total of over £14.9m since the VIP club launched in November 2012.

As Benoit Soucaret, Chief Experience Officer at Merkle Experience & Commerce UK, explained to Econsultancy, this type of strategy is invaluable for retail brands. “Data analysis offers companies a big competitive advantage, offering a deeper understanding of consumers that allows brands to personalise their marketing, whether it be through customised messages, product recommendations, offer of additional services, or segmentation based on the Customer Lifetime Value,” he said. “Data offers insights that brands can leverage to truly understand individuals.”

There are many reasons why customers regularly shop from a given retailer. The concept of loyalty might boil down to product availability (which has recently been sorely tested by supply chain issues), or convenience, particularly in the grocery sector.

It’s important to note Tesco’s increased digitisation, too. Earlier this year, the supermarket rolled out its ‘Value Hacks’ campaign to enhance deals for loyalty members, alongside the announcement that Clubcard vouchers can only be accessed online. This means that paper vouchers will be opt-in only, with members receiving a ‘personalised digital summary’ of their Tesco shopping habits via its app instead. According to Tesco, the number of customers accessing Clubcard via its app now stands at nine million, with Clubcard households reaching over 20 million.

McDonald’s is driving purchase frequency through digital rewards (and ordering)

Calling all Irish customers ☘️

We’re treating our https://t.co/aVdHsEWHK9 members- to an exclusive 2-4-1 offer on tubs and cones of our Ice Cream of the Gods.

Present your https://t.co/aVdHsEWHK9 card or app to redeem in-store. Offer valid from 16th-20th March 2022.T&C’s apply. pic.twitter.com/iPr4AEb1vq

We’ll help you get into the swing of it with

heaps of advice and exclusive offers.

— Pets at Home (@PetsatHome) September 3, 2019

First-party data derived from Clubcard helps Tesco deliver value in areas that consumers want it the most. Tesco Media and Insight is a new platform designed to help suppliers and agencies understand consumer needs and to develop more targeted and relevant ways to serve them.

Some large retail brands are already starting to recognise this opportunity. Target, for example, now allows members of its Target Circle program to link their loyalty accounts with Ulta Beauty’s Ultimate rewards. This means that customers can earn points and rewards from both loyalty programs when they buy from small Ulta Beauty shops located inside Target stores.

Quick Guide to Customer Retention

Despite recent losses leading Hotel Chocolat to pull back on US expansion, the retailer has said that investment in its loyalty program has partly helped it to achieve impressive multichannel growth post-Covid. The retailer’s VIP loyalty customers now account for 71% of its direct-to-consumer UK sales. Additionally, it has seen strong growth in the Japanese market, with sales rising 131% in the 26 weeks ending 26th December 2021.

Clubcard’s position within Tesco is undeniable, and something that has been central to the brand’s overall marketing strategy for years. As Tim Mason, former deputy CEO at Tesco, told Marketing Week back in 2019: “The reason you were doing this was because you were hoping there was some loyalty effect, but what you wanted to do was open a direct marketing channel to consumers, get more data and run the business better.”

Creating a loyalty ecosystem through partnerships, like Target and Ulta Beauty

According to Boots, over one million customers have already shopped the deals, saving over £8m, while the retailer also plans to extend these savings to an additional 1,000 products. Additionally, the retailer is freezing the price of over 1,500 products to ensure they remain affordable for customers in the coming months.

Boots is one example of a brand to recognise the need for value, recently pivoting its well-respected loyalty scheme to a focus on low prices. The retailer has made its loyalty scheme the focus of its ‘Price Advantage’ campaign, explaining how it now offers members exclusive savings on over 400 products each month.

The wedding industry is not usually associated with customer loyalty as such, as it comes with the hope that any purchase will only need to be made once. At the end of 2020, however, David’s Bridal launched the industry’s first-ever free loyalty program, Diamond Loyalty by David’s, in a bid to reward customers for making multiple purchases.

By joining forces, the partnership benefits both retailers through shared data and increased reach. It enables Target to drive new members into its loyalty ecosystem, and for Ulta – whose loyalty program reached 38.2 million active members in Q2 2022 – the beauty retailer is able to further expand its omnichannel footprint, also reaching Target customers.

This notion aligns with the theory that loyalty is more about branding, with company growth being driven through mental availability, i.e. being the first choice in the mind of the shopper, as well as physical availability, which makes products easy to buy. That Clubcard continues to prominently feature in Tesco’s advertising is perhaps proof of this fact.

Boots, Tesco and others provide real value to customers with loyalty pricing

This strategy contributes to perceived value, which can help to motivate consumers to choose a brand over others in the same category. Again, this brings up the debate of loyalty vs. penetration, with retailers like David’s Bridal arguably using the concept of loyalty to drive customer acquisition, rather than true loyalty.

On the same July call, CEO Chris Kempsczinski confirmed that enrolment and participation with My McDonald’s Rewards continues to grow in all active markets, with nearly 22 million US loyalty members active in the last 90 days, driving incremental sales in every market it has launched in.

— McDonald’s UK (@McDonaldsUK) August 4, 2022

Our Reward Squad have travelled all over and dished out #MyMcDonaldsRewards points like they were going out of style????

One example is McDonald’s, which in 2020 launched its ‘Accelerating the Arches’ digital growth strategy, built around the 3D’s of ‘digital, delivery, and drive-thru.’ Central to the strategy is ‘MyMcDonald’s Rewards’ – the company’s first digital global loyalty program, launched in July 2022 in the UK. Aligning with new consumer behaviour driven by the pandemic (such as increased digital app orders), MyMcDonald’s Rewards enables customers to earn rewards wherever and however they get their McDonald’s, with the app acting as a ‘digital storefront’ through which personalised offers can be found.

This ‘direct conversation’ is key to Hotel Chocolat’s loyalty strategy, with the retailer focusing on improving the customer experience for members of its VIP.me loyalty club in the UK. One example of this is its 2021 partnership with ParcelLab, which enables the brand to send delivery updates to loyalty club members via email or push notification if they use the app. Customers can also keep up to date with this via a branded order tracking page on Hotel Chocolat’s website and app.

[embedded content]

— Hotel Chocolat (@HotelChocolat) March 17, 2022

— Target News (@TargetNews) February 28, 2022

Loyalty as an integral part of branding

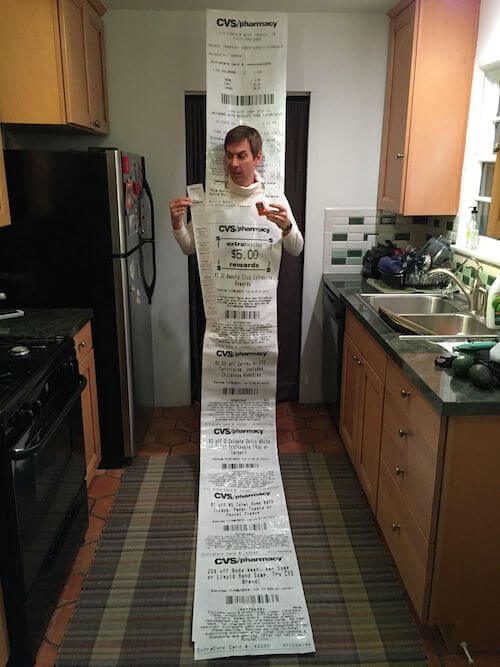

In the UK, Tesco Clubcard is the most popular example of loyalty pricing. Launched in 2020, ‘Clubcard Prices’ offers Clubcard members access to exclusive prices on certain products. In its 2021 Christmas trading statement, Tesco revealed that 95% of its store promotions are reserved for members of its loyalty scheme, further highlighting the value that it brings.

Tobias Buxhoidt, CEO of parcelLab, told Econsultancy that the feature not only enables customers to keep track of their order, but it also offers opportunities for the brand to engage with customers in new and exciting ways. “These include increasing awareness of other products, gifts or services, encouraging additional purchases, as well as showcasing content and advise exactly when the customer is seeking it,” said Buxhoidt.

By delivering emotional rewards, Pets at Home is able to tap into the shared ethics of pet owners, which in turn is likely to drive word of mouth recommendations as well as overall brand advocacy, particularly within the pet and animal retail space. This falls in line with a wider trend of brand purpose, with customers increasingly choosing retail brands based on their shared morals and values.

Pets at Home’s VIP loyalty club continues to drive membership and overall brand advocacy through a combination of both financial and emotion-driven rewards, with its VIP Lifelines initiative providing the latter.

— David’s Bridal (@davidsbridal) June 2, 2021

…including in new or niche categories

As well as charitable giving, the VIP club also fosters a sense of overall community for members, giving them a platform to share help and advice as well as locate lost pets.

But the fun doesn’t stop here – make sure you download the app and opt-in to rewards to collect those sweet, sweet points ???? pic.twitter.com/FaNvhcBY8s

Value at Tesco could also be enhanced by the news that both Sainsbury’s and Lidl are making changes to their loyalty schemes amid economic challenges. Lidl customers will now have to spend at least £250 each month for a 10% discount on their next shop, while Sainsbury’s has changed its Nectar points credit card scheme so that customers only earn one point for every £2 spent (rather than two points for every £1 spent).

The program is a points-based system, but unlike a traditional tiered model, it extends far beyond a single customer. As well as giving the bride the opportunity to earn points with her purchases, any guest or family member can also earn points, which can be exchanged for free gifts at every level, as well as counted towards the end goal of a free honeymoon.

Regardless, the David’s Bridal loyalty program has certainly driven engagement, generating over 1.55 million members since its launch. Kelly Cook, EVP, chief marketing and IT officer of David’s Bridal, told RIS that the program has been hugely successful in driving additional purchases, with 27% of Diamond members staying with the program after the wedding day and buying in other categories rather than dropping off.

The Covid-19 pandemic spurred on a shift in the restaurant industry, with consumers increasingly ordering online, via apps, or third-party delivery services. In order to further drive this behaviour, restaurants are now adding digital loyalty into the mix.

Saving or discounts are among the most popular reasons that customers use loyalty schemes. Amid the cost-of-living crisis, value for money is only rising in importance, resulting in brands also recognising the need to offer customers good value – and to communicate this accordingly. New research from Clarus Commerce found that 65% of US shoppers would even be willing to pay for a premium loyalty service, if there was a guarantee that discounts could help offset the high inflation that’s impacting grocery prices.

Pets at Home builds brand advocacy through emotional rewards

Benoit Soucaret from Merkle Experience & Commerce UK, told Econsultancy: “Loyalty requires a whole new strategy, and it must be earned – not only with products or services, but with emotional bonding from tailored experiences that make consumers feel personally recognised and rewarded… Brands also need a purpose that goes beyond the offering of the product. There’s a need for purpose so that people can identify and relate to them, which ultimately solidifies the loyalty.”

While some loyalty programs are part of an acquisition strategy, McDonald’s Senior Executive Vice President Kevin Ozan said in a Q2 earnings call in July that, for McDonald’s, “loyalty is really about driving frequency and increasing frequency.” This means enticing existing customers to spend time and time again (rather than spend more in one go or even to gain new customers).

What a couple of weeks ????

Alongside this, members of Pets at Home’s Puppy and Kitten club, which offers discounts specifically for products and services needed during an animal’s first year of life, grew 36% year-on-year, with approximately 23,000 average weekly registrations in the year, compared to approximately 7,000 two years ago, which the brand says is “creating a significant lifetime value opportunity.”

Research by McKinsey suggests that many brand loyalty programs are failing to expand beyond traditional rewards and redemption strategies. Out of 50 loyalty programs from top brands studied, it found that only 18% have experience-led programs, and just 6% have connected offerings. According to McKinsey, connected or ecosystem-centric loyalty is likely to shape strategies in the future. This, it states, will be “built around a fluid partnership of products, services, and experiences. We expect some brands to go even further, pursuing partnerships as a new way to compete.”

“Innovators in terms of loyalty all recognise the centrality of customer experience. The most forward-thinking players invest in their customers directly via improved communications, transparency, and genuinely useful content,” he concluded. Hotel Chocolat’s extensive store network is also part of its customer experience, further enabling the brand to dominate in its retail category (and therefore capture loyalty through both mental and product availability).

So, how can retailers get the balance right? Here’s a look at what makes for a successful loyalty scheme in 2022, and what retailers are doing in their attempts to win customers back.

Boots’ investment in a more purpose-driven strategy, which is strongly focusing on maximising value for customers, appears to be paying off. The retailer’s UK sales rose 22% for the first half of 2022 compared to the year prior.

The simplicity of the Tesco loyalty scheme is partly why it is so popular, with the benefit of signing up now immediate for shoppers. There is also a virtuous circle. As Reuters reports, Tesco’s promotional strategy has contributed to its sales growth (of 7.5% on a two-year basis). In turn, this helps Tesco to agree better deals with suppliers, which again feeds into its promotional strategy, with the retailer able to continue offering good value to loyal customers.

Hotel Chocloat facilitates direct conversations with customers

In addition, the program has enabled David’s Bridal to glean direct feedback from customers – another key benefit for all retailers. Cook told RIS that, as a result, the program will soon allow customers to earn two sets of points – one for the bride, and one for their own account.

Loyalty programs aren’t right for all retailers either, of course. Return on investment is imperative, and heavy discounts can in some cases undercut margins. Equally, customers can turn away from loyalty programs due to a lack of perceived value – or even because they don’t like the prospect of offering up their personal information. Many people posit that loyalty within retail and particularly grocery does not truly exist, and that loyalty programs are more aligned with effective marketing (thereby helping to improve brand penetration, rather than real customer loyalty).

However, Sainsbury’s now gives SmartShop app users personalised offers if they use the app to scan items in store. But of course, not all customers want to use self-scan technology or shop in physical stores.

With Hotel Chocolat’s UK online business now three times larger than in 2019, it is a great example of how loyalty programs can give businesses resilience during tough times, when customers are perhaps more likely to lean back on unnecessary spending.

Ulta Beauty at Target, our one-of-a-kind beauty destination, is coming to hundreds more stores in 2022 (building toward 800 total shop-in-shops). Get the details: https://t.co/xgceRjB35f pic.twitter.com/qZ6PL4PfUV

In its FY22 preliminary results for the 53-week period ending 32nd March 2022, Pets at Home stated that the number of active VIPs has reached a record 7.3m having increased by 1.1m (18%) year-on-year, or 29% on a two-year basis. On top of this, it stated that 27% of all VIPs shopped across more than one channel during the year, up 22% year-on-year.

Cheers to all our brides-to-be! ????Sign up for Diamond Loyalty Program by David’s Bridal and earn special gifts & rewards every time you shop – with amazing offers available right when you sign up! Tap to learn more! https://t.co/OhXzPhVpfw

????: @bri_trosclair pic.twitter.com/seCl7kxgcX

At the same time, other factors like value for money, emotional connection, and personalisation can also act as motivation for repeat purchases, ultimately helping retailers build connections with consumers – as well as that all-important set of data insights.

In its annual financial statement, Hotel Chocolat commented that “VIP Me loyalty attachment is already approaching 50% of new store customers in Japan, delivering the benefits of a direct conversation that we have seen work so well in the UK.”

![Tinuiti’s Largest Annual Event Comes to NYC [And to a Screen Near You]](https://research-institute.org/wp-content/uploads/2021/04/what-to-know-before-you-sell-your-small-business-768x432.png)