Image Source: CitrusAd.com

We are helping to solve this by providing buyers a single point where they can access media on a rapidly growing list of retailers. We don’t have every retailer yet, but we’re just getting started.

I see a lot of brands who’ve been in retail media for a while and have built siloed structures where brand and retail media are completely separate. These are really smart people who want to move towards omni-planning, and omni-channel activation, but are struggling because of how they’ve organized. Also, my prediction is that “omni” is the buzzword of choice for the next five years! If you’re just getting started, you’re almost ahead of the game by being able to connect it together all from day one. To accomplish this, many turned to retail media platform solutions, and experienced partners, to help them navigate these new waters. One such platform is CitrusAd.

We recently sat down for a virtual chat with JR Crosby, VP, Agency Strategy for CitrusAd, to learn more about CitrusAd and its philosophies, and what we can expect next from the company, and retail media in general.

If there is a desire to jump in head first, definitely rely on experts, like Tinuiti, to help guide you through the complexity. Lean on commerce media consultancies and agencies if you’re just getting started. It’s most likely these experts are going to help you get started much faster than trying to do it on your own.

I came from a programmatic background, and it’s similar to what happened in programmatic. Early days were, “I have my SSP partner (my supply-side platform) and this is how I get my inventory out into the world.” And then they said, “Wait a minute…why would I have just one SSP partner when I can have multiple SSP partners and give the buy side choice as to where they want to go?” I think it’s a big advantage for Target, and a big advantage for the buy side—now they have choice and can work with whatever platform works best for them.

Q. How does the CitrusAd platform work, and what sets it apart from competitors?

1. Retail media gives brands the ability to get in front of shoppers while they are in the shopping mindset and offer their products at the moment buying decisions are being made. While it’s super important to also be in touch with the consumer while they are engaged in all types of media, the retail environment has a unique value.

Also, things like faster shipping and faster returns—all those things retailers have done to really make it easier to do things, like buy online and pickup in store; Target is awesome at that. And so we have the retailer saying, “OK, I’m not just a brick and mortar business, I’m a digital plus brick and mortar business. I need to make it easy for consumers to transact with me,” so that’s giving them great environments in which to shop, free shipping, free returns—all of those things.

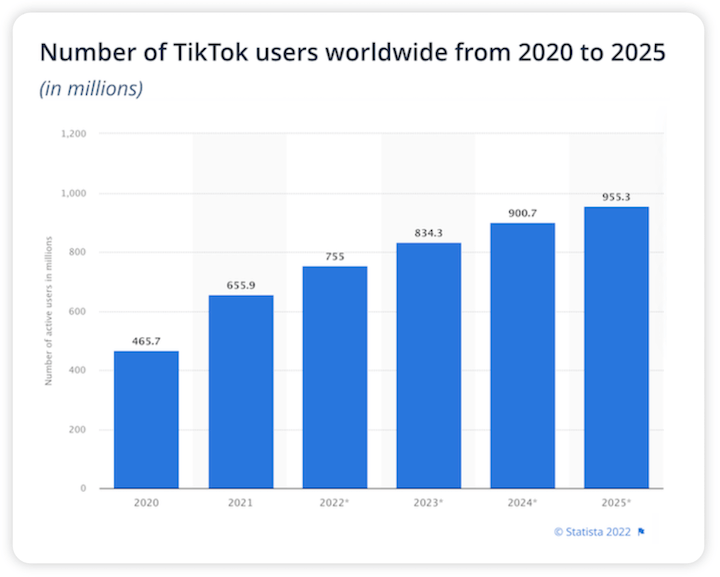

Crosby: From my perspective it’s as easy as this: media dollars follow consumer eyeballs. COVID pushed more people toward digital ordering, which not only made media buyers more interested in investing in retail media, but also pushed retailers to double down on their offerings. That combination along with all of the measurable benefits of retail media led to the boom in popularity.

Also, and importantly, collaborate within your marketing organization so that retail media doesn’t feel like a completely separate silo; it really needs to be part of the total brand marketing conversation.

Now, at Target, the buyers have options as to which retail media platform they want to buy Target Sponsored Product Ads from. I think that’s really interesting because it has historically been that retailers would have just one supply-side platform partner. Now Target has come out and given the buy-side a choice. They might not be the first to do it, but they’re the biggest to make this move.

Crosby: I think that when you talk about the retail media versus other channels, there are three main benefits.

Q. Your website mentions that “CitrusAd streamlines media sales and ad-serving for more than half of the top 20 retailers in the world.” What about your platform, or your business in general, has led so many top retailers to choose CitrusAd?

1. Our philosophy is that we never charge fees; we’re a completely no-fee platform.

Right now, retail media is mostly being utilized for lower-funnel, last-mile marketing. Something I see in the near-future is retail media pushing up the funnel. Why plan branding and retail media separately with the hopes that they intersect? Because retailers own the relationship with the customer, they are in a great position to apply that knowledge to other channels. Imagine being able to buy TV, CTV, audio, or out-of-home, all informed by retail data and measured holistically together; sounds pretty good to me.

Q. What are some common retail media pain points brands have shared with you, or that you’ve experienced yourselves?

3. Because retail media provides faster sales insights, buyers can, in-turn, make faster and more informed optimization decisions. The ability to pivot quickly with confidence is everything in the media world.

I think of it like when I first taught my dad how to use text and emojis, and he just wasn’t sure. Now, he sends emojis, GIFs, and memes! COVID kind of pushed people to unlocking this.

If someone says the word “retail,” what is the next word that comes to your mind? If asked this question even a year ago, I might have thought of retail value, retail price, or—if the week had been especially long and stressful—perhaps even retail therapy.

Q. What do you find are the key differentiators between retail media and more traditional ecommerce channels that makes it so attractive, and so essential?

Crosby: I think the retail media offerings are going to diversify. I think we’re still in the early days, and we’re going to look back in a couple years and think,“Really? That’s all we had to offer?”

Just make it really easy for people to say, “OK, I’m not gonna go to the store; I’m gonna do this while I’m sitting on my couch watching the basketball game.”

2. The ability to precisely measure engagement and ROAS in real-time through retail media is huge. In other channels there are ways to estimate media’s impact on retail sales through complex statistical modeling, but that can be expensive, and is almost always something you receive well after the campaign has finished. Much of this type of measurement is also heavily dependent on third party cookies, which we all know are not long for this world.

While many of us were already regularly shopping online prior to the COVID-19 pandemic, increasing safety concerns and in-person shopping restrictions greatly accelerated online shopper and order volume this past year. It became more important than ever before for brands to adjust their digital advertising strategy to stand out in a space quickly becoming not only busier, but more complex and essential to their overall business success.

Q. Retail media has seen impressive growth this past year, thanks in part to pandemic-necessitated shifts in shopping behavior. What are some other factors that have led to its rise in popularity?

Crosby: CitrusAd was built to be what we call “retail monetization in a box.” We have technology that we incorporate directly into a retailer’s website—a server-to-server integration—that enables those retailers to have sponsored product ads, display ads (or banner ads), and custom brand pages and experiences.

Crosby: If we zoom outside of CitrusAd and look at the retail media ecosystem, it is very complex; it’s fragmented, and it takes a great deal of knowledge and experience to navigate.

One of the biggest differences from the retailer perspective is that we have these multiple offerings we can bring to a retailer and integrate them seamlessly into their ecommerce store—a one-stop-shop for everything they need to launch a media monetization program.

I see so many similarities between programmatic and what’s going on in retail media right now. Just in terms of…there was that inflection point—in probably 2014—where everybody started to take programmatic seriously. And now, a majority of media is delivered programmatically. I get a similar feeling with retail media, and I feel lucky to be able to experience that again—to be in something that you know is the next thing.

Q. As we progress toward a post-pandemic reality, what changes do you anticipate retail media will undergo, if any?

That’s another thing that we’re looking to solve on the buy side—having one place where a buyer can go and buy across many different retailers so they don’t have this “I have to work with 20 different partners” situation. We can’t solve for all of that, because we don’t have every retailer yet, but that’s kind of our vision—to have everything in one place for buyers. I’d say that’s the biggest, macro pain point that I hear.

Crosby: We’re a disruptor in this ecosystem and I think we’re going to continue changing the market’s expectations on fees, transparency, and control. You’re also going to see us breaking into new media channels and launching in more markets. Simplifying the ecosystem by building our retailer footprint is the main focus for now, so I think that’s going to be the biggest thing that you’re going to see from us in the near-term. We have some pretty exciting partnerships that we’ll be announcing soon.

Q. What expert recommendations and tips would you offer brands looking to get started with retail media?

Crosby: I think the retailers respond really well to our approach of transparency, control, and no fees. The retailers want to make it easy for buyers to buy, and we do that. We also work fast; they like that we integrate quickly and when they test it, it works. We have a new retailer that we integrated from start to finish in twelve days! That sort of blows my mind.

Besides the assortment of media products we enable for retailers, there are three main differentiators that their suppliers and media buyers love:

Crosby: Start where you’re going to have the most impact. There is a lot in this landscape, so for someone just getting started, identify your most valuable retailers—whether it’s in terms of scale, opportunity, or relationship. Approach it by solving for them first; don’t try to do everything at once.

I came from an agency background. I spent 9 years working in agencies. So I understand the value—especially when you’re venturing into a new area that is complex, for sure—you need a strong agency partner to be able to help you navigate.

We recently announced Target’s direct integration with CitrusAd through Roundel, and I think that it’s extremely interesting that Target brought us in as a complement to their existing program.

Q. What’s next from CitrusAd?

But today, like so many of us immersed in the performance marketing space, there is only one word that comes to my mind after hearing the word retail, and that word is most definitely “media.”

3. The third differentiator is control; there are really two components to this. The first is that we’ve built our platform to be entirely self-service. The second is that our platform enables exact match keyword targeting, meaning the buyer has full ability to select the relevant search terms they want and value them individually. Most buyers I talk to want this level of control, rather than having the platform make their keyword decisions.

2. We believe in transparency; we get as granular as possible with insights to make sure the buyers get a clear picture of what is happening and why.

It’s pretty crazy how much we’ve grown in this past year, so the retailers are definitely leaning in. And the brands follow the retailers, so here we are!